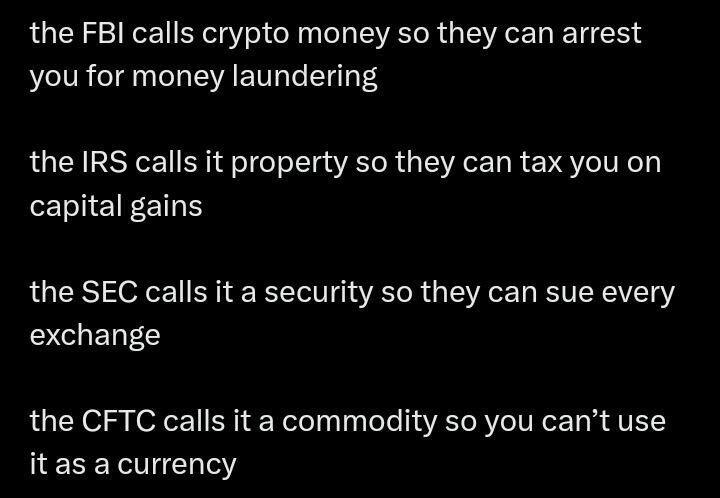

Because digital property is how it is currently classified by the IRS tax code?

Peter, please ask nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m why he continues to repeat that Bitcoin is “digital property.”

This is problematic because, as he surely knows, property is taxed annually.

Bitcoin is a digital COMMODITY.

Discussion

In my view, the IRS *should* have treated it like a digital currency. That would have been fairer for miners.

But since but the CFTC (and now the SEC) both say it’s a commodity. The IRS should do the same so there’s agreement and consistency.

And the IRS should remove the double taxation that miners pay: currently once at the time Sats are mined, and then again when exchanged for fiat. That’s crazy. You don’t tax a gold miner for every scoop of earth they excavate, and then again when they sell the refined metal at market prices.