**Welcome To Trading With The New Daily VIX**

Welcome To Trading With The New Daily VIX

_By SpotGamma (https://www.zerohedge.com/spotgamma)_

New this Tuesday, the trading world now has a VIX1D (0-1 DTE) index. With HIRO, we give you a multi-day view under the SPX hood by showing how its zero DTE options are moving in real time. We also have this view available for hundreds of major stocks and ETFs. What this new index represents is a balance of zero-DTE and one-DTE options on SPX.

> Nonstop 0DTE call buying all day (via @spotgamma (https://twitter.com/spotgamma?ref_src=twsrc%5Etfw)) https://t.co/auzhlYZc7w (https://t.co/auzhlYZc7w)pic.twitter.com/wyJASQj7SD (https://t.co/wyJASQj7SD)

>

> — zerohedge (@zerohedge) April 27, 2023 (https://twitter.com/zerohedge/status/1651644142219304969?ref_src=twsrc%5Etfw)

Let’s take a look at the first three trading days of the VIX1D. First, on Tuesday, April 25th, call selling weighed down on the market, as indicated by the green line while the puts were not impactful. Then, on Wednesday, puts were more in control, leading the market up in the morning and then back down in the afternoon. Lastly, starting with some call buying and then put selling for a doubly bullish lift on the index price, the market trended higher. You can see the meaningful impact of the 0DTE tool throughout these three days.

?itok=r7Be-xnY (

?itok=r7Be-xnY ( ?itok=r7Be-xnY)

?itok=r7Be-xnY)

Adding the new VIX1D as a datapoint to your trading arsenal can get you up to par. But if you combine that with our proprietary key levels, then this can really set your trading apart from the crowd.

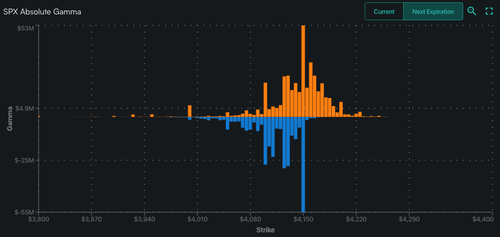

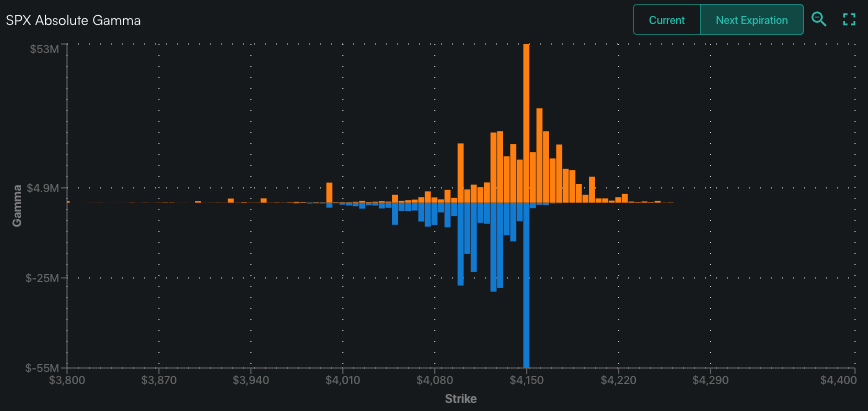

One of over a dozen tools we provide specifically for analyzing index products is our interactive chart of Absolute Gamma, as shown here from Thursday night, which identifies call gamma in orange and put gamma in blue. This is across all option chains but you can also filter it down to zero DTE.

