Gold/bitcoin:

I asked chat gpt?

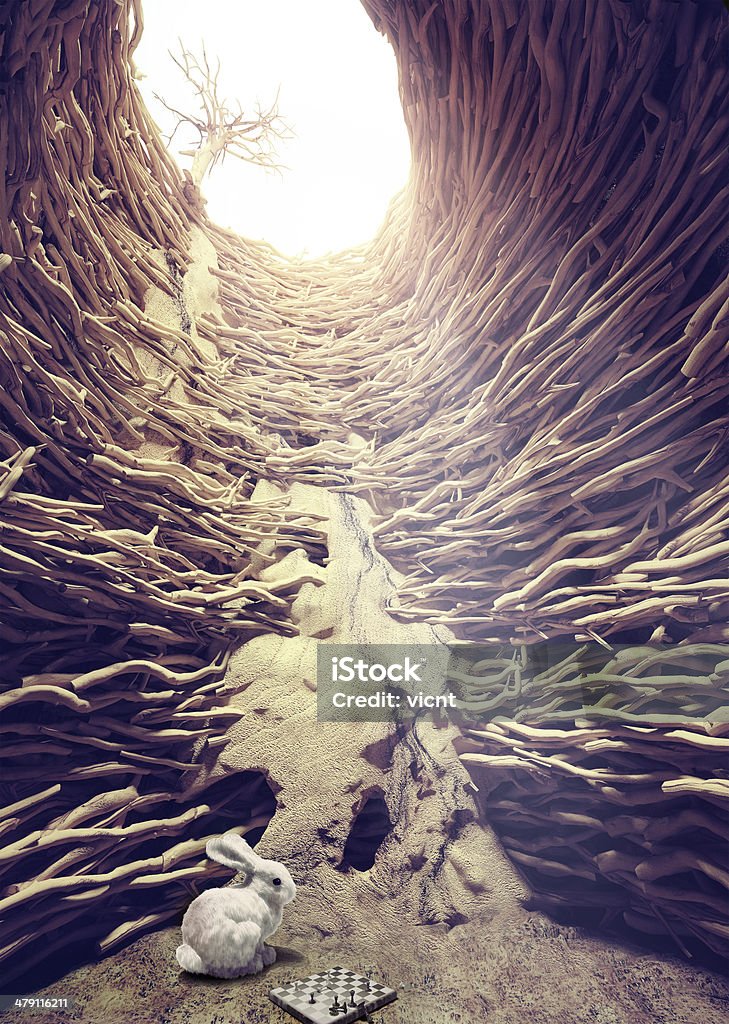

Stability they said…. Se picture after the txt.

We are so early 🙂 #bitcoin

Choosing between investing in gold or Bitcoin depends on your investment goals, risk tolerance, and time horizon. Here’s a comparison of both:

Gold:

• Stability: Gold has a long history as a store of value, especially during times of economic uncertainty. It’s often seen as a “safe haven” asset.

• Physical Asset: Gold is tangible and has intrinsic value, making it less susceptible to technological risks or cyberattacks.

• Inflation Hedge: Gold tends to hold its value well against inflation, though not always in the short term.

• Lower Risk: While it can fluctuate, gold typically sees lower volatility compared to cryptocurrencies.

Bitcoin:

• High Potential for Growth: Bitcoin has shown impressive returns over the past decade, though it comes with high volatility.

• Scarcity: There’s a fixed supply of 21 million BTC, which could potentially drive demand over time.

• Liquidity: Bitcoin is highly liquid and can be bought or sold easily 24/7 on numerous exchanges.

• Risk & Volatility: Bitcoin’s price can swing dramatically in short periods, making it a high-risk investment, especially for short-term traders.

• Adoption & Use Cases: As the world increasingly adopts digital currencies, Bitcoin could benefit as both a store of value and a medium of exchange.

Factors to Consider:

• Time Horizon: If you’re looking for a more stable, long-term store of value, gold might be a safer bet. If you’re aiming for potentially higher but riskier returns, Bitcoin might be more appealing.

• Risk Tolerance: Bitcoin can be highly volatile, so if you’re averse to significant price swings, gold may suit you better.

• Diversification: Many investors choose to hold both to balance risk. Gold offers stability, while Bitcoin provides high-risk/high-reward potential.

In short, gold is a good choice for conservative investors, while Bitcoin is suited for those willing to take on higher risk for the possibility of greater rewards.