**Binance Closes Withdrawals Amid Congestion On Bitcoin Network**

Binance Closes Withdrawals Amid Congestion On Bitcoin Network

_Authored by Ana Paula Pereira via CoinTelegraph,_ (https://cointelegraph.com/news/binance-closes-btc-withdrawals-amid-congestion-on-the-bitcoin-network)

**Crypto exchange Binance closed (https://twitter.com/binance/status/1655227965062672384) Bitcoin withdrawals on May 7 due to an alleged overflow of transactions on the Bitcoin network.**

?itok=PoZ77Z8U (

?itok=PoZ77Z8U ( ?itok=PoZ77Z8U)

?itok=PoZ77Z8U)

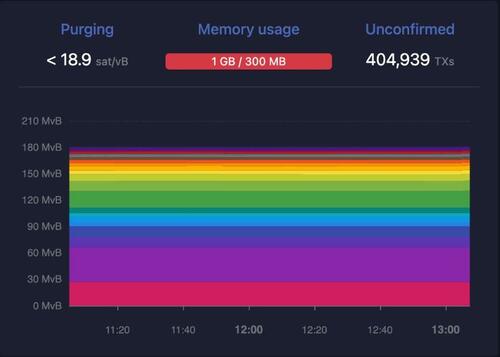

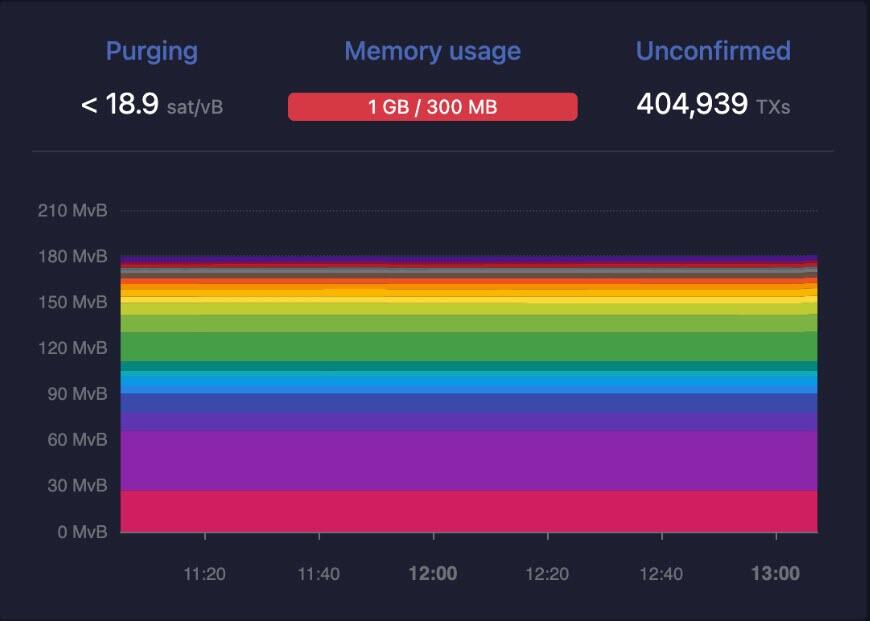

Bitcoin mempool was clogged with over 400,000 transactions waiting (https://mempool.space/) to be processed at the time of writing. The mempool is known as the "waiting area" for incoming transactions before they are verified independently by each node on the network.

?itok=NCVP8bh8 (

?itok=NCVP8bh8 ( ?itok=NCVP8bh8)

?itok=NCVP8bh8)

