How would #bitcoin behave in a recession? (Assuming we’re not in it already)

Discussion

We’ll experience the first time soon I guess. It was designed for these things, so let’s enjoy the ride. Nobody knows what will happen…

Builders will build and more and more people will get orange pilled

Every ~10 mins new blocks would be mined. Thousands of nodes would instantly verify that and enforce the protocol.

#Bitcoin will behave as it always has and always will.

Unfortunately there are still a lot of people out there that look at Bitcoin as a risk asset. Short term I could see it performing similar to tech stocks. Although, there has been some decoupling in recent weeks. So that is definitely in our favor.

I don't think Bitcoin will behave differently in a recession. There will always be those who are either over leveraged or over committed and be forced to sell some, recession or not.

As long as we are correlated to the s&p we haven’t reached our goal. Keep stacking!

I want to assume that:"Bitcoin doesn't give a shit", because the 4 year cycle is not broken yet. But a recession like that what's (hopefully not) coming we haven't seen in generations.

like so

I think the question you’re asking is, “How would people behave in a recession now that bitcoin exists?”

Bitcoin is going to behave exactly as it was coded: new blocks, difficulty adjustment, halvening.

The zaps will continue unabated.

Gm ⚡️

A recession is too small of a timescale imo. The genie is out of the bottle, money printer will continue to go burr, governments will deficit spend, the next 18 mo like the last 18 mo will be a blip on the radar. We HODL.

Other countries trying to make a commodity backed money is more interesting to me to break the Eurodollar, But the plebs will get tired of the game and choose Bitcoin

There is not one universal answer to this question, but let me give you an overview of the two possible scenarios:

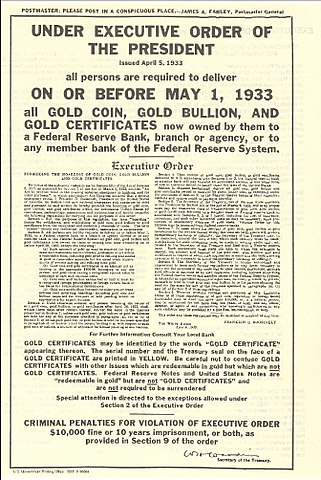

1. Recession and no monetary interference (unlikely)

Markets besides Bitcoin will tank since liquidity dries up and loans can’t be paid back. We will see a lot of defaults (companies, individuals and probably governments alike) due do a lack of earnings inflow. Companies cut jobs, people lose jobs, bills won’t be paid which leads to more defaults. The massive leverage of the whole economy spirals downwards and all of the current fairytale value vanishes. In this case, bitcoin will tank as well, because most will have to find ways to make ends meet, pay bills and continue living in the current inflationary environment. National currencies will get rekt in this process and we will see the rise of new currencies (cbdcs). After the first drawdown, Bitcoin will gain momentum though, because it offers a way out of this mess. How fast this will happen depends on what the people chose firs: cbdcs or bitcoin.

2. Recession and money printer goes brrrrr

In that case, the economy won’t tank that hard, because we won’t have a liquidity crisis that leads to a massive default wave. The flipside of this will be a further, massive spike in inflation which will put people at the edge of being able to afford anything. It will lead to the same end result as case 1 does, but the path will be a little different. In the end, currencies will collapse and cbdcs will be introduced. But without huge drawdowns in the markets. Markets and bitcoin will both rise until the point when national currencies break. It will lead to the same dependence on what people will chose: cbdcs or bitcoin?

Ultimately, all value will be sucked up by bitcoin though. If cbdcs become „successful“ this process will be prolonged. If people (and additional nations) decide to chose bitcoin, there will be a point in future, where bitcoins price will skyrocket in a blink of the eye.

Note, that the above also depends on other macroeconomic developments and it’s impossible to say what exactly will happen, but these two are the main paths.