BlackRock To Launch Bitcoin ETP In Europe

BlackRock To Launch Bitcoin ETP In Europe

https://cointelegraph.com/news/blackrock-list-bitcoin-etp-europe

BlackRock, the world’s largest asset manager, is preparing to launch a Bitcoin exchange-traded product (ETP) in Europe, according to a Feb. 5 report by Bloomberg.

?itok=8d15q9aR

?itok=8d15q9aR

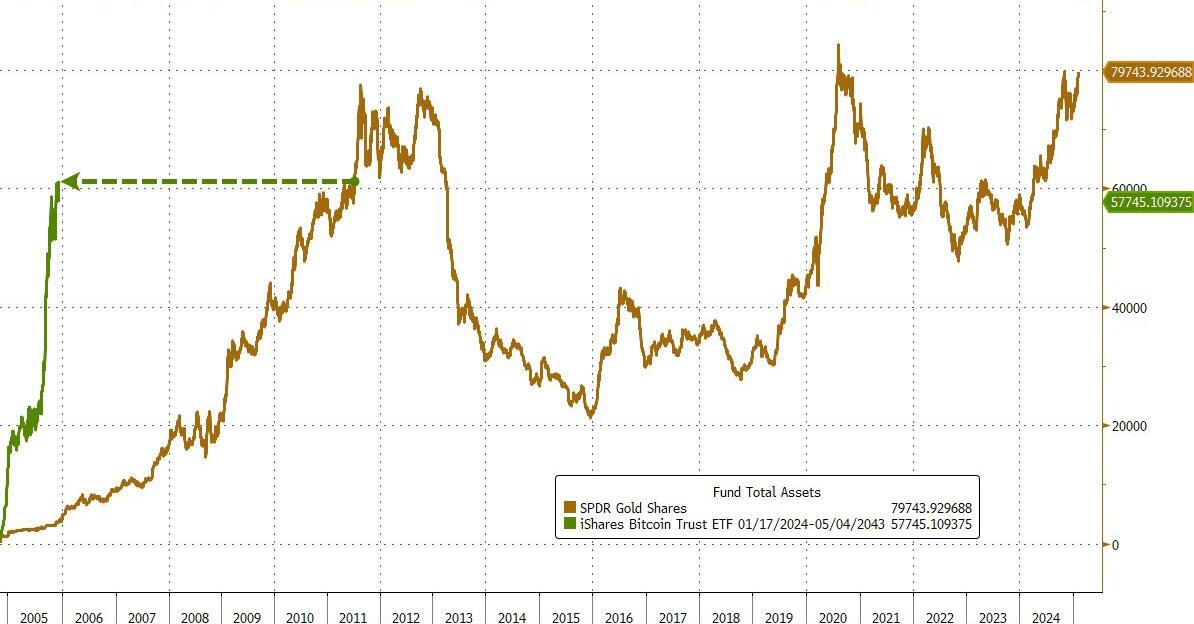

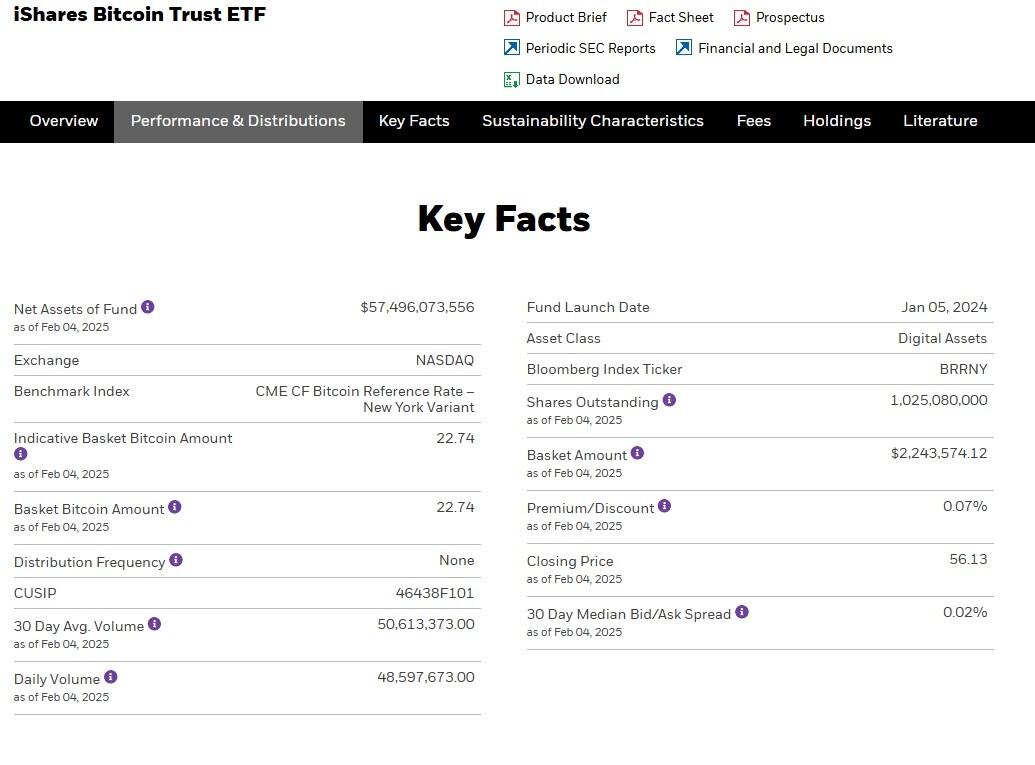

The move comes after BlackRock’s US spot Bitcoin exchange-traded fund (ETF), iShares Bitcoin Trust (IBIT), drew upward of $57 billion in net assets after launching in January 2024. BlackRock’s IBIT fund is America’s most popular spot Bitcoin ETF and chived in just a year what it took GLD (the most popular gold ETF) seven years to achieve...

?itok=VixWYi8E

?itok=VixWYi8E

BlackRock’s European Bitcoin ETP will reportedly be domiciled in Switzerland. The asset manager plans to start marketing the fund as soon as this month, Bloomberg https://www.bloomberg.com/news/articles/2025-02-05/blackrock-said-to-list-bitcoin-exchange-traded-product-in-europe

, citing people familiar with the matter.

BlackRock is a top ETF issuer, with $4.4 trillion in assets under management (AUM) across its suite of ETPs. This would be BlackRock’s first Bitcoin ETP outside of North America, Bloomberg said.

?itok=g59eNy4-

?itok=g59eNy4-

BlackRock’s IBIT is the US’s most popular BTC ETF. Source: https://www.blackrock.com/us/individual/products/333011/ishares-bitcoin-trust

