แทรกแซงตลาด(หุ้น) like a boss 😂

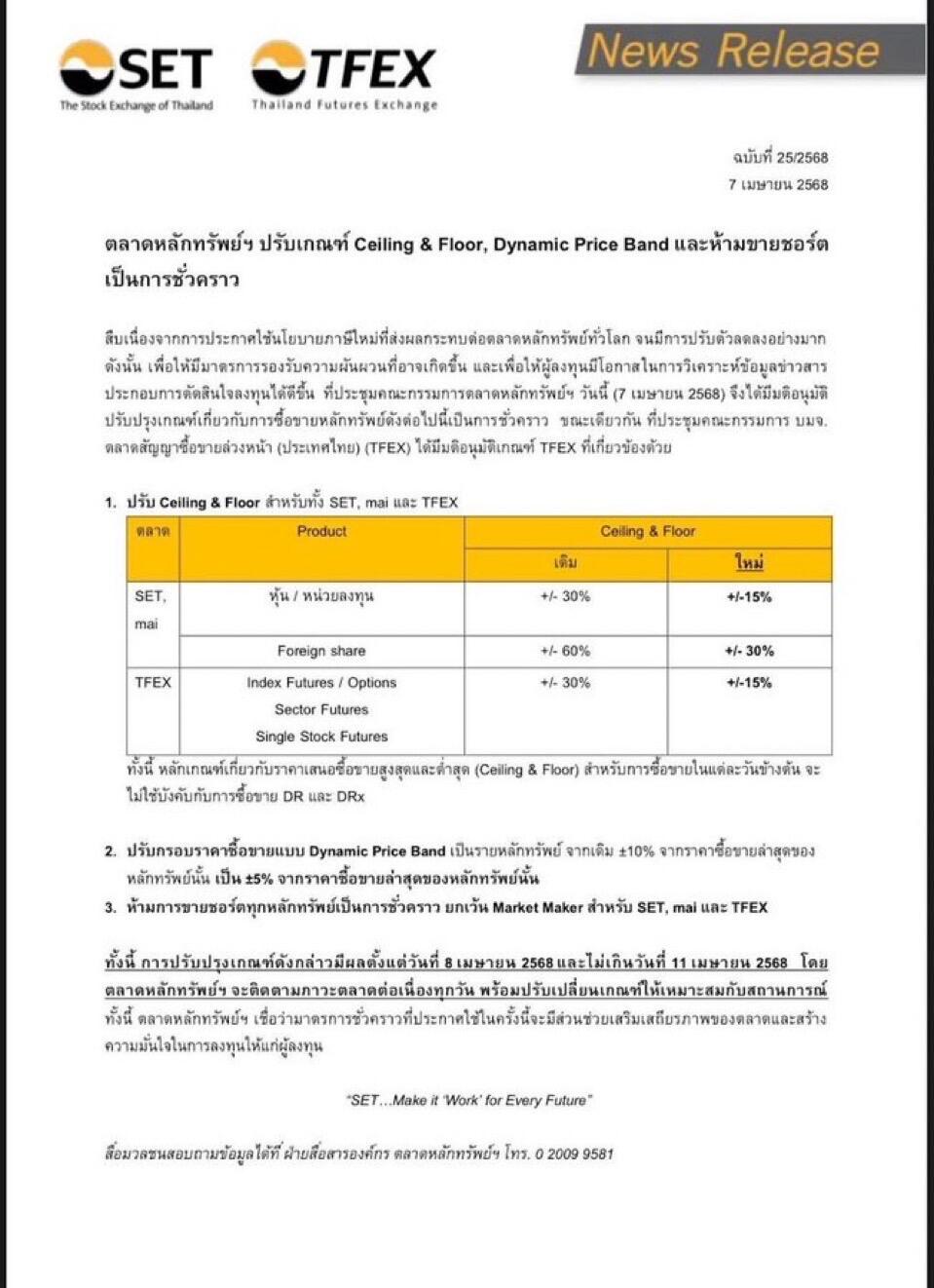

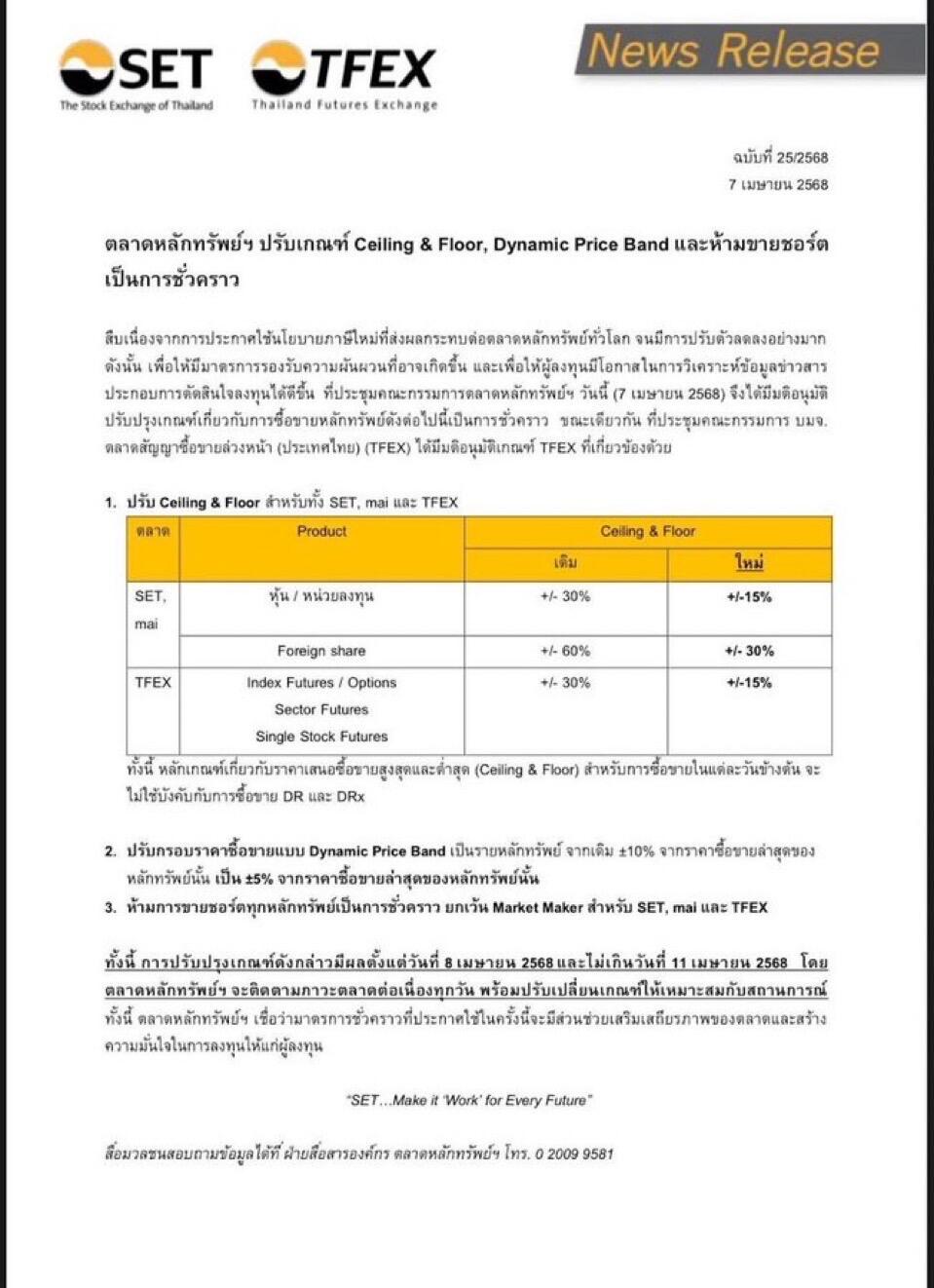

ปรับเกณฑ์ ซิลลิง ฟลอร์ เหลือ 15% และห้ามขายชอร์ตทุกหลักทรัพย์ ตั้งแต่ 8-11 นี้

Bitcoin fix this..

