**Hawkish FedSpeak & Stagflation Scares Spark Big Reversal In Markets**

Hawkish FedSpeak & Stagflation Scares Spark Big Reversal In Markets

UMich inflation expectations re-surged, retail sales were a disaster, and manufacturing production plunged... but apart from that stagflationary set-up, everything is awesome _(because headline industrial production rose more than expected, core retail sales was a smidge less terrible than expected, and headline UMich sentiment improved)_.

It was a hard week for both 'soft' data and 'real' data as they both showed serial disappointment (a positive for some assets in the case of inflation signals) but overall, **'hope' - the spread between hard and soft data - is at its lowest since March 2001**...

?itok=MZ6muhur (

?itok=MZ6muhur ( ?itok=MZ6muhur)

?itok=MZ6muhur)

_Source: Bloomberg_

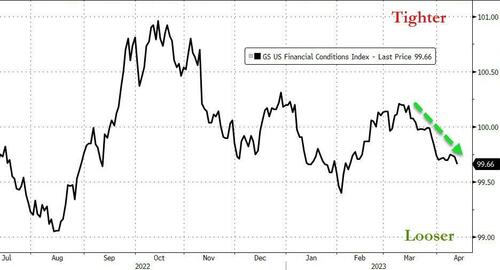

Amid all that, traders shifted their short-term views on The Fed hawkishly, spurred on by the UMich inflation exp spike and The Fed's Waller who made it clear there was more 'pain' to come (https://www.zerohedge.com/markets/hawkish-comments-feds-waller-send-may-rate-hike-odds-surging):

> _**“Because financial conditions have not significantly tightened, the labor market continues to be strong and quite tight, and inflation is far above target, so monetary policy needs to be tightened further,”**_

He is not wrong...financial conditions are easing and that's not what The Fed wants...

?itok=9bz0BDIc (

?itok=9bz0BDIc ( ?itok=9bz0BDIc)

?itok=9bz0BDIc)

_Source: Bloomberg_

**The odds of a 25bs hike in May now up to 85%** \- almost back to pre-SVB levels...

?itok=vQbhXJns (

?itok=vQbhXJns ( ?itok=vQbhXJns)

?itok=vQbhXJns)