_Bitcoin mempool at 16:42 UTC on May 7. Source: mempool.space_

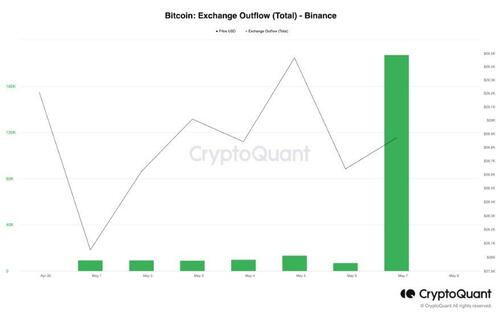

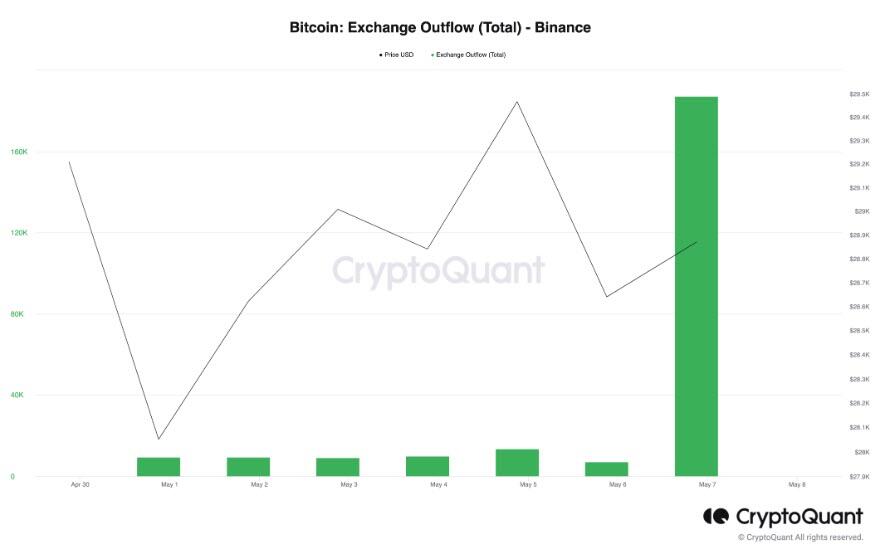

**Binance tweeted (https://twitter.com/binance/status/1655250881997332482) that BTC withdrawals had resumed after nearly an hour of halting.** Outflows on the crypto exchange peaked on Sunday, rising (https://cryptoquant.com/asset/btc/chart/exchange-flows/exchange-outflow-total) to $187 million, according to data from CryptoQuant.

**Behind the congestion is believed to be a surge in BRC-20 transactions in the last few days due to memecoins like Pepe (PEPE).** The memecoin trading hype drove Bitcoin transaction fees to their highest point (https://cointelegraph.com/news/memecoin-hype-drives-bitcoin-transaction-fees-to-multi-year-highs) in two years. On May 3, the total amount of fees paid on the Bitcoin blockchain reached $3.5 million, jumping nearly 400% from late April, Cointelegraph reported.

?itok=gZeaHU7f (

?itok=gZeaHU7f ( ?itok=gZeaHU7f)

?itok=gZeaHU7f)

_Bitcoin outflow on Binance over the past seven days. Source: CryptoQuant._

Developed after Ethereum’s ERC-20 token standard (https://cointelegraph.com/explained/erc-20-tokens-explained), **BRC-20 is an experimental token standard recently introduced that allows users to create and transfer fungible tokens on the Bitcoin blockchain.** It is currently becoming a hot spot for meme tokens.

CoinMarketCap's data shows (https://coinmarketcap.com/currencies/pepe/) that PEPE's price has climbed over 263% in the last week. As of writing, however, the memecoin is down over 7% following a 30% drop on May 6 as whales profited from Binance's recent listing (https://cointelegraph.com/news/pepe-memecoin-hits-1-billion-market-cap-fueled-by-binance-listing). Crypto exchanges MEXC Global, Bitget, Gate.io, and Huobi listed PEPE trading pairs (https://cointelegraph.com/news/more-crypto-exchanges-list-pepe-following-trading-frenzy) two weeks ago, kicking off the token hype.

**Since the introduction of Dogecoin in 2013 (https://cointelegraph.com/news/from-memecoin-to-billion-dollar-player-dogecoin-breaks-1-bln), memecoins have become a major part of the cryptocurrency world,** making and ruining fortunes alike. Investopedia defines (https://www.investopedia.com/meme-coin-6750312) a memecoin as a cryptocurrency represented "with comical or animated memes, that are supported by enthusiastic online traders and followers."

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Sun, 05/07/2023 - 21:30

https://www.zerohedge.com/crypto/binance-closes-withdrawals-amid-congestion-bitcoin-network