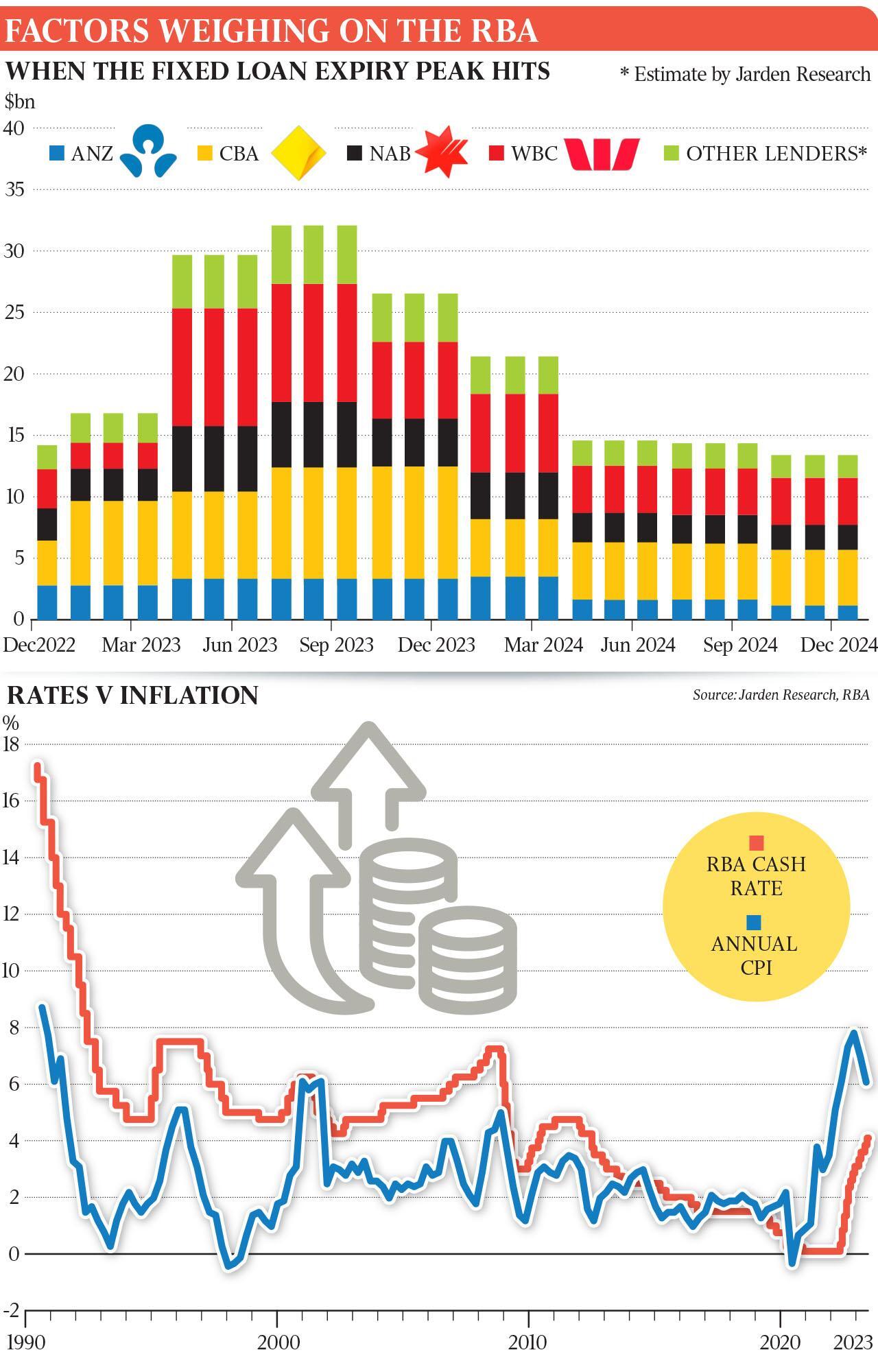

~$110B of #AUStriches mortgages coming off fix rate from April 2023 thru March 2024.

This is the calm before the storm.

~$110B of #AUStriches mortgages coming off fix rate from April 2023 thru March 2024.

This is the calm before the storm.

Going to be interesting to see what the next 12 months bring.

Hey friends i don’t know this stuff. Does this mean a bunch of mortgages will switch into current aka higher interest rate mode and fuck over a bunch of aussies who own homes? 😳

Pretty much nailed it!

Canada is on same path, The USA is a bit different they literally sign for 30yrs locked rate

Wow really?

Yup, currently we are only seeing the variable rate people hurt right now, at current rates my mortgage would be +400/month at today’s rates. I don’t renew till 2026 so i have a bit of lane way

Wow that’s a huge increase!

I am going to be ok, this situation is an extreme but more is coming the longer our rates stay high

This will be heartbreaking for many.

I’ve got a lot of family members that will be in a tough situation soon in Oz, I’m grateful that I am not in this awful situation.

Thoughts are with all that will endure very harsh conditions 🫂

There will be pain, I can only hope that people’s financial situation is not too over done.

Yeah man it’s fucked up. Different situation here but as an aspiring a first (and ideally only) time with my fiancee we are the ones who would have to take on HER crazy high new mortgage monthlies. It’s undoable!! We’ve basically just given up until everything breaks or a miracle happens

Aspiring first/only-time *buyer

whoops

Your on a good pathchain

It’s no longer a dream to own your own home, better of renting and stacking sats!

