China Strikes Back: Slaps 34% Tariff On US Goods After Trump's 'Liberation Day'

China Strikes Back: Slaps 34% Tariff On US Goods After Trump's 'Liberation Day'

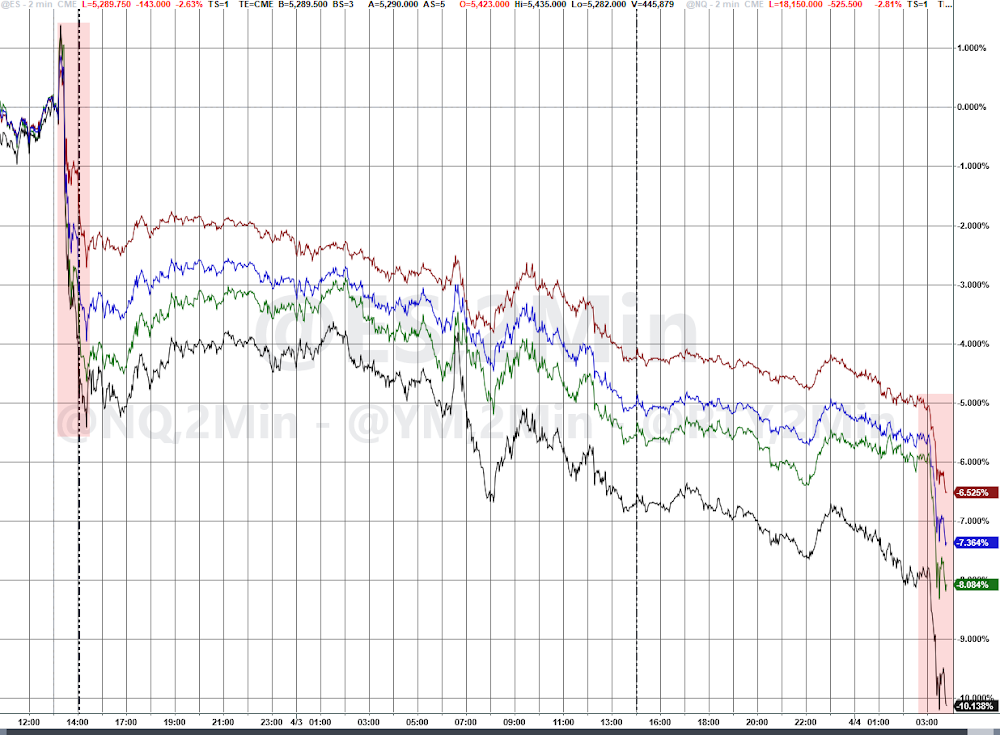

U.S. equity futures took another leg lower, the VIX spiked to 36, Treasury yields slipped (UST10Y <4%), crypto tumbled, and the dollar reversed its European session gains—just after 06:00 ET—when China hit back at President Trump's "Liberation Day" tariff blitz.

Beijing retaliates:

China to impose additional 34% tariffs on **all** imported U.S. products starting April 10, the official Xinhua news agency reports.

— Javier Blas (@JavierBlas) https://twitter.com/JavierBlas/status/1908099877759795260?ref_src=twsrc%5Etfw

According to state-run Xinhua, Beijing announced it would slap 34% retaliatory tariffs on all U.S. imports starting April 10. Details were scarce at the moment.

?itok=suNewkB_

?itok=suNewkB_

"Chinese authorities said they will start a probe into medical CT X-ray tubes imported from the US and India, and halt imports of poultry products from two American companies," Bloomberg noted.

Xinhua also reported that Beijing announced export control measures on certain rare earth-related items but did not provide specifics.

China announces export control measures on certain rare earth-related items https://t.co/HBW2ahcjv1

— China Xinhua News (@XHNews) https://twitter.com/XHNews/status/1908106306516668749?ref_src=twsrc%5Etfw

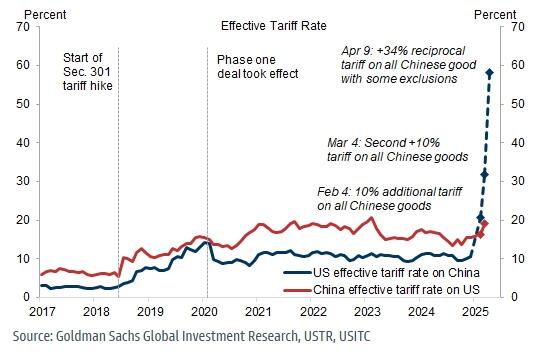

The move comes two days after Trump's tariff-a-palooza pushed the effective U.S. tariff rate on Chinese goods to 54%.

Deutsche Bank's George Saravelos noted on Thursday that the https://www.zerohedge.com/markets/beijing-slams-trumps-unilateral-bullying-tariffs-signals-retaliatory-action

this week has been the 50%+ tariff rate on China (far worse than expectations) and the key connector economy Vietnam, which affected $600bn worth of manufactured goods to the U.S. combined.

Goldman helped clients visualize this move.

?itok=wu68E7R1

?itok=wu68E7R1

On Thursday, Beijing condemned the escalating tariff war, calling it "unilateral bullying. " It added that it "firmly opposes" the tariff war and "will resolutely take countermeasures to safeguard its own rights and interests."

