wrt ppl saying a .01 utxo transaction potentially costing 10k$ in the future when fiat price will exceed millions.. and therefore these utxos becoming unspendable..

"potentially".. based on what assumptions?

wrt ppl saying a .01 utxo transaction potentially costing 10k$ in the future when fiat price will exceed millions.. and therefore these utxos becoming unspendable..

"potentially".. based on what assumptions?

1. what were the median fees 5 years ago when bitcoin was at 3k, and what is the median now at x10? any data in this, how to search?

2. does increased usd price equal more adoption aka real world trade transactions by default? the fees are still based on sats/vbyte and not usd/vbyte.. but maybe im missing something else..

3. can it all not balance itself out still when assuming once networth in usd gets bigger gradually and threshold to accumulate sats gets higher (=not per se more transactions)? is this assumption realistic?

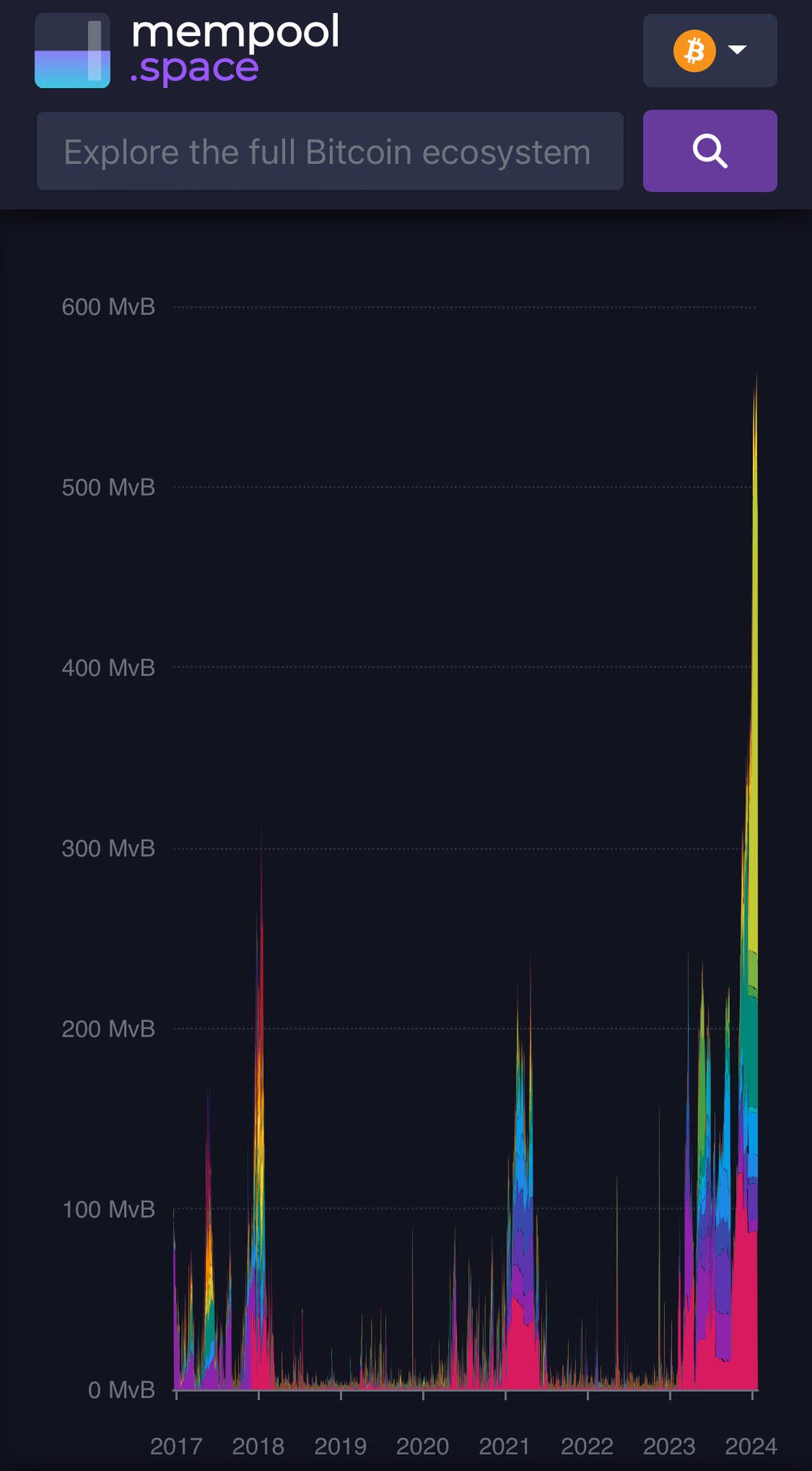

1. mempool.space

thank you

corrected for the temporary ords peak from 2024 as outlier and imagining a median, doesnt seem like 10x had much effect to me

maybe we'll get more volatile ups and downs, but im having a hard time imagining a 01 utxo will get priced out indefinitely

would love actual median tho bc im just pulling from imagination here

nostr:npub12262qa4uhw7u8gdwlgmntqtv7aye8vdcmvszkqwgs0zchel6mz7s6cgrkj meow?

you could use timechaincalendar.com. but I guess you would like to have a csv export to create a plot

You’ve shared brilliant thoughts here.

