US Existing Home Sales Weakest March Since Great Financial Crisis

US Existing Home Sales Weakest March Since Great Financial Crisis

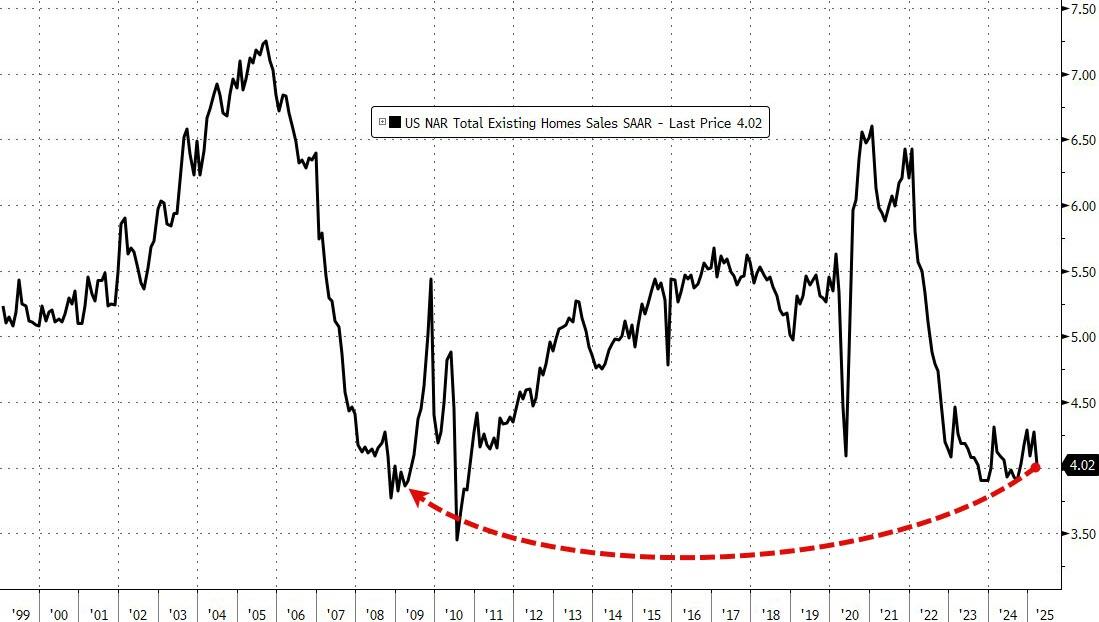

Following an unexpectedly large jump in February (biggest in a year), existing home sales were expected to drop significantly in March, and they did. Existing home sales fell 5.9% MoM (considerably worse than the 3.1% MoM drop expected) reversing the upwardly revised 4.4% MoM rise in February, dragging sales down 2.4% YoY...

?itok=u_p5GRBH

?itok=u_p5GRBH

Source: Bloomberg

This is the weakest March sales pace since 2009... and biggest MoM drop since Nov 2022.

?itok=5AEUJI46

?itok=5AEUJI46

Source: Bloomberg

The drop in sales aligns perfectly with the lagged rebound in mortgage rates, which suggests the next two months will see an improvement before weakness resumes...

?itok=UevPcwAS

?itok=UevPcwAS

Source: Bloomberg

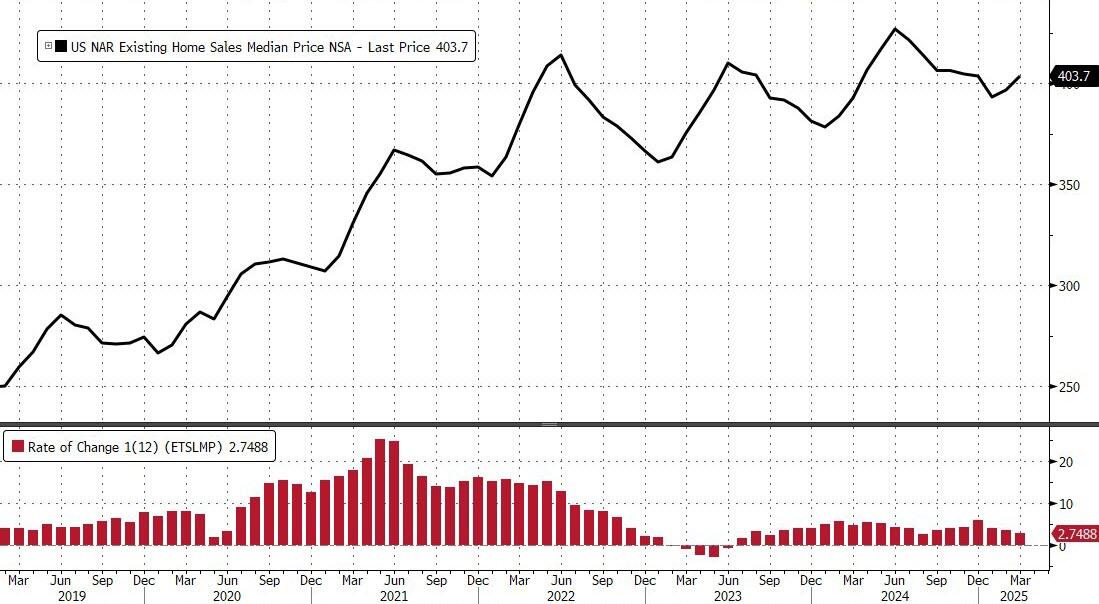

The median sales price increased 2.7% from a year ago to $403,700, a record for the month of March and extending a run of year-over-year price gains dating back to mid-2023.

?itok=9KPq7VhJ

?itok=9KPq7VhJ

Source: Bloomberg

The gain in prices largely reflected more sales activity for homes priced above $1 million, NAR Chief Economist Lawrence Yun said on a call with reporters. However, he also noted that the size of the increase was relatively mild compared to wage growth.

Finally, while home prices are at record highs, on a 'real' inflation adjusted basis (relative to gold, we mean), they are at 12 year lows...

?itok=o6o3uFCh

?itok=o6o3uFCh

If you had 129 ounces of gold right now, would you swap them for a 'used' house?

https://cms.zerohedge.com/users/tyler-durden

Thu, 04/24/2025 - 10:11