And here we are—risk assets getting hammered again on a Friday morning—as tensions between Washington and Beijing escalate sharply to end the week. Both superpowers remain locked in a stalemate over China's subsidization of fentanyl precursor chemicals to Mexico, which has fueled the overdose death crisis in the United States.

Stay on top of the tariff war:

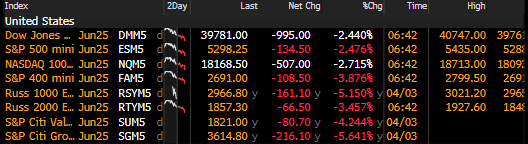

In markets, main US equity futures indexes were hammered lower after China retaliated.

?itok=K4bvLTC_

?itok=K4bvLTC_

A lot more red.

?itok=tpyC-Fne

?itok=tpyC-Fne

UST10Y <4%.

?itok=uWHF8dSx

?itok=uWHF8dSx

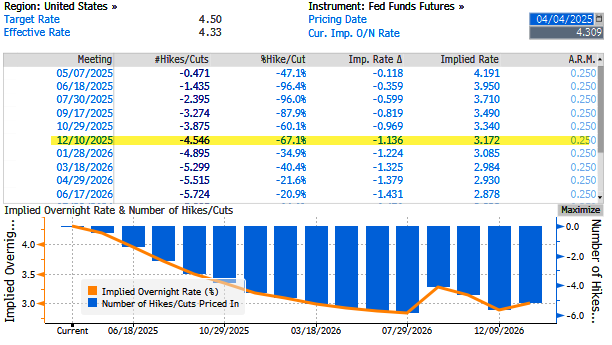

Implied interest rate cuts top 4.5 for the year.

?itok=tYwuf6lD

?itok=tYwuf6lD

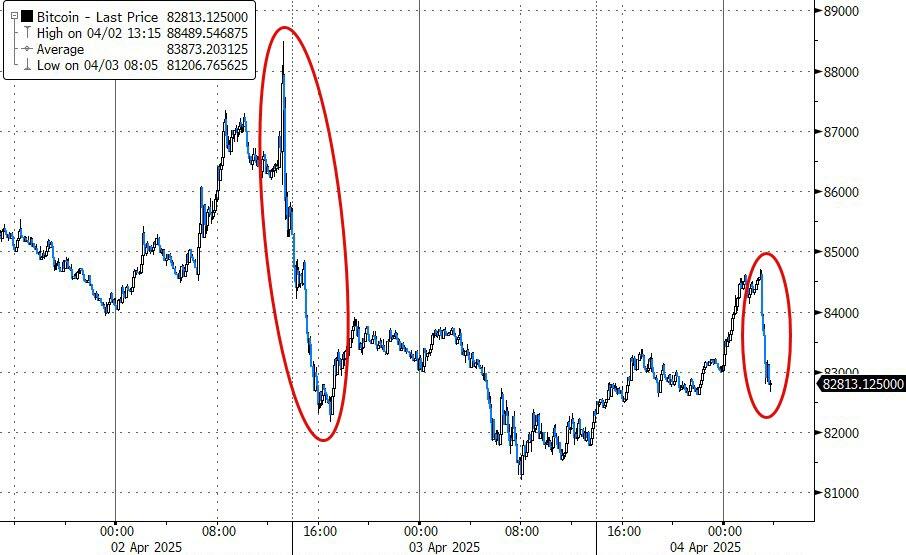

Bitcoin tumbles.

?itok=OqRV9Yrg

?itok=OqRV9Yrg

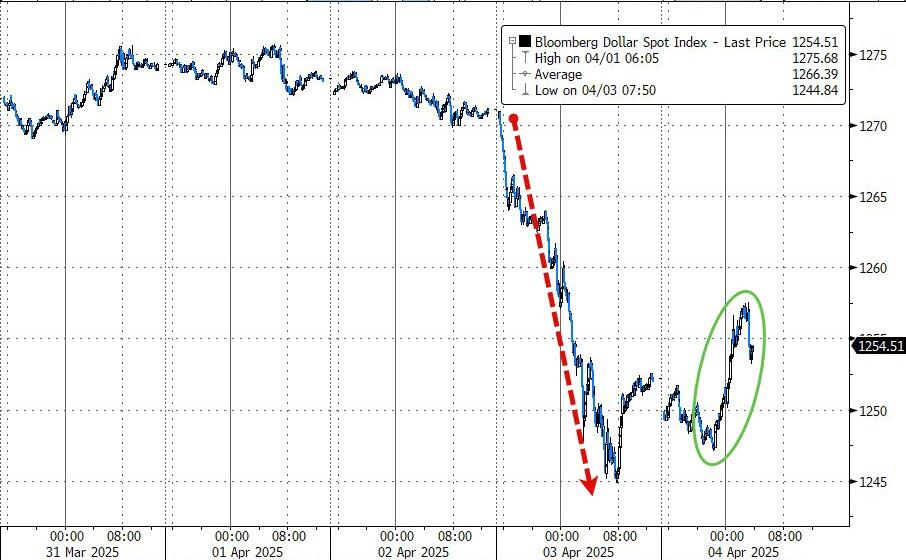

Dollar loses steam after European surge.

?itok=TmHf_dbz

?itok=TmHf_dbz

And Yuan weaker.

?itok=S2JlBQNW

?itok=S2JlBQNW

*Developing...

https://cms.zerohedge.com/users/tyler-durden

Fri, 04/04/2025 - 07:00