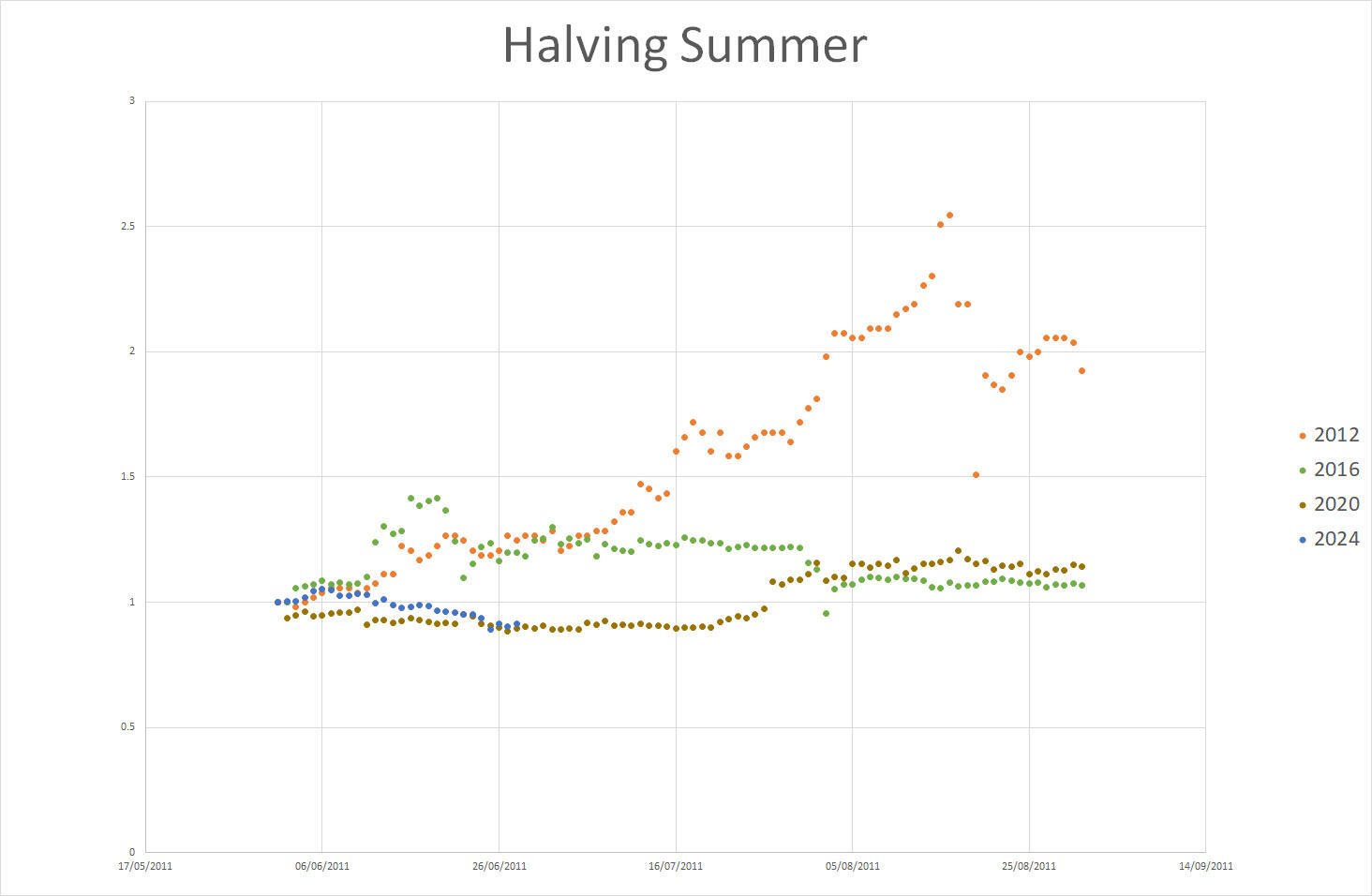

Heard someone mention “well it’s summer now” and was reminded of the summer doldrums. Looking at the data and while some rather exciting early outliers rather muted, but how about looking as post halving years.

Thought this year could be similar to 2017, which we’re sort of diverged from but the summer data suggests we’re still tracking. It won’t repeat so don’t expect a dip a couple of weeks (80k?!? we can only hope) but then things start running into the end of August, 1.96X where started June, or $205k.

No leverage, no selling,just staying humble, stacking sats and enjoying some time with the family…….. #bitcoin

nostr:nevent1qqstpcv66kjgsw0xfns053e7ng7mp0424sxhnr84ynveck7427uxv5cpz7aua