**Fed Hikes 25bps As Expected, Signals 'Hawkish Pause'; Warns Of 'Tighter Credit Standards'**

Fed Hikes 25bps As Expected, Signals 'Hawkish Pause'; Warns Of 'Tighter Credit Standards'

**Tl:dr;** Fed raises rates by 25 bps as expected.

Policy statement softens the rate guidance in a way **consistent with past pauses** and The Fed **deletes reference to "some additional policy firming may be appropriate."**

A clear hat-tip to the banking crisis:

> "Recent development are likely to result in tighter credit conditions" removed and replaced with "Tighter credit conditions"

The decision was **unanimous**.

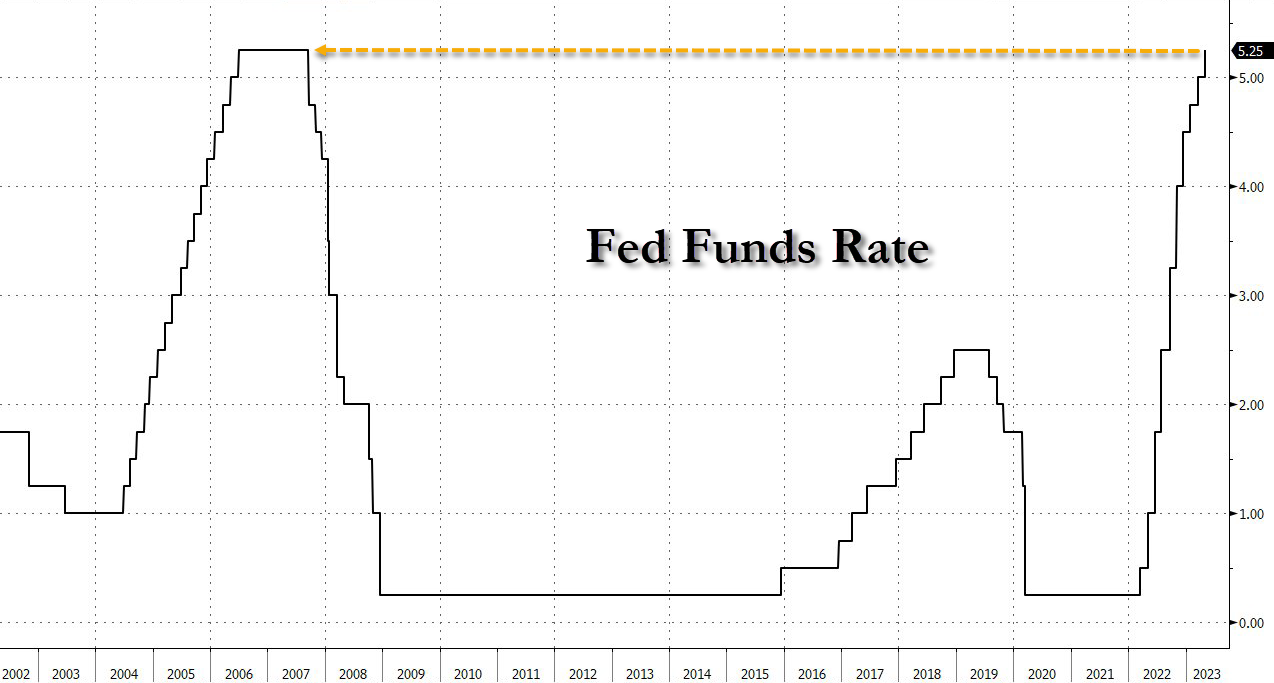

As WSJ Fed Whisperer Nick Timiraos notes: _"The FOMC statement **used language broadly similar to how officials concluded their interest-rate increases in 2006**, with no explicit promise of a pause by retaining a bias to tighten."_

_ ?itok=sEPD5q7n (

?itok=sEPD5q7n ( ?itok=sEPD5q7n)_

?itok=sEPD5q7n)_

**This is clearly more of a hawkish pause since it doesn't suggest whether 'policy easing' may be appropriate...**

?itok=jivh33TT (

?itok=jivh33TT ( ?itok=jivh33TT)

?itok=jivh33TT)

**...but then again, if Powell had gone that far, markets would have panicked over "what does he know"?**

What happens next?

