**Argentina Abandons USDollar In China Trade As Local Bitcoin Reaches Record High**

Argentina Abandons USDollar In China Trade As Local Bitcoin Reaches Record High

Over the last few weeks, it has seemed you can't turn a page, blink at a pixel, or hear a news report without some form of **de-dollarization** headline shrieking at you. From Brazil to Saudi Arabia, and from India to Argentina, and increasing number of nations are 'reportedly' shifting away from the dollar hegemon.

Some recent headlines:

- "No Reason" For Malaysia To Rely On US Dollar, PM Warns As Yuan Influence Grows (https://www.zerohedge.com/geopolitical/no-reason-malaysia-rely-us-dollar-pm-warns-yuan-influence-grows)

- De-Dollarization Just Got Real (https://www.zerohedge.com/markets/de-dollarization-just-got-real)

- Here Are 7 Signs That Global De-Dollarization Has Just Shifted Into Overdrive (https://www.zerohedge.com/geopolitical/here-are-7-signs-global-de-dollarization-has-just-shifted-overdrive)

- De-Dollarization Has Begun (https://www.zerohedge.com/geopolitical/de-dollarization-has-begun)

And today it escalated furtheras Reuters reports (https://www.reuters.com/world/china/argentina-govt-pay-chinese-imports-yuan-rather-than-dollars-2023-04-26/)that **Argentina will start buying the bulk of its Chinese imports in yuan instead of dollars, as it seeks to preserve its shrinking supply of USDollars**.

> _In April, it aims to pay around $1 billion of Chinese imports in yuan instead of dollars and thereafter around $790 million of monthly imports will be paid in yuan, a government statement said._

The decision aims to ease the outflow of dollars, Argentina's Economy minister Sergio Massa said during an event following a meeting with the Chinese ambassador, Zou Xiaoli, as well as with companies from various sectors.

> _**"Following the worst drought in history, Argentina must keep its (foreign) reserves robust,"**_ Sergio Massa said, per Anadolu Agency.

**In November last year, Argentina expanded a currency swap with China by $5 billion**, seeking to strengthen Argentina's international reserves.

> _The agreement will allow Argentina "to work on the possibility" of advancing the rate of imports, Massa added (https://www.reuters.com/world/china/argentina-govt-pay-chinese-imports-yuan-rather-than-dollars-2023-04-26/), with yuan-denominated import orders being authorized in 90 days rather than the standard 180 days._

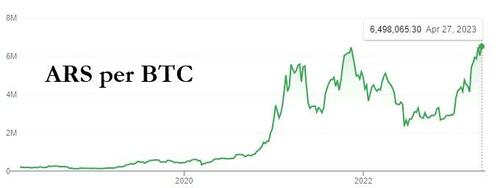

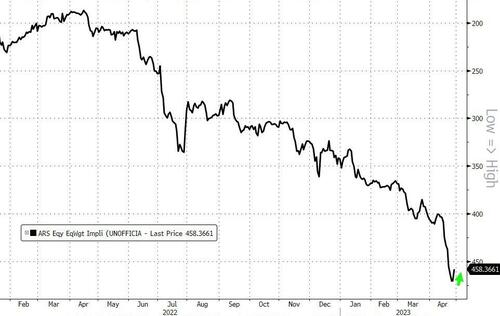

On a side note, as Argentina' official peso rate has crashed 99% against the dollar since the start of its rolling crisis in 2018, the price of Bitcoin just hit a record high in the South American nation...

?itok=VL_mWHfr (

?itok=VL_mWHfr ( ?itok=VL_mWHfr)

?itok=VL_mWHfr)

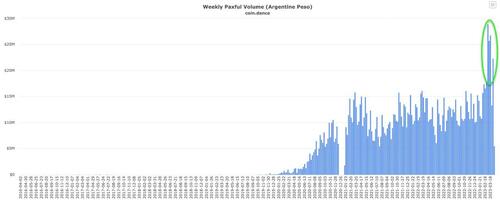

At the same time, as CoinTelegraph reports, (https://cointelegraph.com/news/bitcoin-price-hits-new-record-high-in-argentina) Bitcoin and similar cryptocurrencies operating outside governments’ and central banks’ purview are increasingly emerging as alternatives. For example, data shows (https://coin.dance/volume/paxful/ARS) that Bitcoin’s peer-to-peer weekly volume in Argentina reached a record high of nearly $30 million in March on the Paxful exchange.

?itok=Wh10ghCF (

?itok=Wh10ghCF ( ?itok=Wh10ghCF)

?itok=Wh10ghCF)

_Bitcoin weekly volume in Argentina. Source: Paxful/CoinDance_

Earlier in April, the National Commission of Value (CNV), **Argentina’s securities regulator, approved a Bitcoin-based futures index (https://cointelegraph.com/news/argentina-securities-regulator-approves-bitcoin-futures-index) on the Matba Rofex exchange set to debut in May.**

The derivative, settled in pesos, will enable accredited investors to gain exposure to the Bitcoin markets.

Finally, and ironically, **Argentina’s parallel exchange rate, known as the blue-chip swap, jumped** after Argentina’s Economy Ministry said the **central bank is preparing to dramatically hike its benchmark interest rate by 1,000 basis points** Thursday as a renewed peso selloff in parallel markets piles more pressure on the country’s economic crisis.

?itok=OZrA6Ph1 (

?itok=OZrA6Ph1 ( ?itok=OZrA6Ph1)

?itok=OZrA6Ph1)

The rate strengthened 2.2% to about 460 pesos per dollar, on pace for the biggest one-day gain since mid-January.

Nevertheless, de-dollarization continues to accelerate globally.

As we detailed recently, (https://www.zerohedge.com/geopolitical/its-defund-global-police-moment-jen-says-de-dollarization-happening-stunning-pace)the greenback’s share in global reserves slid last year at **10 times the average speed of the past two dec…