**Morgan Stanley Slides As Credit Loss Provisions Surge Due To Commercial Real Estate Exposure**

Morgan Stanley Slides As Credit Loss Provisions Surge Due To Commercial Real Estate Exposure

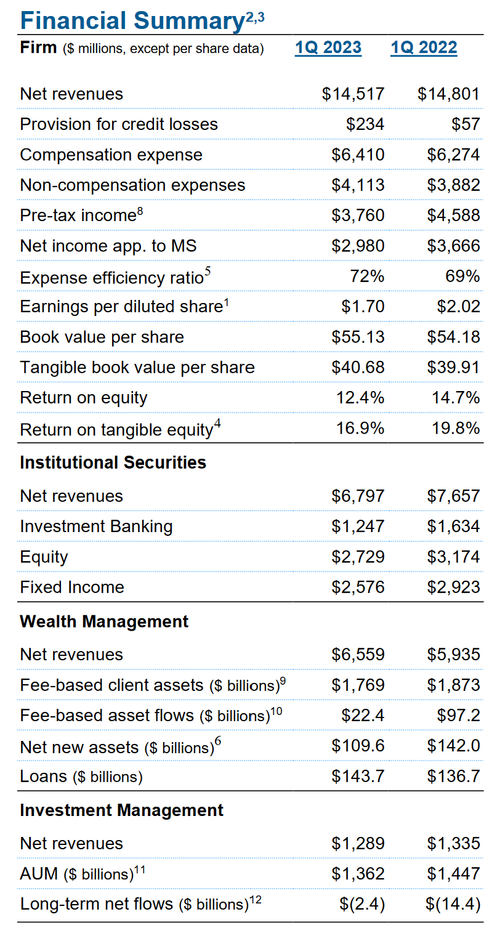

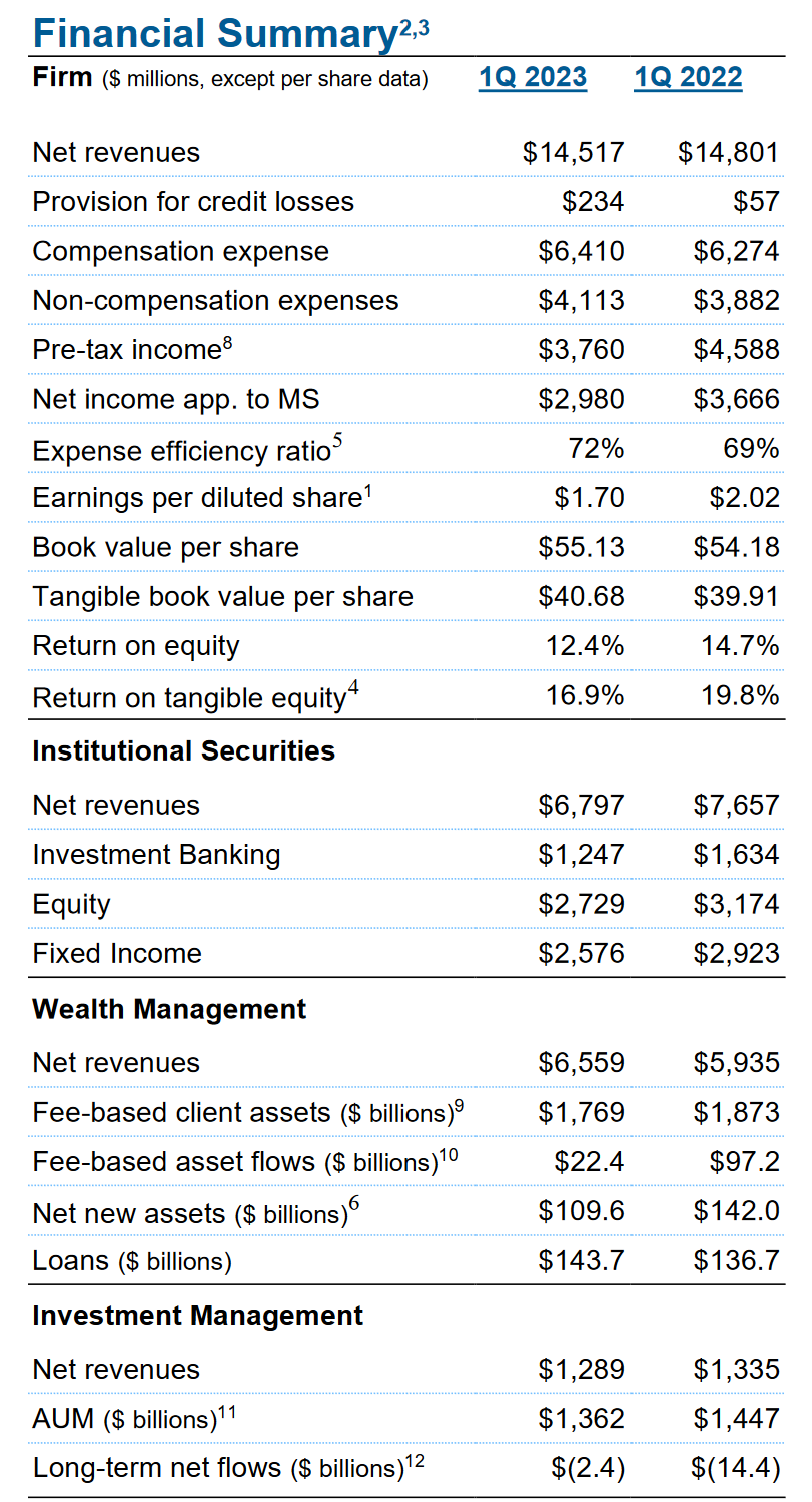

On the surface, Morgan Stanley's earnings should have been strong enough to prompt a boost in the stock price: unlike its biggest competitor Goldman, which yesterday tumbled after reporting lousy Q1 numbers including a rare miss in FICC, MS not only beat across the board (https://www.morganstanley.com/content/dam/msdotcom/en/about-us-ir/shareholder/1q2023.pdf)but also saw its investment bank generate stronger than expected results; even so, both revenue and profits dropped Y/Y, with net income down to $3.0 billion, or $1.70 per diluted share, vs net income of $3.7 billion, or $2.02 per diluted share, for the

same period a year ago. Here is a summary of what the bank reported:

- EPS $1.70, _**beating**_ estimates of $1.65

- Net revenue $14.52 billion, _**beating**_ estimates of $14.07 billion, down from $14.8 billion Y/Y

- Wealth management net revenue $6.56 billion, +11% y/y, **beating** estimates of $6.48 billion

- Wealth Management pretax profit $1.7 billion, estimate $1.81 billion; wealth management pretax margin +26.1%, estimate +28%

- FICC sales & trading revenue $2.58 billion, **beating** estimates of $2.42 billion

- Equities sales & trading revenue $2.73 billion, -14% y/y, **missing** estimates of $2.86 billion

- Institutional Investment Banking revenue $1.25 billion, **beating** estimates of $1.12 billion

- Advisory revenue $638 million, -32% y/y, **beating** estimates of $544.6 million

- Equity underwriting rev. $202 million, -22% y/y, **missing** estimates of $219.9 million

- Fixed Income Underwriting revenue $407 million, -5.8% y/y, **beating** estimates of $356.6 million

And visually:

?itok=nW-sas0_ (

?itok=nW-sas0_ ( ?itok=nW-sas0_)

?itok=nW-sas0_)

**Here are several other notable numbers:**

- Total deposits $347.52 billion, vs est $352.17 billion

- Non-interest expenses $10.52 billion, vs estimates of $10.12 billion

- Compensation expenses $6.41 billion, vs estimates of $6.07 billion

- Non-compensation expenses $4.11 billion, vs estimates of $4.09 billion

- Net interest income $2.35 billion, vs estimate $2.46 billion

- Effective tax rate 19.3%, estimate 22%

- Expense efficiency ratio 72%, estimate 72.4%