?itok=EyzrMwvv (

?itok=EyzrMwvv ( ?itok=EyzrMwvv)

?itok=EyzrMwvv)

\* \* \*

Since March 22 (the last FOMC statement, which included the dot-plot and economic projections), markets have been 'just a little bit turbo' but amid all that vol, bonds and stocks are modestly higher while the dollar has tumbled and alternative currencies (bitcoin and gold) have outperformed...

?itok=oRgEK9ZJ (

?itok=oRgEK9ZJ ( ?itok=oRgEK9ZJ)

?itok=oRgEK9ZJ)

_Source: Bloomberg_

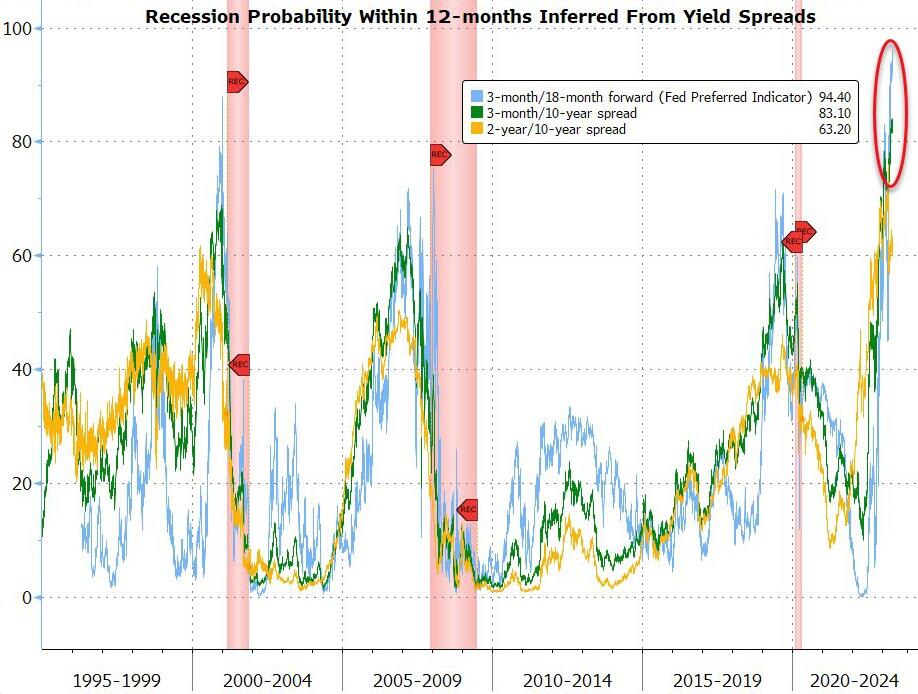

However, **The Fed’s preferred recession rate-spread indicator** (3-month/18-month forward) is now flashing red **implying a 94% probability of a recession within the next year**

?itok=o3S499ia (

?itok=o3S499ia ( ?itok=o3S499ia)

?itok=o3S499ia)

