I think daddy Pow-pow needs to show he’s in charge. Can’t just give into market demands.

The Fed’s playing a game of chicken with the economy and can’t be seen to swerve first. That’s my read anyway.

I think daddy Pow-pow needs to show he’s in charge. Can’t just give into market demands.

The Fed’s playing a game of chicken with the economy and can’t be seen to swerve first. That’s my read anyway.

At this point the Federal funds rate is only for the chumps at retail level, and not a measure of inter-bank credit (the overnight repos, and a plethora of opaque fed facilities like BTFP now provide inter-bank credit). So the question in my mind is how much pain do they want to inflict on the average Joe six-pack?

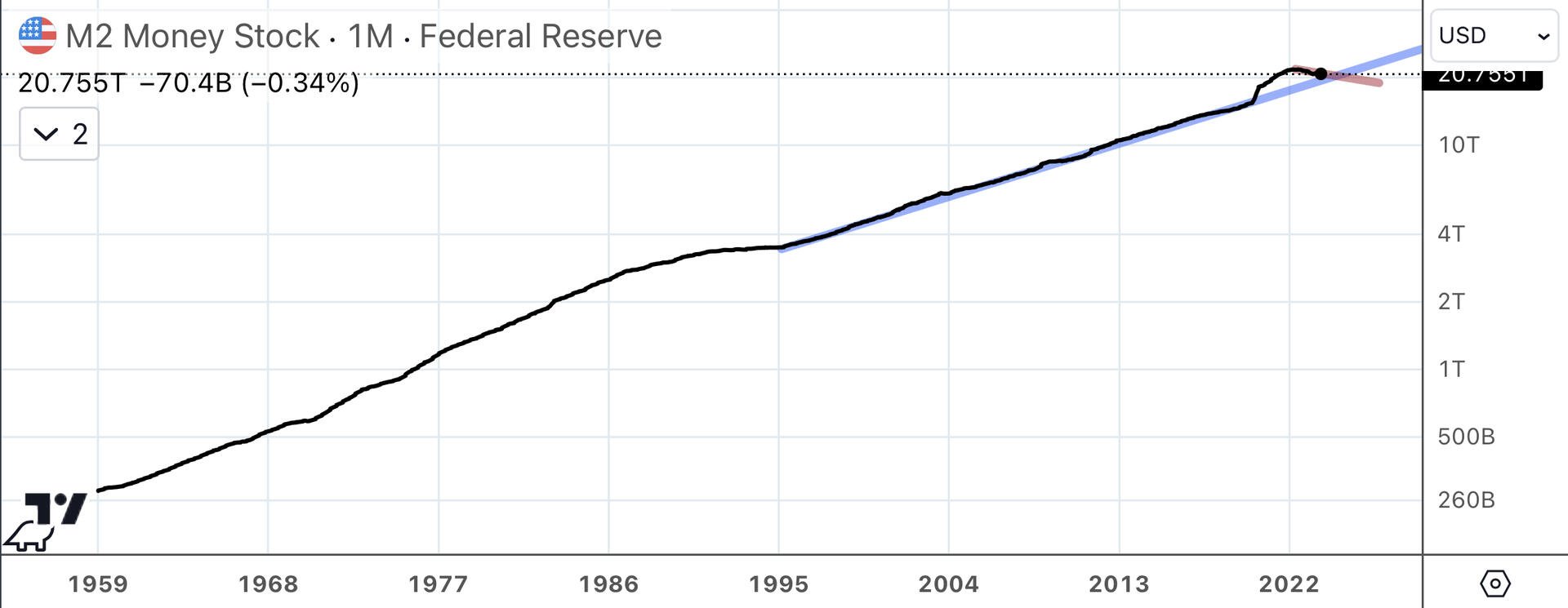

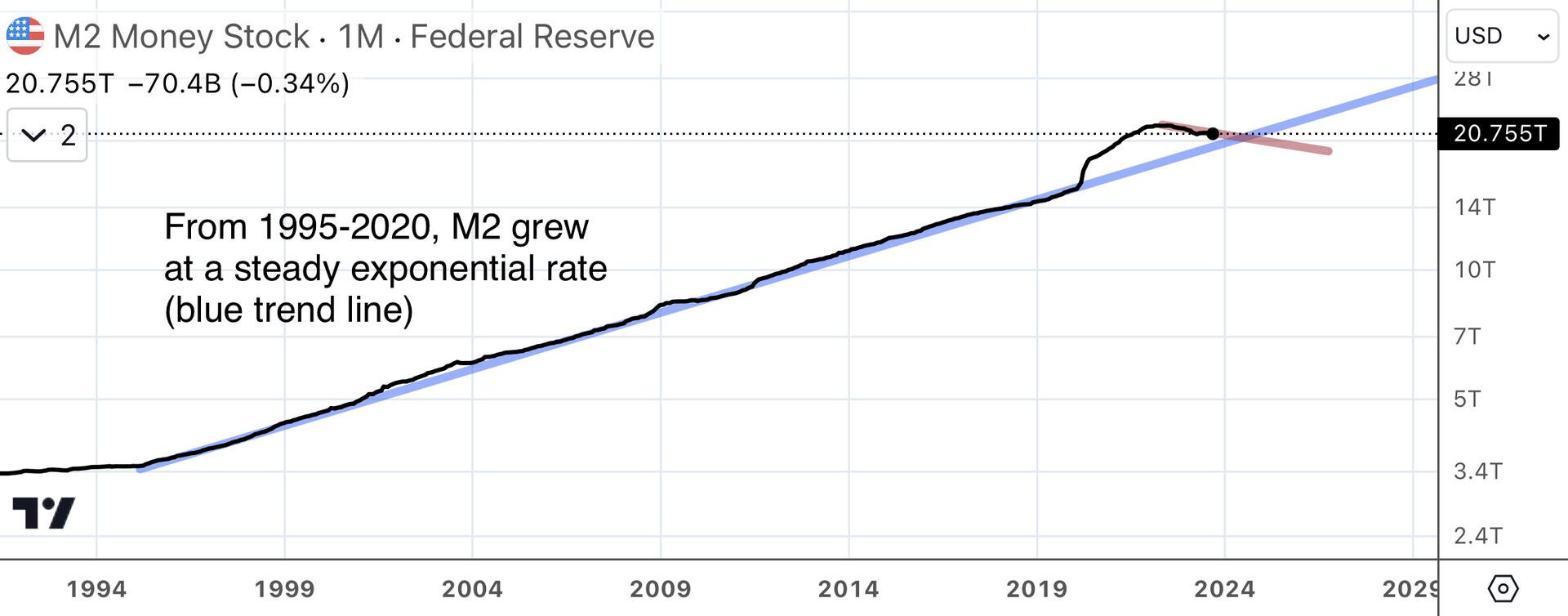

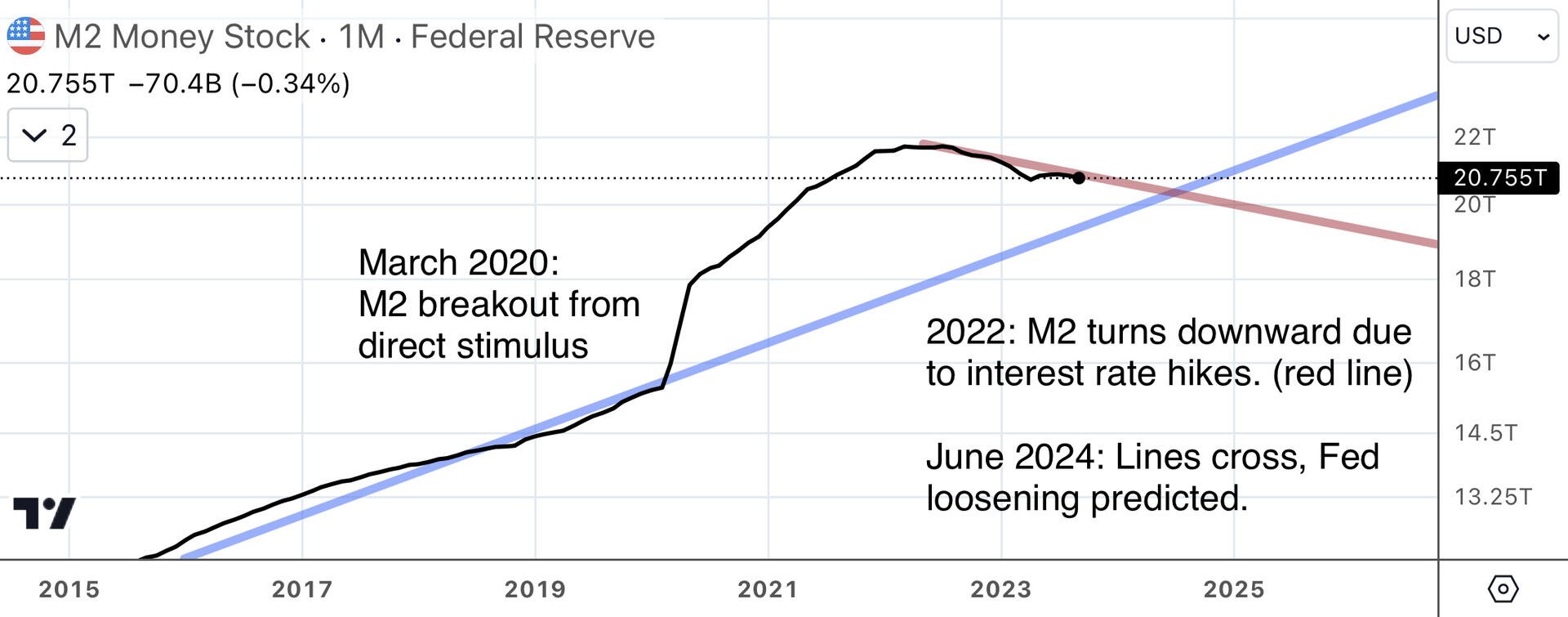

My read is they want to get M2 back to the trend line. June 2024 gets them there. When they do ease, two things will happen, in order: asset price spike then consumer price inflation.

The State’s ideal is to thread the needle, fitting the Presidential election smack between the asset spike and the consumer price inflation. That way, the incumbents get to claim victory over the booming stock market AND having tamed “inflation”.

If the Fed turns the printer back on too early, Joe six-pack’s six-pack will increase in price before Joe has a chance to vote the party line.

They are definitely trying to thread the needle. I think the chart reads more accurate in log scale

Exactly

I just listened to the latest TFTC with Peter St Onge. He said that back in the 70’s, there were actually two periods of inflation. After the first one, the Fed turned the money printer back on too soon and the inflation came roaring back. That led to the second round of tightening that cost Carter the election and the Democrats their previously strong plurality (and paved the way for Regan).

My intuition is that the Fed learned from this experience and will be willing to hold out longer on the first round of pain than they otherwise would have.