**Bank Bailout Facility Usage Rises First Time Since SVB, MM Fund Outflows Soar**

Bank Bailout Facility Usage Rises First Time Since SVB, MM Fund Outflows Soar

After last week saw The Fed's balance sheet shrink significantly (https://www.zerohedge.com/markets/fed-balance-sheet-shrinks-3rd-straight-week-bank-bailout-facility-usage-eases) back from its bank-bailout resurgence,all eyes will be back on H.4.1. report (https://www.federalreserve.gov/releases/h41/) this evening to see if things have continued to 'improve' or re-worsened amid regional bank shares unable to bounce above post-SVB lows ahead of earnings.

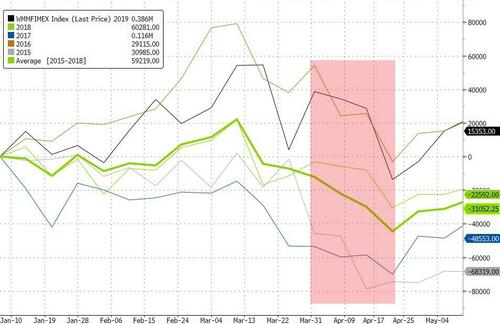

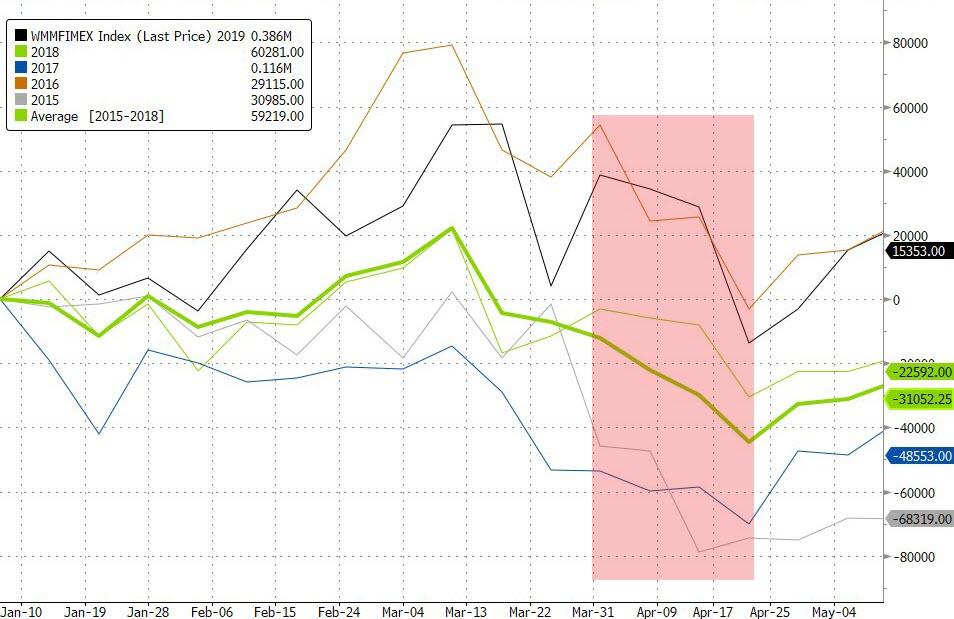

In a big surprise, **this week saw a $68 billion OUTFLOW from Money Market funds** \- the largest since July 2020 (after $380 billion of INFLOWS over the previous five weeks)...

?itok=E-TsXF79 (

?itok=E-TsXF79 ( ?itok=E-TsXF79)

?itok=E-TsXF79)

_Source: Bloomberg_

The breakdown was **$58.9 billion from Institutional funds** and **$9.72 billion from retail funds.**

That pulled assets from their $5.277 trillion record high and suggests last week's deposit INFLOWS may be about to accelerate - good news for banks?

?itok=l5yhjBaa (

?itok=l5yhjBaa ( ?itok=l5yhjBaa)

?itok=l5yhjBaa)

_Source: Bloomberg_

Added to last week's deposit inflows, this suggests - in the short-term - the banking crisis is easing (at least in the minds of investors).

