**Commodities Bellwether Flashes US Recession Warning**

Commodities Bellwether Flashes US Recession Warning

_Authored by Bloomberg's Nour Al Ali,_

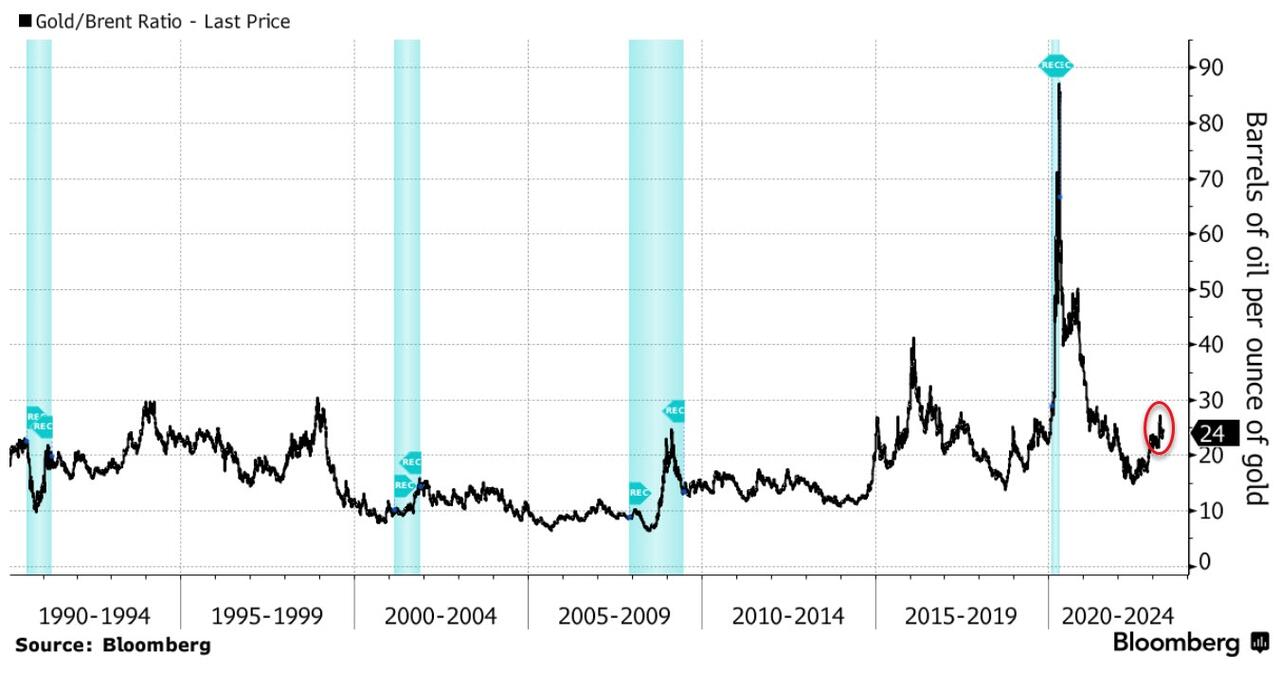

**The commodities market’s bellwether for recessions is flashing a warning sign.**

As uncertainty circles the markets on whether the Fed is approaching the end of its tightening cycle, **the gold-to-oil ratio suggests commodities traders are hedging against the risk of a US recession.**

?itok=N-oSwRrl (

?itok=N-oSwRrl ( ?itok=N-oSwRrl)

?itok=N-oSwRrl)

With oil prices down this year while gold is up, the ratio has surged to almost 24, compared with an average of less than 17 since 2000.

**Anything significantly above that average is considered as a warning sign by some market participants.**

The performance of gold and oil relative to each other is a measure of investor sentiment on the economy, as both assets are cyclical and priced in dollars.

**Historically, gold tends to outperform oil during the onset of a recession or great economic uncertainty.**

We’ve seen this trend during the global financial crisis, the recession of the early 1990s, and even in what’s known as the mini-recession of 2015-16, though that was due to Saudi Arabia’s oil-price war with the US.

**Now, uncertainty about the Fed’s interest-rate path and a potential economic downturn will likely see the the ratio increase even further.**

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Wed, 04/26/2023 - 14:46

https://www.zerohedge.com/markets/commodities-bellwether-flashes-us-recession-warning