I don't think it's necessarily a function of fiat price of bitcoin, though it is correlated. The popularity of bitcoin, or more specifically the velocity of transactions entering the mempool is what matters here.

Here is how I see it. Bitcoin transactions (and fees) are, in its simplest form, an auction system. Some people need to get into the next block and will be willing to bid more. These are the transactions that will ultimately drive the cost to transact (fees).

Yes, some people can wait and will bid less but they will have a lesser impact on pushing the price of blockspace since their transactuons will just sit in the mempool until average fees drop to a point where they finally reach the minimum price to be included.

These lowball transactions don't necessarily pull down the median fee to transact since they just sit in the mempool. No one is necessarily competing against them racing to a price floor. This only happens if we have partially full blocks and an empty mempool. If that ocurrs, lowball fees will drive fee price. I doubt that will ever happen.

While the large overpaid fee transactions do increase the median price and over time, continue to pull up the average price to transact. As such, when looking at median fee to transact over time, due to the nature of the acution system and blockspace scarcity there is a natural pull for fees to increase, not to decrease.

The point here is there is a median fee paid which establishes a general baseline cost to transact. This baseline cost has no bearing on the size of your UTXO. Though the size of your UTXO eventually will matter.

As more people use bitcoin (or more precisely as more transactions enter the mempool bidding for limited block space) the median price/vb will naturally go up as more people bid against one another for blockspace. It's a simple function of scarcity/price as I outlined above.

Eventually, if the average median fee over time continues to rise based off the concept of blockspace scarcity, then your small UTXO will evenatually get swallowed up by the cost/vb to transact. As it may end up costing as much in fees to transact your small UTXO as there are bitcoin represented by that particular UTXO.

The fiat price of bitcoin is simply a loose correlation with the "popularity" of bitcoin. As the price goes up more people get interested and try to enter the space and make a transaction.

Ultimately I think the fee/vb is driven mostly by the velocity of transactions entering the mempool. Or more specifically the velocity of new transactions entering the mempool that exceed the minimum fee required to have been included in the previous block. This may be a whole other discussion but I say it's based off the previous block because no one really knows what the lowest fee for the next block will ultimately be until it is mined.

If transactions cost that much they think the number of miners won't increase? Lol 😆 🤣 😂

didnt even think ab the hash! thanks

having more miners doesn’t increase block space

It'll make it cheaper though. And those who still can't afford the main chain can use lightning. If I'm sending 10m 10k isn't a big deal. I just closed a 1.1m usd real estate sale in a developing market. See my note. I had to arrange 4 bodyguards, 3 cars, decoy duffel bags etc. As the buyer wanted to pay a large portion I'm cash.

not asking about lightning here, that's another topic unrelated to what im trying to figure out here (ie. effect on selfcustody)

I just assume an onchain tx may cost about 50000 sats. For .01 BTC UTXO, thats 5%. Hefty sure, but not unspendable.

are we only going to be able to buy high value things or in bulk.. wondering rn 😆

#fees #utxo

Price is not the matter. It’s about price in sat/vB ratio.

If you transaction will cost 250.000 sats (no matter the price) because of how scarce the block space is and you will have smaller utxo… you could effectivly burn all of that utxos kust to pay feed.

Transcation is about optimization.

TX consisting of one UTXO would be significantly smaller than one where you have to get three or more inputs together in order to spend desired ammount.

So it’s not about the price of #Bitcoin.

trying to really understand here (a me-issue, im sure you're saying rational things, just not clicking for me yet)..

before my next attempt understanding your reply this needs to be answered for me to make sense of it, i feel: what factors affect the blockspace and its effect on fees? is it just the amount of people using bitcoin at the exact same time (ignoring timezones)?

Yes. But actually it’s not that simple.

Let’s say that basic transaction consisting of one UTXO can span around 180 . Circa, as it matters if you use “older” or “newer” type of adress and such.

But if you need more inputs in that transaction, your transaction can bloat maybe up to 250 bytes or even more.

And then your transaction fee is basically this number * current fee to get into block.

Blockspace is actually very scarce so yes, from simpliest point of view the price of that space should follow the current demand for it in any given moment but it’s not the case all the time. Sometimes you need to do a transaction but you don’t mind to wait so you try to pay less than it’s current price.

Or, the exact opposite. You need to make sure you’ll end up in another block no matter the cost - then you put your fees way higher than needed so there is a chance almost = 100% you’ll get picked to the next block.

Blocks space is extremely scarce. As time goes by and adoption increases more people/entities will transact on the base layer. Price will adjust to meet demand. Just look at past blow off tops in the cycle and you will find high fees for transactions.

but they cooled off also, no?

Exactly! It’s dynamic. But as time goes on the baseline cost will trend higher all else equal because demand will increase(in fits and spurts).

Check out this unspendable UTXO calculator https://jlopp.github.io/unspendable-utxo-calculator/ by nostr:npub17u5dneh8qjp43ecfxr6u5e9sjamsmxyuekrg2nlxrrk6nj9rsyrqywt4tp

Even at a fee rate of 1,000 the fee on a P2TR coin is 68k ~ 7% of a 0.01 utxo. Not great but not unspendable

that's not unspendable at all idk why ppl are freaking out

I hope this adds some clarification.