However, it's never that easy, as BofA noted earlier (https://www.zerohedge.com/markets/tax-receipts-are-leaning-toward-worst-case-debt-ceiling-scenario), **it's that time of year again when corporations pull cash from MM funds to pay taxes.**

In 2022, the 3rd week of April saw $41.6bn of institutional outflows from MM funds. In 2021, the same period was institutional outflows of around $19.6 billion. 2020 was a COVID shitshow, but 2019 saw a $42.3 billion withdrawal.

So this year's $59.8 billion institutional outflow is significant in its size compared to the last few years (but the seasonal tax-driven nature of the outflow should counter any over-excitement for now).

?itok=d51f8Lx3 (

?itok=d51f8Lx3 ( ?itok=d51f8Lx3)

?itok=d51f8Lx3)

Though not wanting to piss all over those hopeful fireworks, we note that **reverse repo continues to rise...**

?itok=jvR05ZGx (

?itok=jvR05ZGx ( ?itok=jvR05ZGx)

?itok=jvR05ZGx)

_Source: Bloomberg_

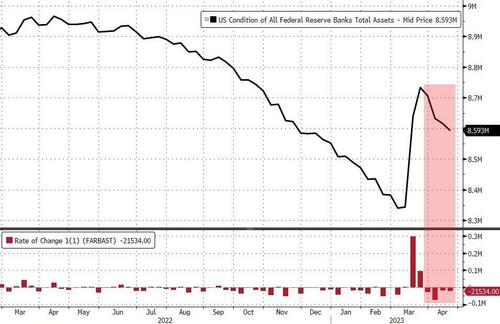

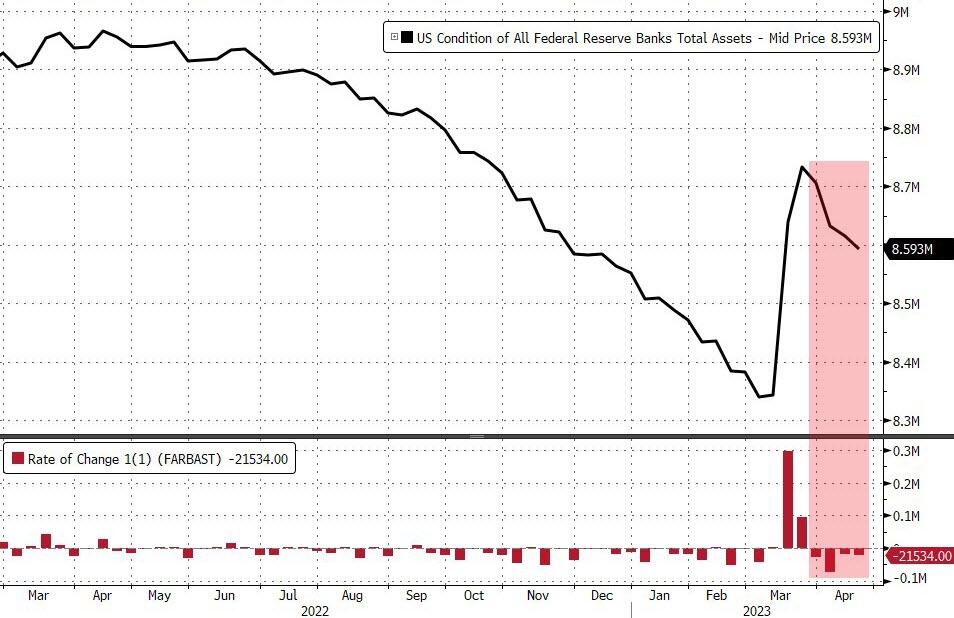

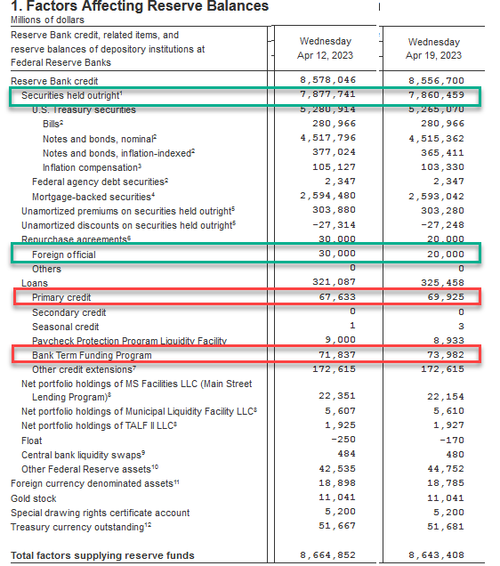

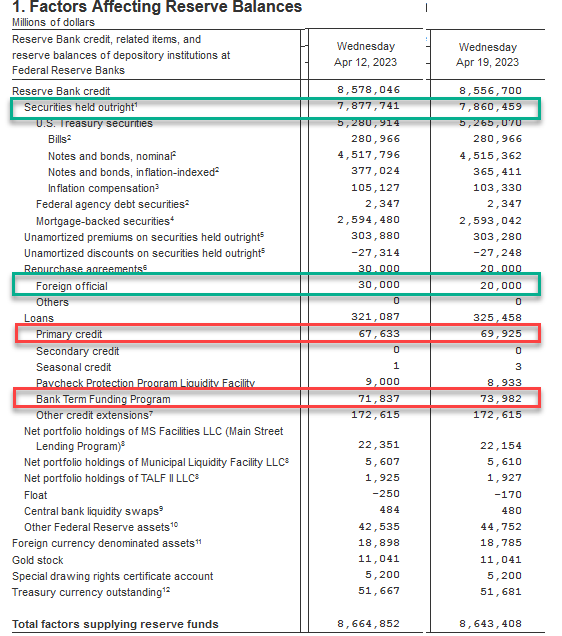

The most **anticipated financial update of the week** \- the infamous H.4.1. showed **the world's most important balance sheet shrank for the 4th straight week last week, by $21.5 billion,** slightly more than last week's tumble (helped by a **$17bn QT**)...

?itok=xoJXEw4u (

?itok=xoJXEw4u ( ?itok=xoJXEw4u)

?itok=xoJXEw4u)

_Source: Bloomberg_

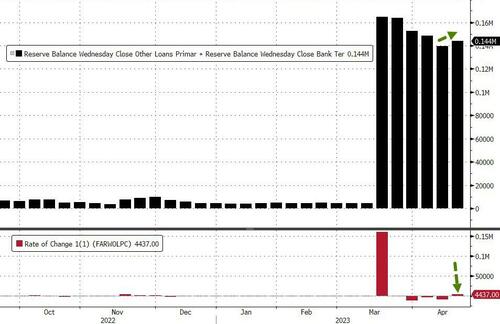

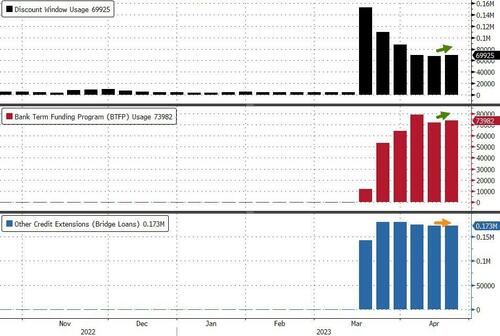

Looking at the actual reserve components that were provided by the Fed, we find that **Fed backstopped facility borrowings ACTUALLY ROSE last week** from $139 billion to $144 billion (still massively higher than the $4.5 billion pre-SVB)...

?itok=moY9UKqV (

?itok=moY9UKqV ( ?itok=moY9UKqV)

?itok=moY9UKqV)

