**WTI Rises After Bigger Than Expected Crude Draw**

WTI Rises After Bigger Than Expected Crude Draw

Oil prices ended marginally **higher after stronger-than-expected China GDP growth** which prompted overnight gains. But most of that was given back by the close as **a key German investor sentiment survey weighed on crude**, "as optimism for the eurozone's largest economy remains downbeat in the coming quarters," said Edward Moya, senior market analyst at OANDA, in a market update.

> _"Oil isn't getting any good news here and that means prices could continue to hover around the $80 a barrel level, or even see a tentative dip below if sellers get some help from a strong dollar."_

Expectations are for more inventory draws this week.

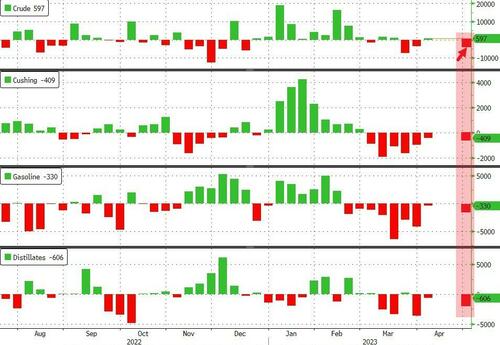

**API**

- **Crude -2.675mm (-500k exp)**

- Cushing -600k

- Gasoline -1.00mm (-1.2mm exp)

- Distillates -1.9mm (-900k exp)

The third weekly crude draw of the last four weeks. Stocks at Cushing saw another decline while product inventories rounded out the across-the-board decline in stocks...

?itok=Fq3UrOpp (

?itok=Fq3UrOpp ( ?itok=Fq3UrOpp)

?itok=Fq3UrOpp)

_Source: Bloomberg_

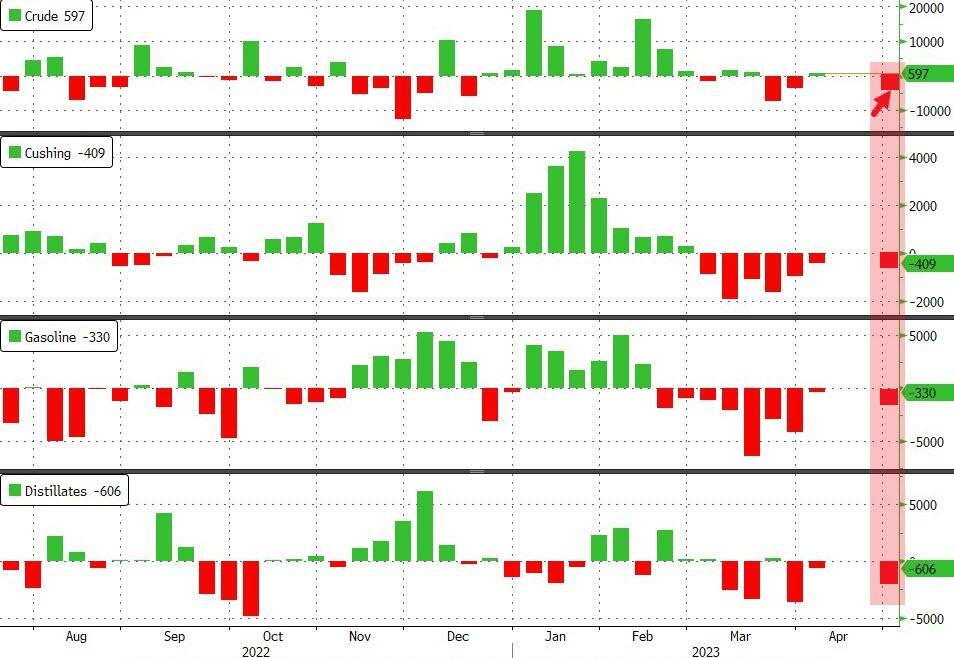

WTI was hovering around $80.80 ahead of the API data and rose very modestly after...

?itok=gZ_nkVnO (

?itok=gZ_nkVnO ( ?itok=gZ_nkVnO)

?itok=gZ_nkVnO)

Looking ahead, economic data will be in focus as a "strong economic recovery in China and the avoidance of hard landings in Europe and the U.S. are both priced into the market with WTI trading with an $80 handle," said analysts at Sevens Report Research in Tuesday's newsletter.

So, while the path toward new year-to-date highs in WTI is narrow, it is "possible," they said.

_**"Growth data in the U.S. and Europe will need to be Goldilocks while better-than-expected data from China would be a welcomed surprise."**_

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 04/18/2023 - 16:35

https://www.zerohedge.com/energy/wti-rises-after-bigger-expected-crude-draw