Here’s a fun party trick for your normie friends who think their house has appreciated. Plug in the Price they could sell at, the Cost they paid to buy it and the number of Years held:

(Price/Cost)^(1/Years)

It will give you a number like 1.0845. This means the house’s Compound Annual Growth Rate (CAGR) was +8.45% per year.

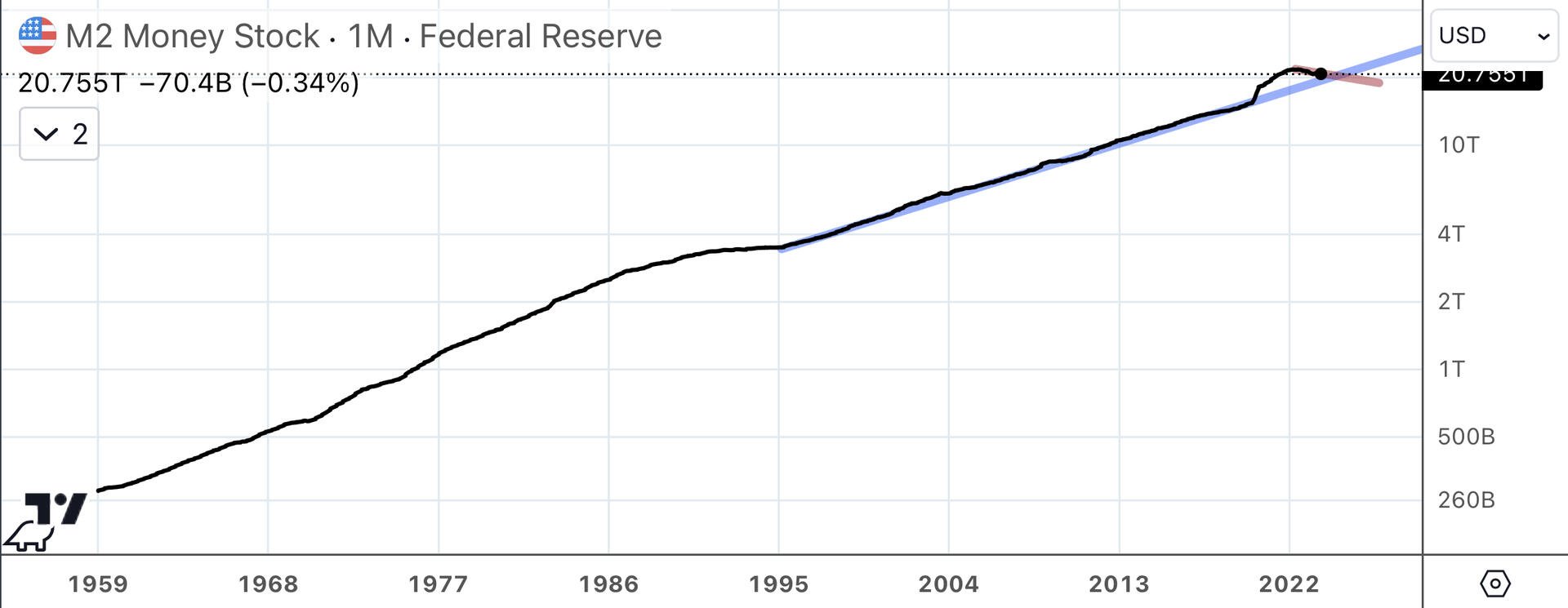

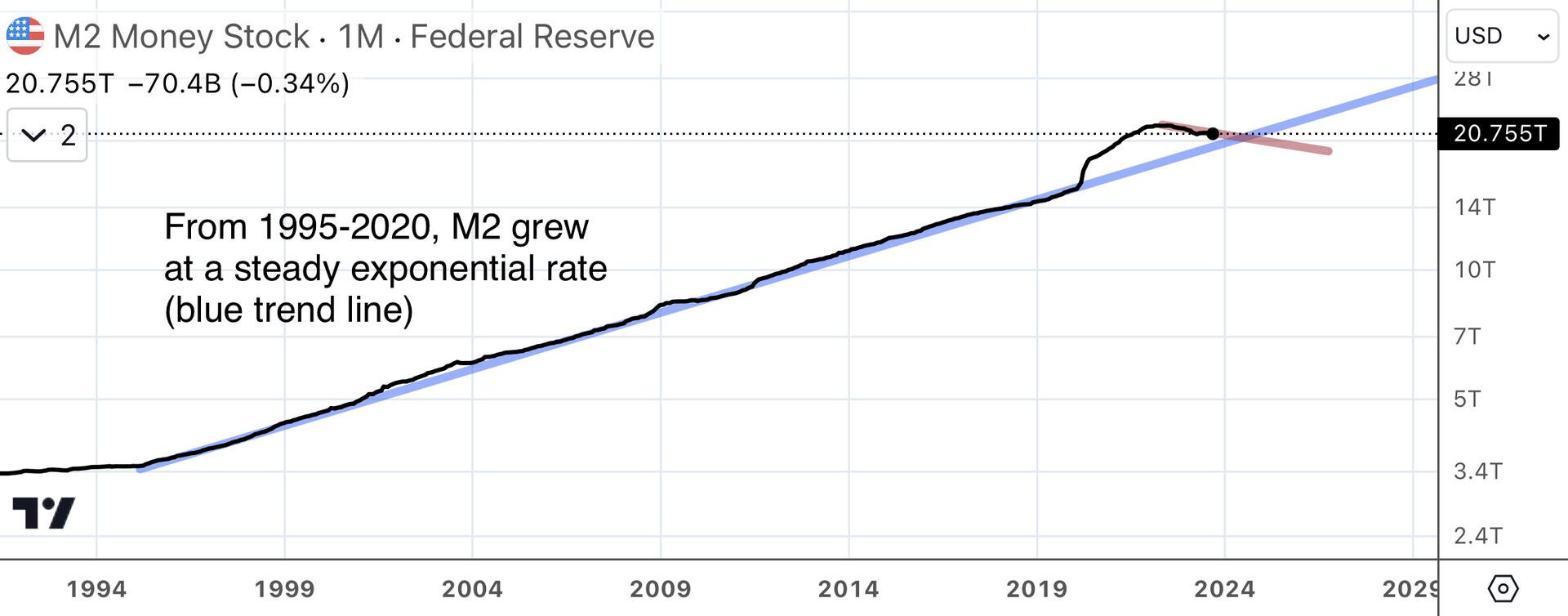

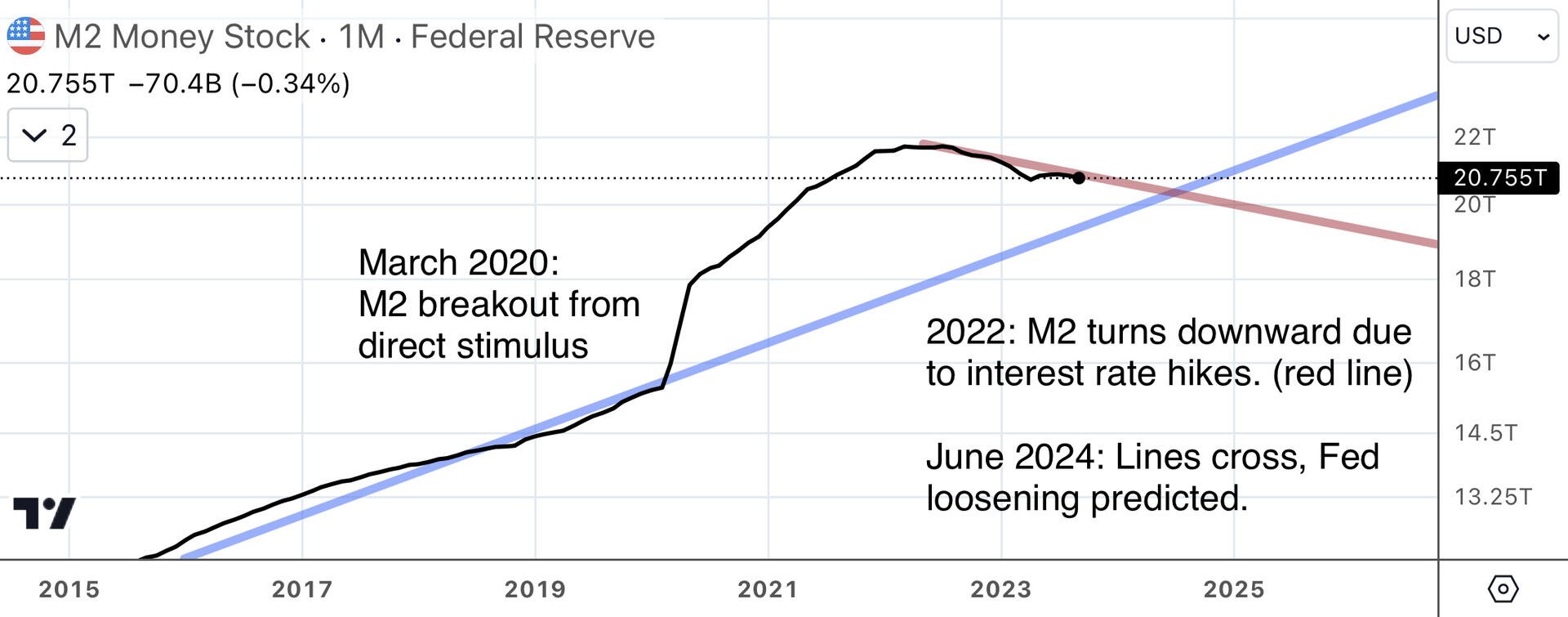

Then do the same for the M2 money supply. Replace Price/Cost with the M2 estimates from today and their purchase date.

Did they beat inflation? If not, then their house was not an asset, but a liability.