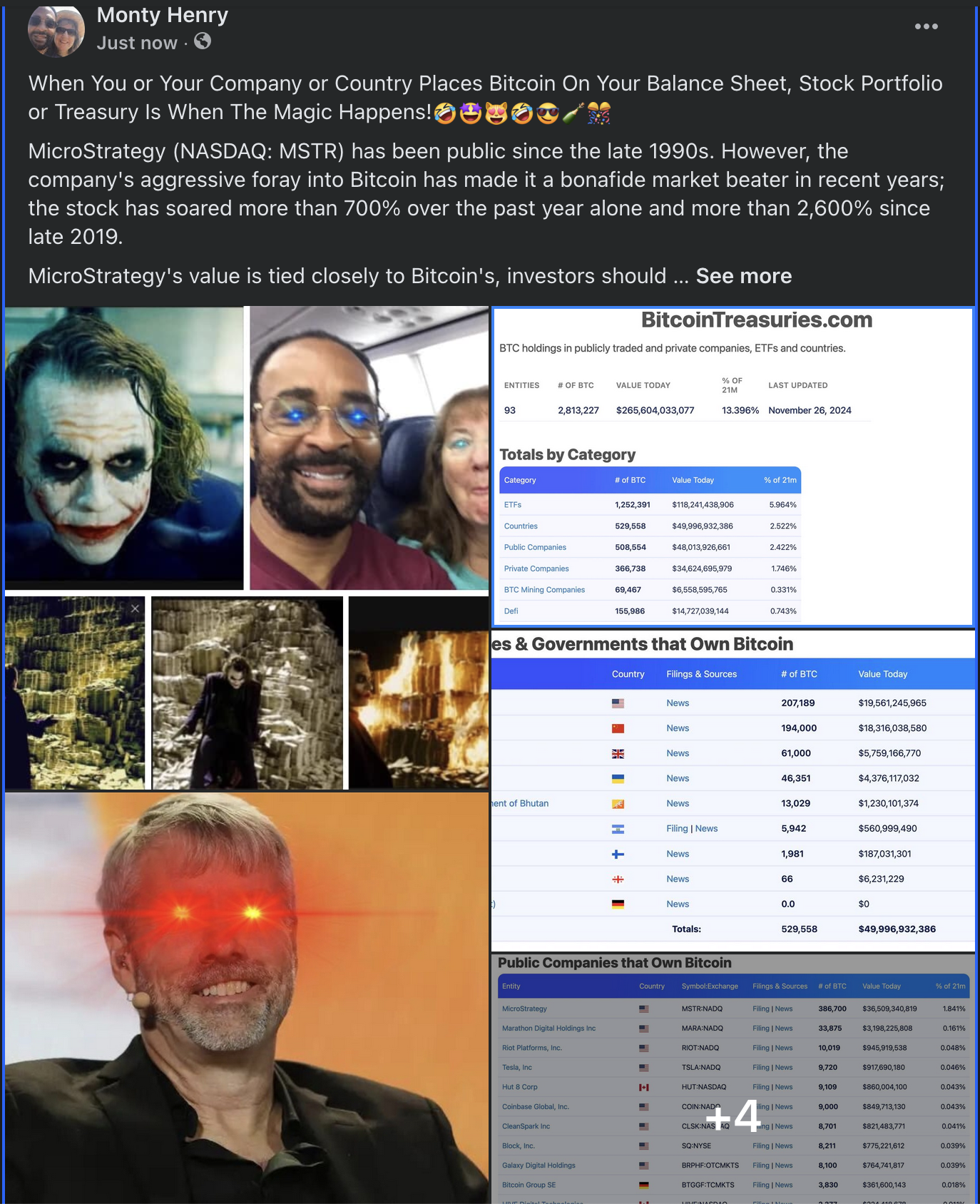

When You or Your Company or Country Places Bitcoin On Your Balance Sheet, Stock Portfolio or Treasury Is When The Magic Happens!🤣🤩😻🤣😎🍾🎊

MicroStrategy (NASDAQ: MSTR) has been public since the late 1990s. However, the company's aggressive foray into Bitcoin has made it a bonafide market beater in recent years; the stock has soared more than 700% over the past year alone and more than 2,600% since late 2019.

MicroStrategy's value is tied closely to Bitcoin's, investors should probably understand and believe in Bitcoin's value and utility to be interested in MicroStrategy's stock.

Not Investment Advice.

Remainder Of The Article: Nasdaq-Listed MicroStrategy And Others Wary Of Looming Dollar Inflation, Turns To Bitcoin: https://dpl-surveillance-equipment.com/bitcoin-and-crypto-currency/nasdaq-listed-microstrategy-and-others-wary-of-looming-dollar-inflation-turns-to-bitcoin-and-gold/