If redemption doesn't matter why has the dollar fallen 95% since then?

Discussion

Because the issuer continued to issue more dollars. This is a policy, if they chose to not do it, it would probably not happened like that. Gold redemption indeed made it more difficult for governments to issue money. But this is not a requirement to people actually using something as money.

Do you know the difference between money, currency and credit?

Maybe you may educate me.

"Gold is money and all the rest is credit" -JP Morgan

Money is a commodity of inherent value, in particular gold, which is the most durable commodity and therefore the best form of physical savings and has therefore been chosen by the market as money.

Credit is a promise to pay money.

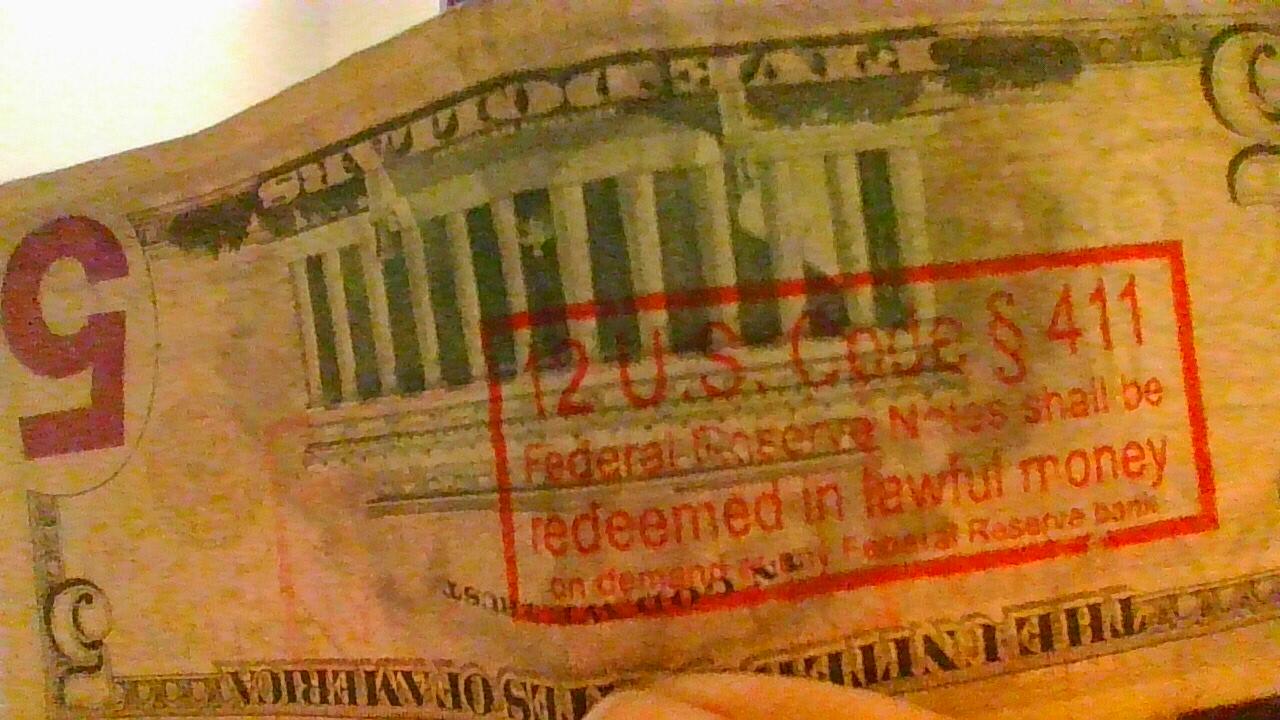

Currency is a credit instrument which promises to pay the bearer some amount of money on demand. The current "pound sterling" notes still print this false promise on their face. US law still guarantees that Federal Reserve Notes shall be redeemed on demand. Of course, neither promise is honored.

Bitcoin is a (crypto) currency, a digital currency cryptographically secured. It is not a commodity because there are no Bitcoins. Instead it is a ledger entry that cannot be redeemed, just like fiat bank deposits or fiat notes.