These high **gamma** (https://spotgamma36281.lt.acemlnc.com/Prod/link-tracker?redirectUrl=aHR0cHMlM0ElMkYlMkZzdXBwb3J0LnNwb3RnYW1tYS5jb20lMkZoYyUyRmVuLXVzJTJGYXJ0aWNsZXMlMkYxNTIxNDE2MTYwNzgyNy1HYW1tYSUzRnV0bV9zb3VyY2UlM0ROZXdzbGV0dGVyJTI2dXRtX21lZGl1bSUzRGVtYWlsJTI2dXRtX2NvbnRlbnQlM0RXZWxjb21lK3RvK1RyYWRpbmcrd2l0aCt0aGUrTmV3K0RhaWx5K1ZJWDFEKyU3QytTcG90R2FtbWErV2Vla2x5KzQlMkYzMCUyRjIzJTI2dXRtX2NhbXBhaWduJTNEU3BvdEdhbW1hK1dlZWtseSswNCUyRjMwJTJGMjM=&sig=Cz1n3XskrsK6Vu2gLN2X8z5BtG8X15PxSpb3JtfzTG2T&iat=1682895644&a=%7C%7C90422304%7C%7C&account=spotgamma36281%2Eactivehosted%2Ecom&email=YK6kOrzZEVDGxXaBnX9lZ2VLY1pGRWb2%2B0FTX4hhTec%3D&s=89e6732b8a77fc6da39d2729b64a74da&i=738A918A1A8203) levels are structural boundaries which have a statistically-significant influence over price action. The price tends to be attracted to these levels, but price movements also generally slow down near them and reverse direction.

?itok=Riez_JCq (

?itok=Riez_JCq ( ?itok=Riez_JCq)

?itok=Riez_JCq)

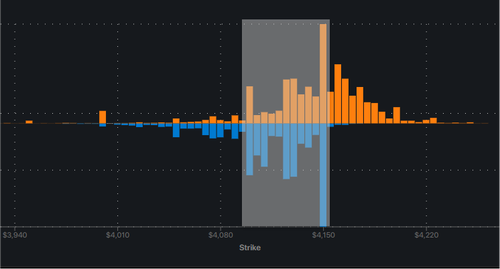

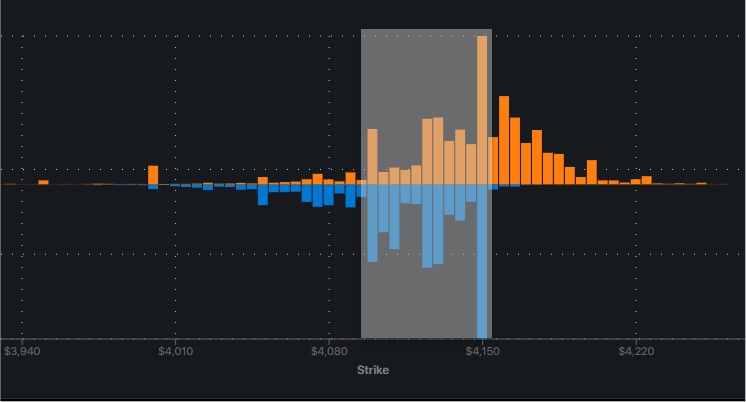

Alternatively, here is a view of that same Absolute Gamma tool but restricted to the scope of zero DTE option structure. Although the bigger picture of all chains shows an important structural firewall at 4000 for the broader market, that 4000 level is too far away for zero DTE traders to take meaningful interest. What this more focused view clarifies is that zero DTE options have the heaviest market gamma between 4100 and 4150, which is where the market was taking its bets for Friday.

Below 4100, there are not enough puts to generate substantial gamma.

?itok=1YMTQRR_ (

?itok=1YMTQRR_ ( ?itok=1YMTQRR_)

?itok=1YMTQRR_)

This structural backbone provides context which helps to make signals from VIX1D less noisy. We can use key gamma boundaries and levels to set up high-probability trades. In outlier events where the price breaks outside of these ranges, especially if the price is still below the Call Wall or above the Put Wall, there is less gamma to slow down the price and there can be some very big moves akin to the price escaping from the bottom or top of a volume profile. If breaking above a new level, all the buyers are making money (rather than trying to _get it back_ at resistance), and that trend can easily move beyond expectations.

As an example of a tactical application, if you see HIRO option flow moving up and leading the price, then you might want to open a covered call (long shares and short a call) to enhance your position and collect some yield if there is not much movement in the underlying price. Or if your outlook is directionally neutral, such as if the price is near our largest Absolute Gamma level and there is positive market gamma, then you could t…

https://www.zerohedge.com/markets/welcome-trading-new-daily-vix