_Source: Bloomberg_

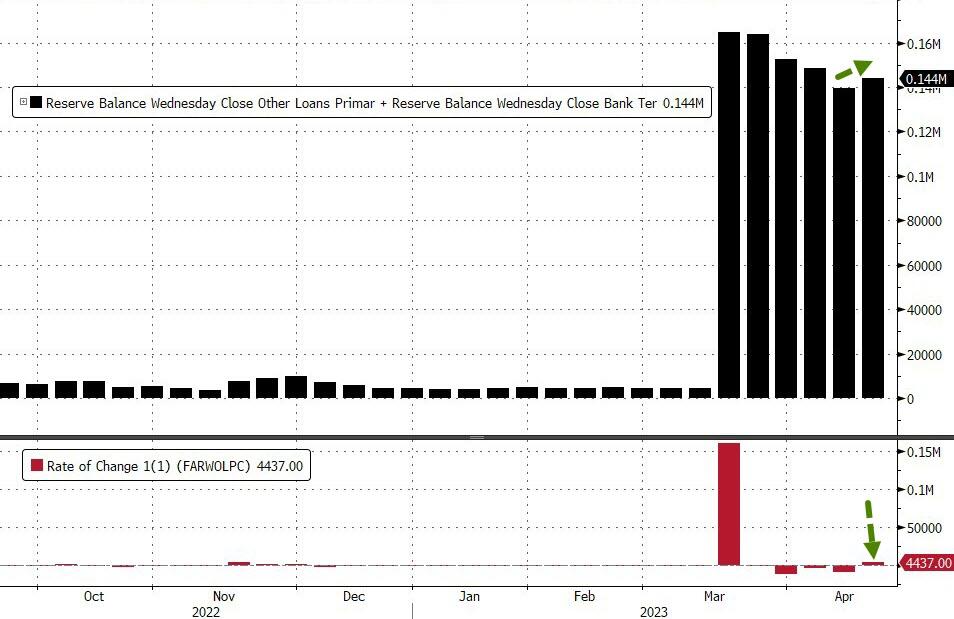

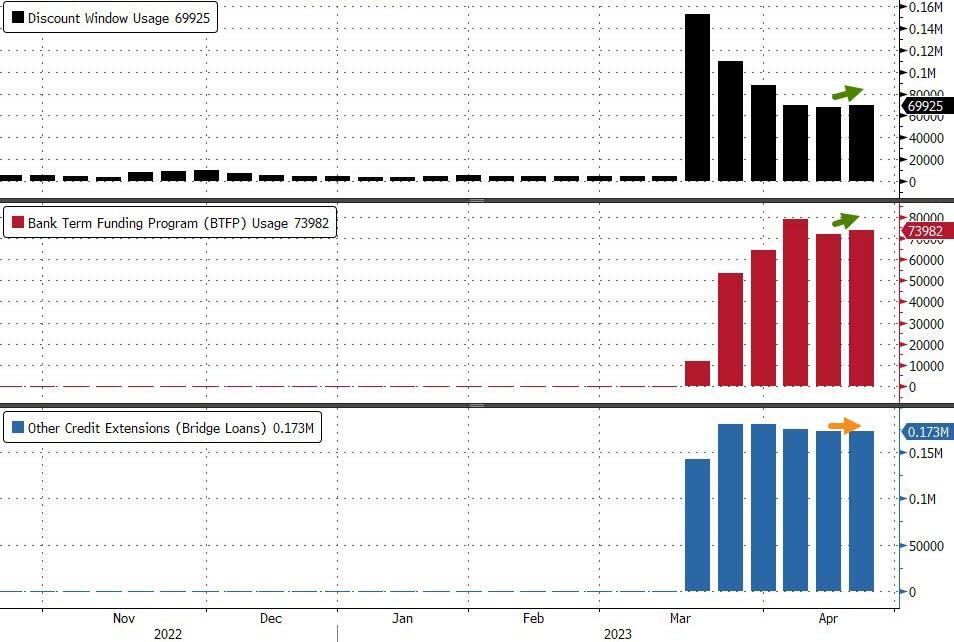

...but the composition shifted, as **usage of the Discount Window rose by $1.6 billion to $69.9 billion** (upper pane below) along with **a $2.1 billion increase in usage of the Fed's brand new Bank Term Funding Program, or BTFP, to $73.98 billion** (middle pane) from $79.0 billion last week. Meanwhile, other credit extensions - consisting of Fed loans to bridge banks established by the FDIC to resolve SVB and Signature Bank were unchanged at $173BN (lower pane)...

?itok=K5DY1JB7 (

?itok=K5DY1JB7 ( ?itok=K5DY1JB7)

?itok=K5DY1JB7)

Scanning down the H.4.1, we note that Foreign repo was down $10BN to $20BN (though it is still troubling that some bank still needs this much USD) and Other Fed Assets rose $2.2 billion (after falling last month)...

?itok=zvG3uHFh (

?itok=zvG3uHFh ( ?itok=zvG3uHFh)

?itok=zvG3uHFh)

With the MM outflows, deposit inflows, and Fed balance sheet shrinking again, it appears the 'banking crisis' is over.…