This ends poorly

Discussion

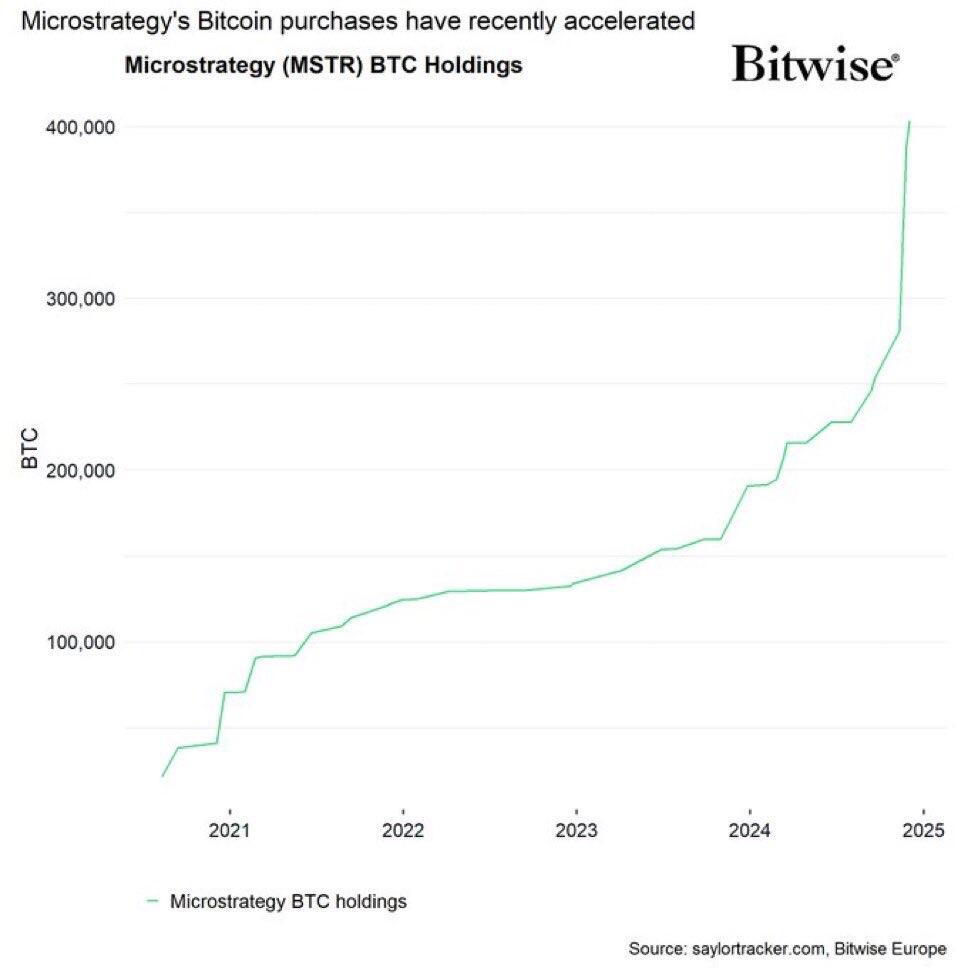

The saylor implosion is inevitable. Mt Gox pain will be unleashed and I will take my draw down like a man.

Most likely, IMO, MSTR premium evaporates in the next severe bear market rendering it essentially an ETF (for which some underpaid; but most overpaid) - this is what happened the last severe bear market. The question would then be whether or not Saylor can borrow even harder enough to convince justifiably gun-shy prospective investors to get the flywheel going again.

The much less likely scenario - but still very possible - is that the next bear market is severe enough and for long enough that Saylor ends up having to liquidate these holdings before Bitcoin bounces back. This, of course, would be fatal for MSTR (at least in its capacity as a proxy for holding BTC).