#Siamstr

แทรกแซงตลาด(หุ้น) like a boss 😂

ปรับเกณฑ์ ซิลลิง ฟลอร์ เหลือ 15% และห้ามขายชอร์ตทุกหลักทรัพย์ ตั้งแต่ 8-11 นี้

Bitcoin fix this..

#Siamstr

Gemini says...

Based on the news release from the Stock Exchange of Thailand (SET) and Thailand Futures Exchange (TFEX) dated April 7, 2025 (2568 B.E.):

Actions Taken by Thai Regulators:

Due to significant market declines attributed to the impact of a new tax policy on global stock markets, the SET and TFEX have temporarily implemented the following measures, effective from April 8, 2025, until no later than April 11, 2025:

* Reduced Price Limits (Ceiling & Floor): The maximum daily price movement limits have been tightened:

* For SET and mai listed stocks/units: Changed from +/- 30% to +/- 15%.

* For Foreign shares: Changed from +/- 60% to +/- 30%.

* For TFEX Index Futures/Options, Sector Futures, Single Stock Futures: Changed from +/- 30% to +/- 15%.

* (These limits do not apply to DR and DRX trading.)

* Adjusted Dynamic Price Band: The dynamic price band for individual securities (preventing sudden large price moves within a short time) has been adjusted from +/- 10% to +/- 15% of the last traded price. (Note: While the daily limits are tighter, this specific band is wider).

* Banned Short Selling: Short selling of all securities on SET, mai, and TFEX is temporarily prohibited, with an exception for designated Market Makers.

What These Measures Aim to Achieve:

According to the SET's news release, the intended purposes of these temporary measures are:

* Manage Volatility: To provide measures to cope with the high market volatility stemming from the external shock (new tax policy).

* Provide Investor Time: To give investors more opportunity to analyze information and news before making investment decisions during a turbulent period.

* Stabilize the Market: The SET believes these actions will help stabilize market conditions.

* Build Investor Confidence: Ultimately, the goal is to reinforce investor confidence in the market.

In essence, the regulators are trying to prevent panic selling and extreme price drops by artificially limiting how much prices can fall each day and removing the downward pressure that can be exerted by short sellers betting on further price declines.

How This "Meddling" Could Be Worse Than Letting the Market Correct Itself:

While the regulators aim for stability, interventions like these are often criticized for potentially causing other problems compared to allowing market forces to operate freely, even if it means a sharper crash:

* Distorted Price Discovery: Price limits and short-selling bans prevent assets from reaching their true market-clearing price based on supply, demand, and investor sentiment. This can mask the actual perceived value or risk, leading to inefficient resource allocation.

* Reduced Liquidity: Short sellers can add liquidity to the market by providing shares to buy. Banning them can reduce trading volume and widen the gap between buying and selling prices (bid-ask spread), making it harder and more expensive for investors to trade. Price limits (hitting the floor) can halt trading altogether, completely removing liquidity.

* Trapped Sellers: Investors who genuinely need or want to sell their holdings might be unable to do so if the price hits the lower limit for the day, trapping them in positions they wish to exit.

* Delayed Adjustment: Preventing a sharp correction can prolong the period of uncertainty. A natural crash, while painful, can sometimes lead to a quicker bottoming out and recovery as weak hands are flushed out and prices reach levels attractive to new buyers. Intervention might just delay the inevitable decline, leading to a slower, grinding bear market.

* False Sense of Security/Moral Hazard: Interventions can create a perception that regulators will always step in to prevent significant losses. This might encourage excessive risk-taking in the future (moral hazard).

* Damage to Confidence (Counter-argument): While intended to build confidence, heavy-handed intervention can sometimes signal desperation or a lack of faith in the market's underlying strength, potentially damaging long-term confidence among some participants who prefer freely functioning markets.

In summary, the regulators are prioritizing short-term stability and confidence over the market's natural price discovery mechanism. Critics argue that such interventions interfere with market efficiency, can trap investors, reduce liquidity, and potentially only delay necessary price adjustments, possibly leading to worse long-term outcomes than a quicker, albeit more painful, market correction.