Do you get to refinance/renew whenever you want up to that date at which point it just happens if you hadn’t?

Ok.

2015s signed at 3.29, then with my son on the way we “ported over that mortgage to our current house, and signed an additional mortgage at 3.99. No “real transfer costs” cause i was adding to my ledger with the bank.

2022 rates at 2.2% I break old mortgages and sign single mortgage at 2.2%

When I broke the mortgages i paid 10k in fees (fines for getting out early) but overall my total borrowed dropped by ~25k due to the reduced rate of interest compounded over 30yrs

So yes you can renew when you want or hold till term. Theres penalties.

Correct. The first screenshot is what the median mortgage might have looked like in 2020 when taken out at a fix rate of 1.5% - the fix rate is only locked in for a short period, often 2-3 years.

The second image is the new monthly repayment if the same mortgage moved to today’s variable rate of 5.7%

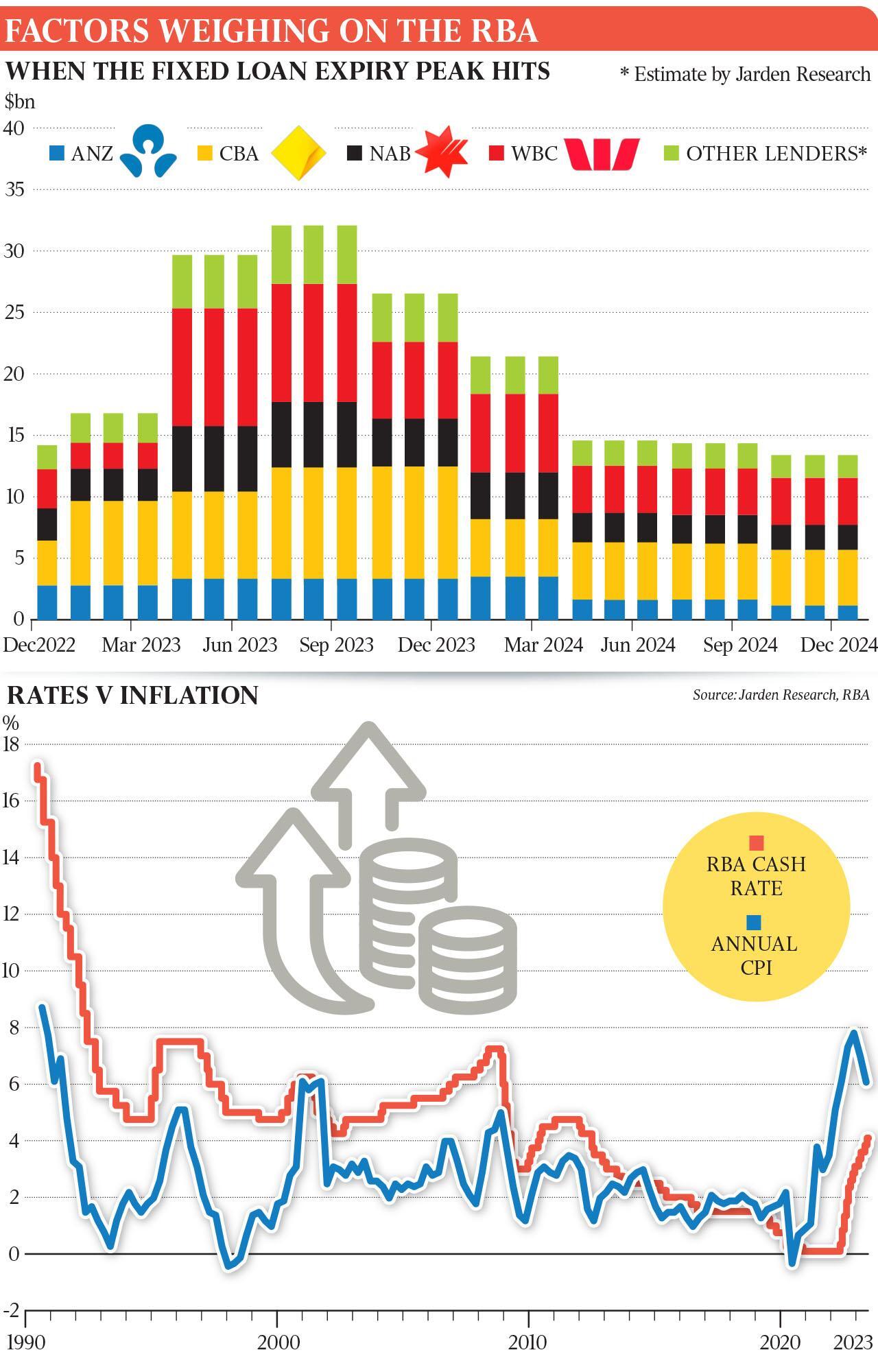

Mortgage holders see their repayments go up massively, that is on top of everything else (fuel, electricity, gas, groceries etc.) inflating 30% all whilst wages are at their lowest since 2009.

This is how central bankers “fix” the economy when their money printing comes back to bite - by throwing millions into poverty and getting them to lose their jobs at the same time.

Cool system eh?

In Australia, do fixed mortgage rates have to be renewed every few years? In Canada it's every 5 and I think that's our timeline too.

Yes, fixed rate is typically locked in for 1-5 years and then will switch to market variable rate. The US is the only market with 30-year fixed, that’s a dynamic unique to them. Aus and Canada markets are very similar