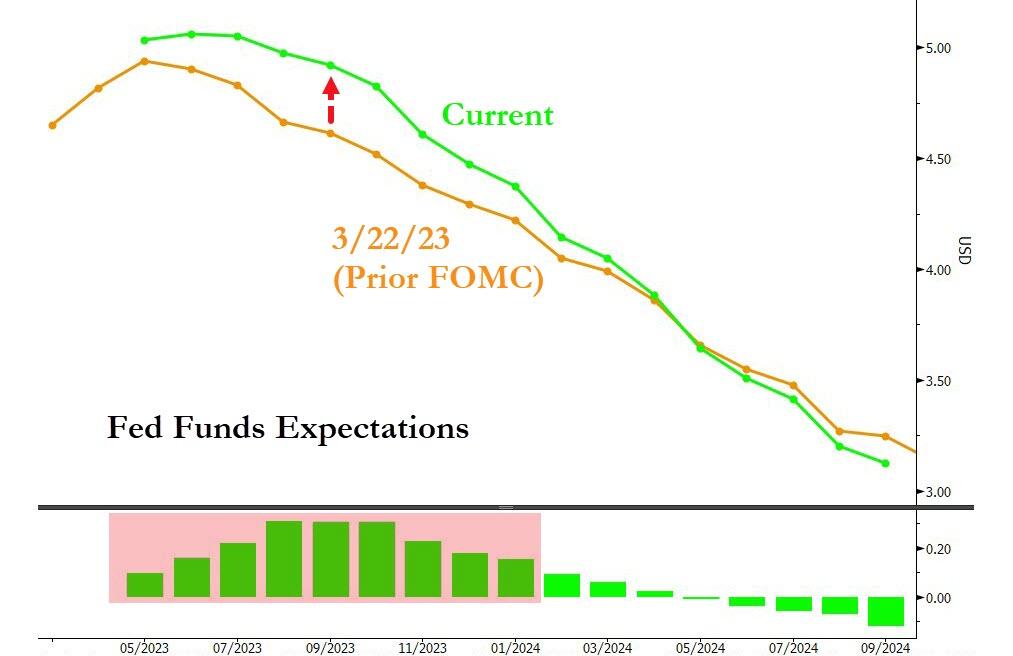

Interestingly, the market's expected rate trajectory of The Fed has shifted somewhat hawkishly, mainly due to the plunge in rate-hike odds that occurred on the day of the FOMC meeting...

?itok=KVpTxzx5 (

?itok=KVpTxzx5 ( ?itok=KVpTxzx5)

?itok=KVpTxzx5)

_Source: Bloomberg_

Rate-hike expectations have drifted higher since the last FOMC...

?itok=ybx4aK3M (

?itok=ybx4aK3M ( ?itok=ybx4aK3M)

?itok=ybx4aK3M)

_Source: Bloomberg_

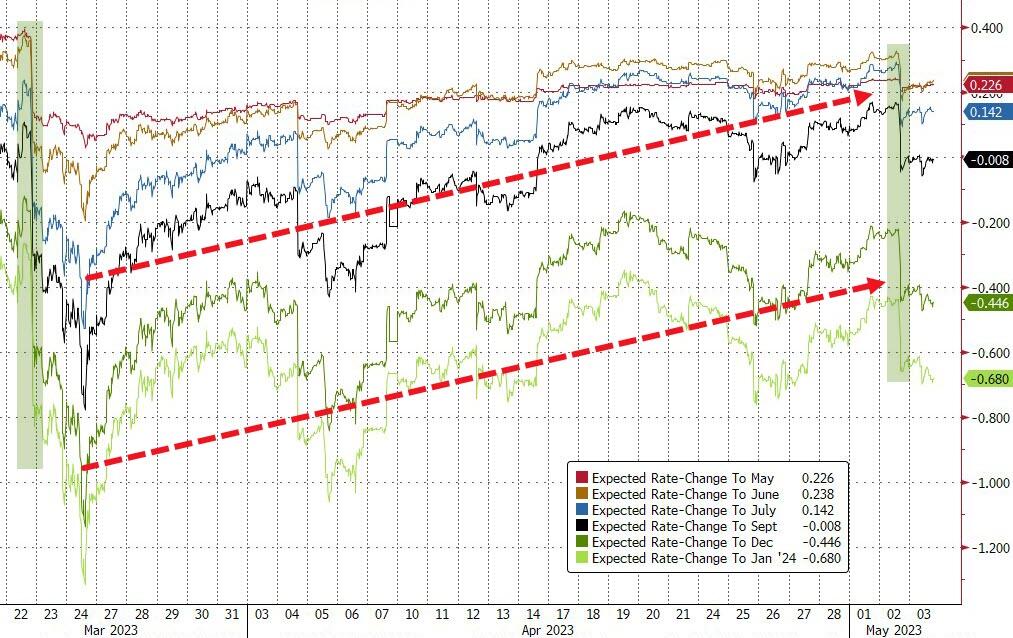

**Today's 25bp hike is a lock from the market's perspective,** but what is really the focus today is any hints that The Fed is done (and the market for now, is convinced they will be with **just 5% odds of a 25bp hike in June**).

