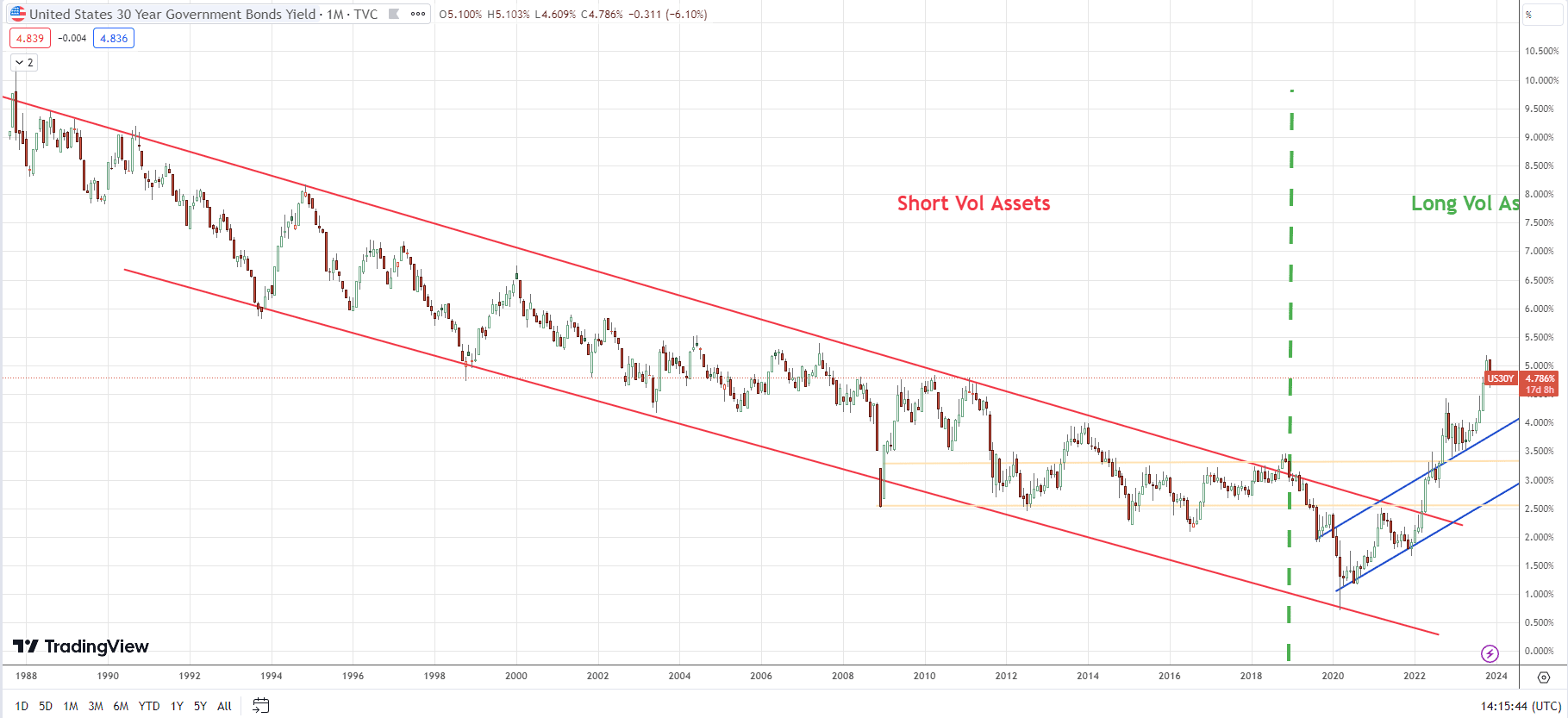

A structural market change not seen in decades is upon us. Here's why…

After WWII and until 1981, we lived in a long vol environment.

This forced capital to be allocated strategically as rates were rising.

In an inflationary system, this is a "normal" market.

https://fred.stlouisfed.org/series/FEDFUNDS

After 1981 as rates fell, short vol strategies and projects that didn't make sense became popular.

This brought on derivative games and private investment games of hot potato...

Place your bets, just don't be left holding the bag.

Post 2000, we entered into a deflationary environment.

After 41 years, we're now entering back into a long vol environment.

The ramifications are drastic for short vol strategies, projects, and deals that don't make economic sense.