Expanding crypto product suite

BlackRock has been doubling down on IBIT’s success with international expansions. In January, BlackRock https://cointelegraph.com/news/blackrock-launches-bitcoin-etf-canada

on the Cboe Canada. The ETF allowed Canadian investors to access BlackRock’s flagship US spot Bitcoin fund.

Overall, US Bitcoin ETFs saw more than https://cointelegraph.com/news/blackrock-bitcoin-etf-tops-rivals-2024-net-inflows

in 2024, or roughly $144 million in net inflows each trading day, according to data from Farside Investors.

In November, US BTC ETFs https://cointelegraph.com/news/us-bitcoin-etfs-break-100-billion

for the first time, according to data from Bloomberg Intelligence. Crypto analysts at Steno Research expect Bitcoin ETFs to attract another roughly $48 billion worth of net inflows in 2025.

Bitcoin has “become [a] more important component […] of investors’ portfolios structurally” as they increasingly seek to hedge https://cointelegraph.com/news/bitcoin-debasement-trade-jpmorgan

, investment bank JPMorgan said in a December report, citing the “record capital inflow into crypto markets.”

Surging institutional inflows could cause positive https://cointelegraph.com/news/2025-demand-shock-bitcoin-price-spike-sygnum

for Bitcoin, potentially sending BTC’s price soaring in 2025, asset manager Sygnum Bank said in December.

https://cms.zerohedge.com/users/tyler-durden

Thu, 02/06/2025 - 07:45

https://www.zerohedge.com/crypto/blackrock-launch-bitcoin-etp-europe