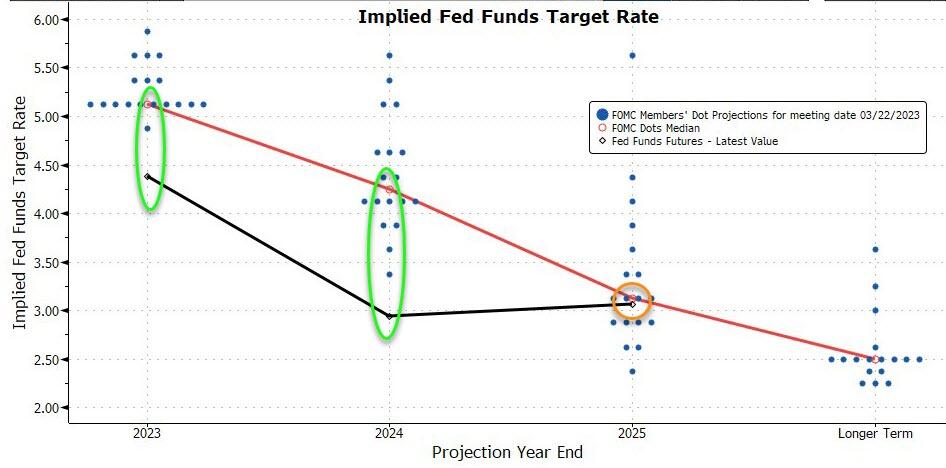

But, **the market remains massively dovishly divergent from The Fed**'s dotplot rate expectations for this year and next...

?itok=ftqaVW46 (

?itok=ftqaVW46 ( ?itok=ftqaVW46)

?itok=ftqaVW46)

As we noted earlier,a single sentence in the FOMC statement (https://www.zerohedge.com/markets/single-sentence-will-define-everything-heres-what-fed-will-say-today) will change everything everything today and all eyes will also be on whether there are any dissents.

- Federal Open Market Committee raises benchmark rate by 25 basis points, as forecast, to target range of 5%-5.25%

