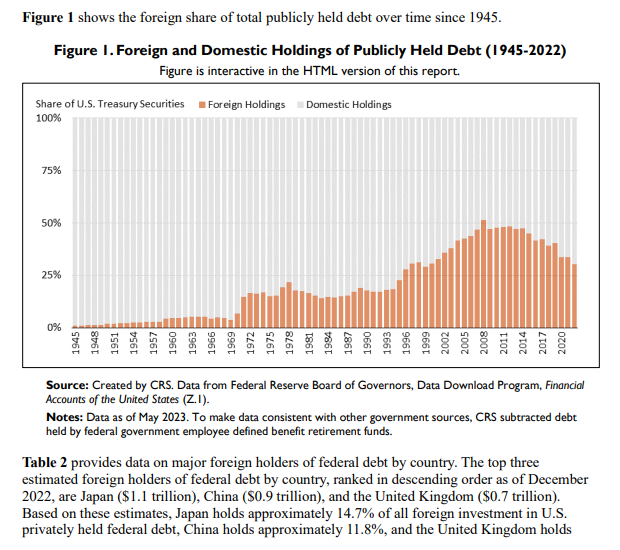

nostr:npub1egvswnt7kelt7x9wew3sakuavpq8a4kg9leyp59xqfj5rwnayq2qgk9zfr has it gone down in real terms, or has domestic holdings just been ramped up in comparison?

Foreign holders of US debt has declined https://sgp.fas.org/crs/misc/RS22331.pdf

This means by extension use of actual USD transfers in international commerce also have declined. USD debt is only needed for foreign holders as collateral used to hold excess foreign reserves from trade that banks cannot guarantee safely

Discussion

nostr:npub10tatyrd9pk4dwem62mev9ark2kzw7pywp2veujfaheejmnq9r0dqyksw7k Domestic holdings of USG debt have gone up. Foreigners are selling USG debt and using gold instead. Prices might be quoted in USD, but the net settlement will be done in gold. Central bank purchase of gold already proves this.