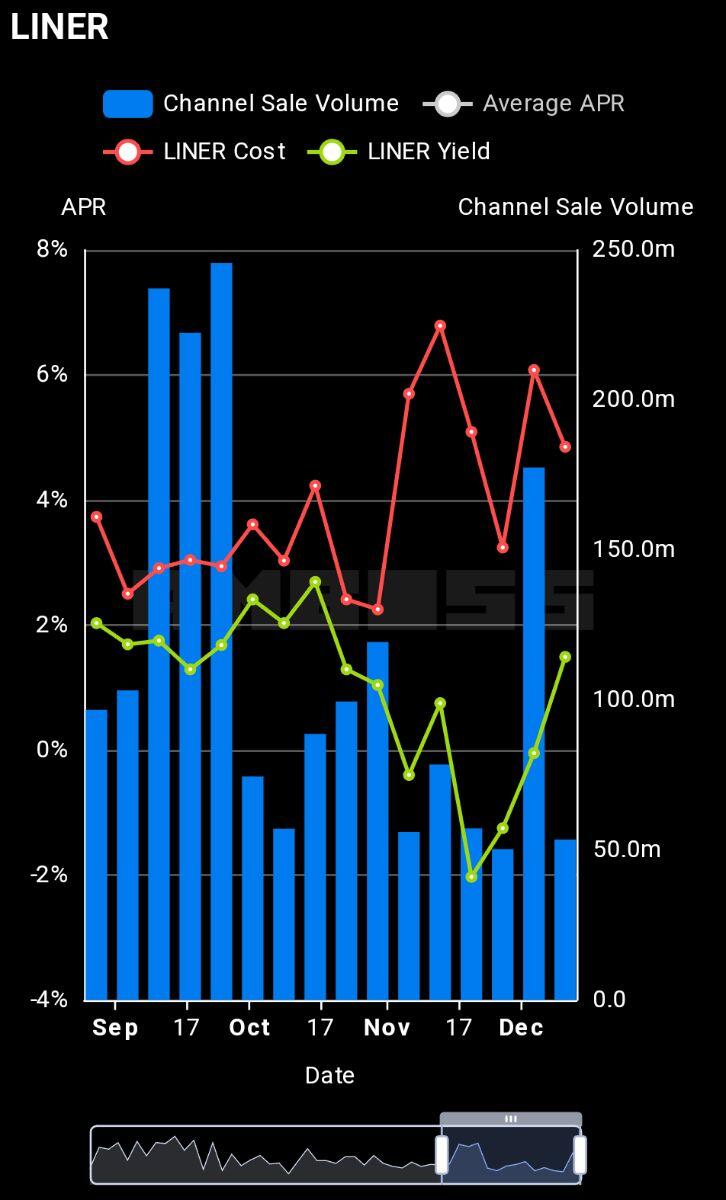

Yields from selling channels on Magma briefly dropped below zero as mempool fees screamed higher.

This is mostly due to the conservative calculation methodology where the close fee is predicted to match the open fee, but will be revised (⬆️ likely) as close fee data is received.

#m=image%2Fjpeg&dim=726x1200&blurhash=%5DD5Fb8gQVpsPVUm%24oIo%25jEogndjCa%24kYbyX%3DohnMbbofrloHXCbIj%5DkGoff3jbjWWZW%40oes*fkV%3DkCohjYofXBoIoHbJjX&x=58b17fc7e4aa077a7d18bcfd785190e3526e2449c2375536fa881bc5f039f69c

#m=image%2Fjpeg&dim=726x1200&blurhash=%5DD5Fb8gQVpsPVUm%24oIo%25jEogndjCa%24kYbyX%3DohnMbbofrloHXCbIj%5DkGoff3jbjWWZW%40oes*fkV%3DkCohjYofXBoIoHbJjX&x=58b17fc7e4aa077a7d18bcfd785190e3526e2449c2375536fa881bc5f039f69c

Magma sellers also made a request for higher fixed fee options, which we implemented. Sellers can now align their pricing to support larger channel opens, for higher yields and lower prices.

https://twitter.com/ambosstech/status/1732399748781629612?t=22DvQLx4quXsfOgQB4EbpQ&s=19

As a result, channel sellers on Magma are capturing higher yields by increasing fixed fee prices while Magma/Hydro channel buyers are seeing larger channels reach lower prices.

LN Yields are again reaching 2% APY despite the high fee environment on Magma.