Given the increasing price per ounce over time you would think so, but no: in 2023 about 3,000 metric tons of gold were added to the global supply.

Think what that implies about inflation and Bitcoin.

Given the increasing price per ounce over time you would think so, but no: in 2023 about 3,000 metric tons of gold were added to the global supply.

Think what that implies about inflation and Bitcoin.

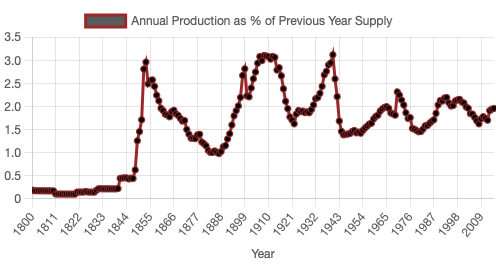

Rate of change is percentage of total supply, not an absolute number. Total above-ground stock is circa 212,582 tonnes, so your 3,000 denotes 1,4%, which seems too high, but okay.

Mining added 1% to supply, in 2023, and the majority of the rest of the supply growth came from recycled gold (mostly melted jewelry, as people responded to the spike in price) leading to a temporary jump of market-available gold of 3%.

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-full-year-2023/supply

Not sure on those exact numbers since the page you link states 3,644 mined and 1,237 recycled in 2023, but I graphed production as a percentage of supply and you're right: it's basically 2%. Given this stability from 10 tons/yr to the recent 3,600 tons/yr, you have to wonder whether that's a free market decision. If not, then we still have the question of why 2%.