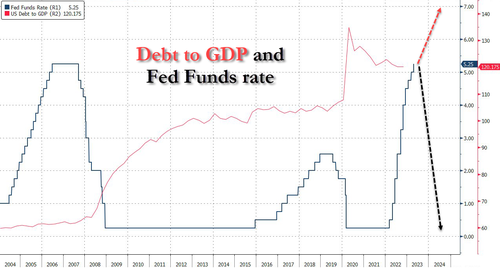

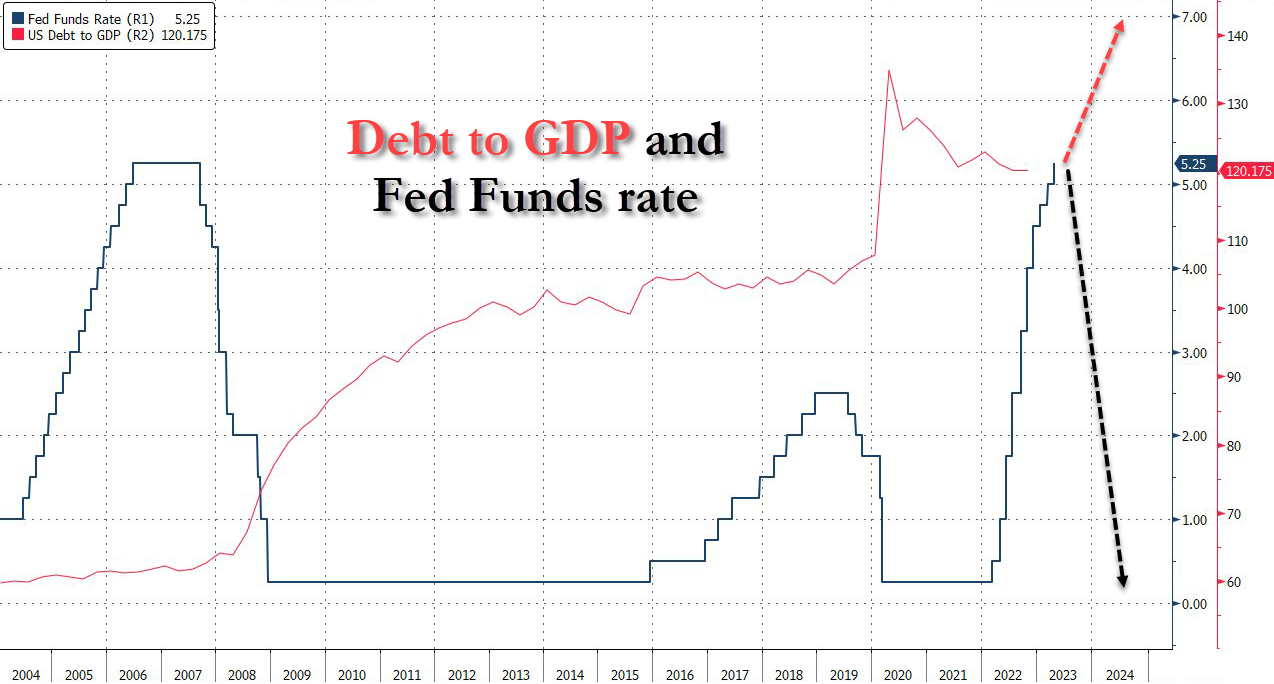

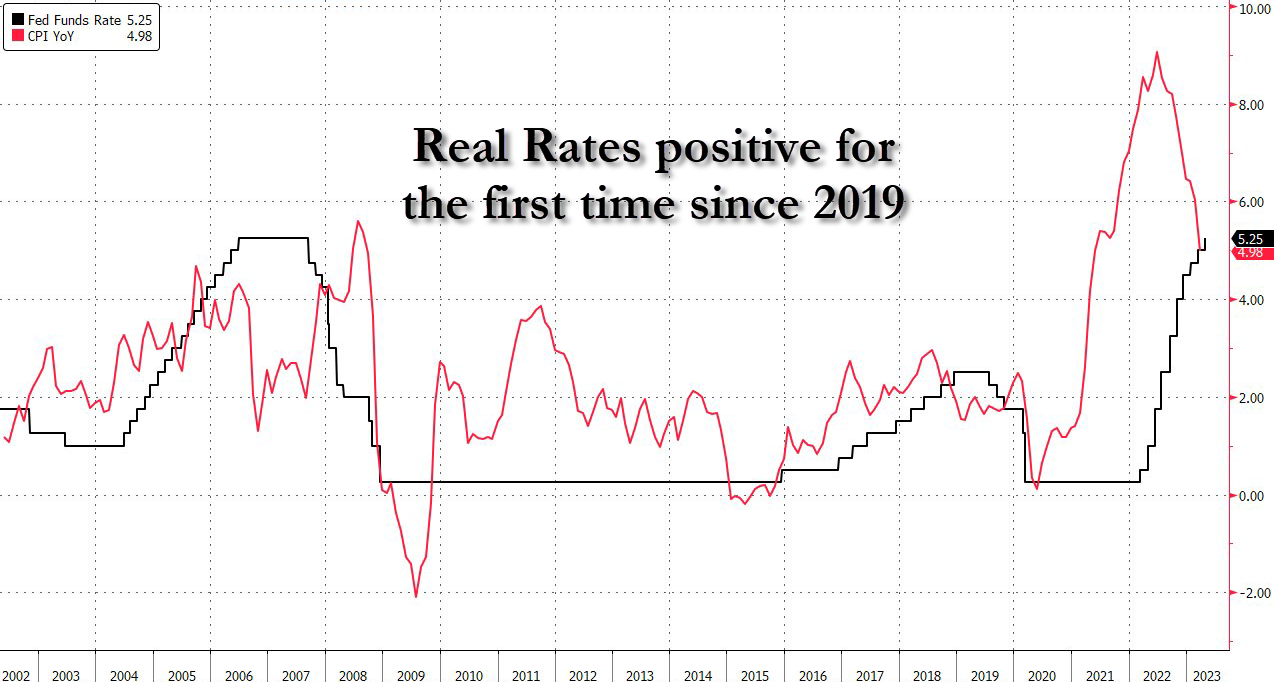

This hike moves Real Rates positive for the first time since 2019...

?itok=R0vLSOLY (

?itok=R0vLSOLY ( ?itok=R0vLSOLY)

?itok=R0vLSOLY)

- **FOMC omits prior language saying “some additional policy firming” may be warranted, suggesting Fed could pause at the next meeting**

- FOMC will take into account various factors “in determining the extent to which additional policy firming may be appropriate”

**And the vote was unanimous.**

Additionally, The Fed highlights the impact of the banking crisis:

> **_FO…