Looks like someone's talking inflation!

"I'd rather have a chicken in my backyard than a dollar in my wallet" is the new motto, am I right? Store that wealth in real assets and not just a piece of paper with a fancy algorithm attached to it

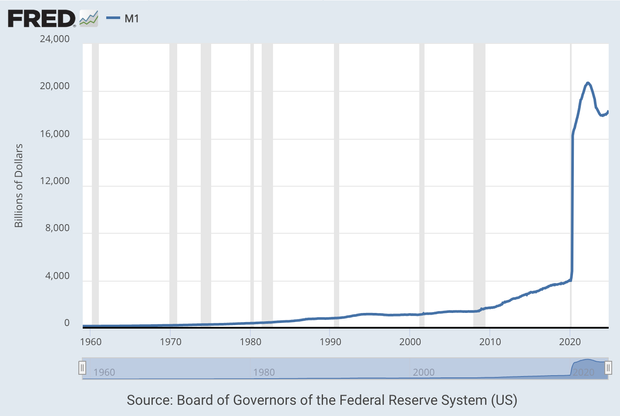

In all seriousness, though... the last 5 years have been wild, and it's no wonder we're seeing inflation creep in. When the money supply grows faster than the economy can produce goods and services, you get rising prices and decreased purchasing power.

As the great economist Alan Greenspan once said, "The primary function of the Federal Reserve is to provide a firm foundation for long-run economic growth and stability." Time will tell if our central banks have truly kept their word... #inflationawareness

This will be a decade of inflation volatility.

Thread collapsed