- Fee-based asset flows $22.4 billion, estimate $24.28 billion

Including key credit metrics:

- Book value per share $55.13

- Tangible book value per share $40.68

- Return on equity 12.4%, estimate 12.7%

- Return on tangible equity +16.9%, estimate +16.9%

- Standardized CET1 ratio 15.1%, estimate 15.1%

The bank also noted that Wealth Managementattracted $110 billion of new assets during the quarter, leading to $6.6BN in net revenues, positively impacted by mark-to-market gains on"investments associated with certain employeedeferredcompensation planscompared to losses a year ago." The results "reflecthigher net interest incomeversus prior yearprimarilydriven byhigher interest rates,even as clients continue toredeploysweepdeposits. These results werepartially offsetbyan increaseinexpenses as well as higherprovisions forcreditlosses."

MS also said that its Investment Managementresultsreflected netrevenuesof $1.3billiononAUMof$1.36trillion(vs $1.33 trillion exp) amid declines inasset valuesfrom a year ago.

And a few other notable comments:

- Compensation expense increased primarily driven by higher expenses related to certain deferred compensation plans linked to investment performance partially offset by lower compensation associated with carried interest

- Gorman says Equity and Fixed Income revenues were strong, but Investment Banking activity remained constrained

- Results reflect higher net interest income driven by higher interest rates, even as clients continue to redeploy sweep deposits. Results partially offset by an increase in expenses as well as higher provisions for credit losses

- Investment Management results reflect net revenues of $1.3 billion on AUM of $1.4 trillion amid declines in asset values from a year ago

So far so good, **but what has spooked investors this morning and sent the stock price lower after an initial kneejerk higher,** was the bank's admission that not all is well, specifically as relates to the "credit event bogeyman" du jour. To wit, Morgan Stanley revealed that it took a provision for credit losses of $234 million, more than double the estimated $99.1 million, and more than quadrupling the $57 in Q1 '22, and here's why:

> _**Increases in provisions for credit losses wereprimarilyrelated to commercial real estate and deterioration in themacroeconomic outlook from a year ago.**_

As a result, after briefly spiking above $90, MS stock has dipped as low as $86.5, which however is hardly a disaster as …