_Source: Bloomberg_

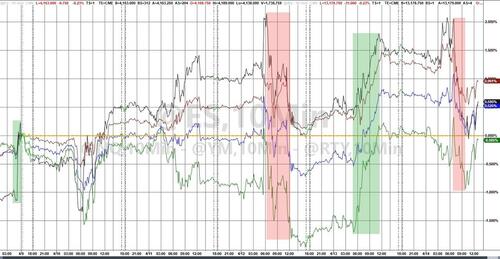

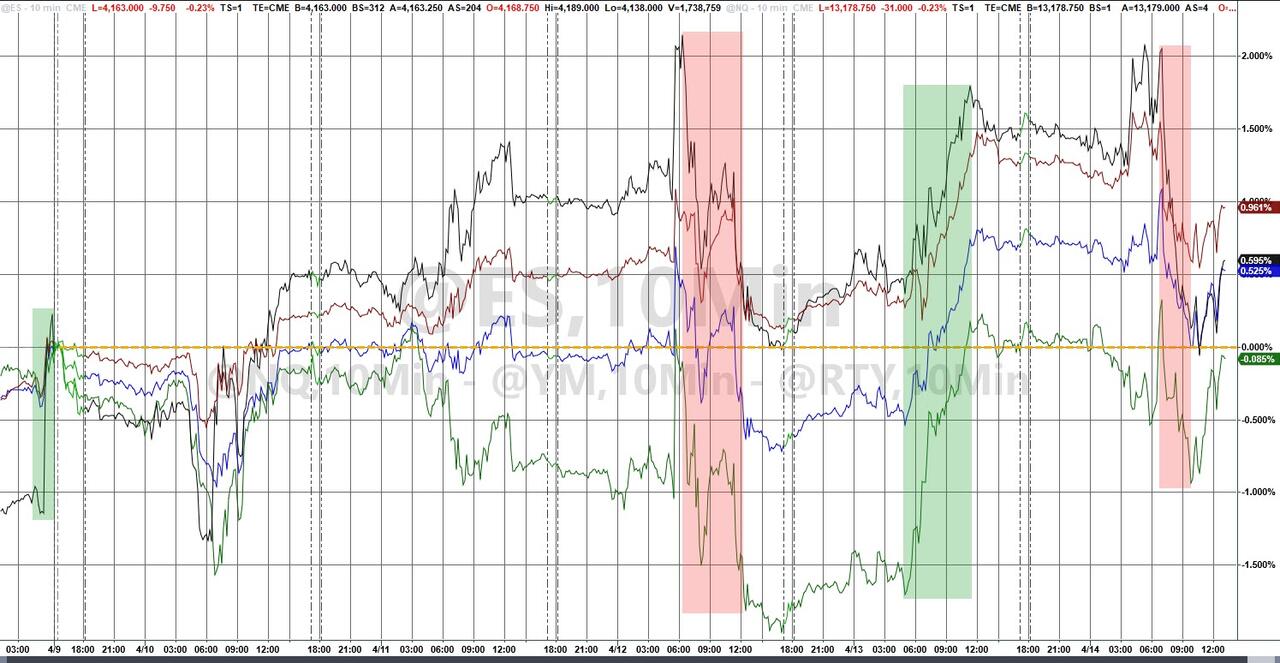

US equities ended the week mixed with the Nasdaq basically unchanged and The Dow outperforming (these are changes from Friday's early futures close). The day was a bit chaotic as hawkish comments (and data) battled bonanza bank earnings (BA and UNH weighed the Dow down -177pts opposing GS and JPM's gains +90pts)...

?itok=uWCggcgk (

?itok=uWCggcgk ( ?itok=uWCggcgk)

?itok=uWCggcgk)

The early ugliness in stocks today (QQQ below) was **led by negative delta 0DTE traders' flow** which turned at the key gamma strike level and dropped all the way down to the Hedge Wall before rebounding...

?itok=R7New2LZ (

?itok=R7New2LZ ( ?itok=R7New2LZ)

?itok=R7New2LZ)

_Source: SpotGamma_ (https://www.zerohedge.com/spotgamma)

Additionally we note that S&P Net Spec positioning rose last week...

?itok=p1tFc7pT (

?itok=p1tFc7pT ( ?itok=p1tFc7pT)

?itok=p1tFc7pT)

_Source: Bloomberg_

...from the 'most short' since 2011...

?itok=uaNJy6pc (

?itok=uaNJy6pc ( ?itok=uaNJy6pc)

?itok=uaNJy6pc)

_Source: Bloomberg_

Banks dominated today's price action after earnings and along with energy stocks were the week's winners. Utes and real estate were the ugliest horses in the glue factory...

?itok=EYFjBH96 (

?itok=EYFjBH96 ( ?itok=EYFjBH96)

?itok=EYFjBH96)

_Source: Bloomberg_

With JPM up over 7% today (and C soaring too)...

?itok=-GT8KJeC (

?itok=-GT8KJeC ( ?itok=-GT8KJeC)

?itok=-GT8KJeC)

_Source: Bloomberg_

But as the big banks soared, the small banks pushed back to the post-SVB lows...

?itok=deBWjoXR (

?itok=deBWjoXR ( ?itok=deBWjoXR)

?itok=deBWjoXR)

_Source: Bloomberg_

Another week with a big divergence between defensives (lower) and cyclicals (higher)... which is odd given the hawkish shift in rates...

?itok=rY2FC7iZ (

?itok=rY2FC7iZ ( ?itok=rY2FC7iZ)

?itok=rY2FC7iZ)

_Source: Bloomberg_

Both Equity (VIX) and bond (MOVE) implied vol plunged this week with the forme…

https://www.zerohedge.com/markets/hawkish-fedspeak-stagflation-scares-spark-big-reversal-markets