**Billionaire Steven Roth's Mega Manhattan Redevelopment Project Battered By CRE Turmoil**

Billionaire Steven Roth's Mega Manhattan Redevelopment Project Battered By CRE Turmoil

The billionaire head of Vornado Realty Trust is facing an uncertain future regarding his multi-billion dollar investment plan to build "gleaming office skyscrapers around Manhattan's universally hated Penn Station," according to Bloomberg (https://www.bloomberg.com/news/articles/2023-05-02/billionaire-steven-roth-s-bet-near-nyc-s-penn-station-battered-by-office-woes). The uncertainty comes as the regional banking crisis has sparked a painful credit crunch already battering commercial real estate.

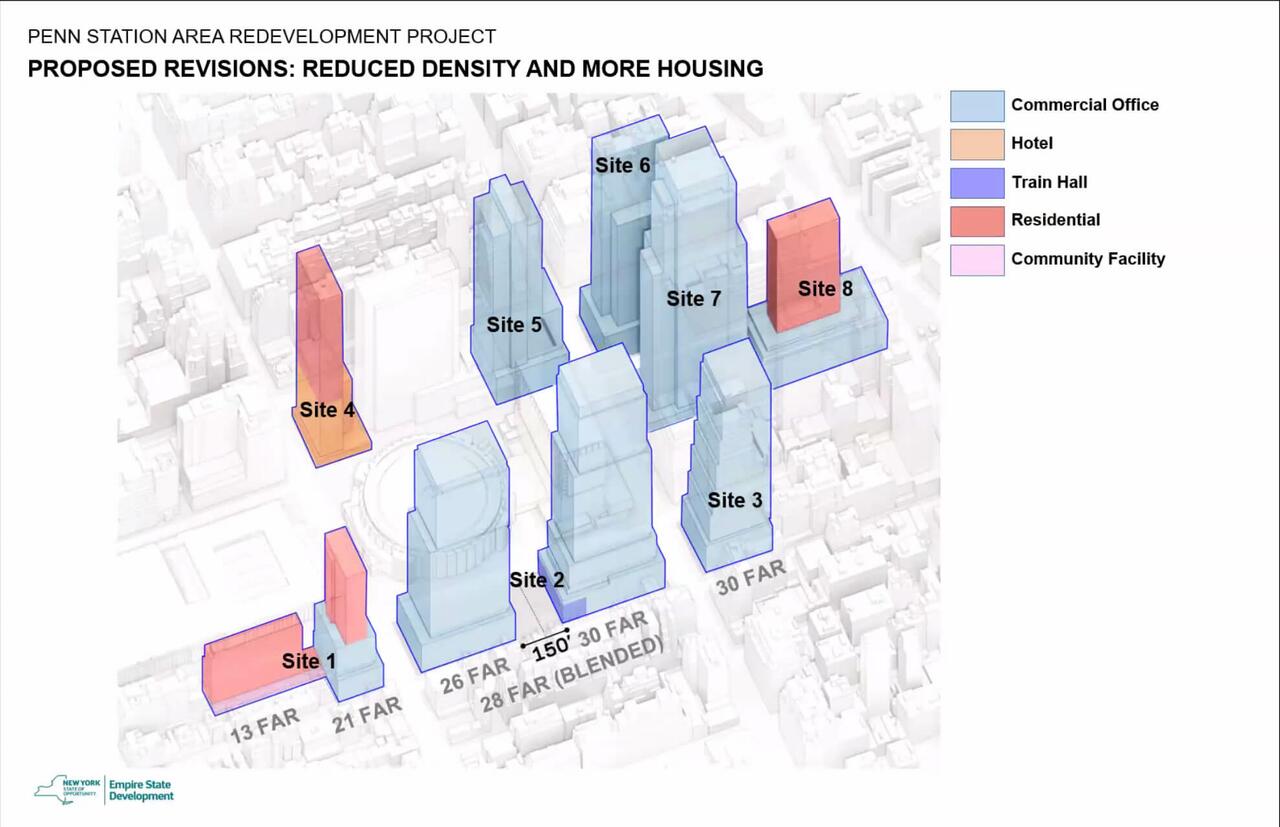

"We're going to take a breath," stated Chief Executive Steven Roth during Vornado's quarterly earnings call on Tuesday. He maintained the plan to continue investing upwards of $2 billion in redeveloping over 5 million square feet in what he calls "Penn District." Vornado's redevelopment plan to build new office buildings and refurbish older ones is a bet to capitalize off the modernization of Penn Station.

?itok=CAPrKjdo (

?itok=CAPrKjdo ( ?itok=CAPrKjdo)

?itok=CAPrKjdo)

Roth has spent the last two decades acquiring plots of land around the train station in Manhattan. The billionaire saw the potential for an area of the city to flourish once redevelopment projects were completed, but have since been overshadowed by high office vacancy rates in a post-Covid environment, along with a regional banking crisis that has spread to commercial real estate.

Shares of his Vornado plunged to a 27-year low last week when the tradeable REIT of office, retail, and residential buildings surprised investors with an announcement about delaying its dividend to preserve cash.

?itok=LhP-zfjE (

?itok=LhP-zfjE ( ?itok=LhP-zfjE)

?itok=LhP-zfjE)

We have repeatedly shown readers big banks such as JPM (https://www.zerohedge.com/markets/nowhere-hide-cmbs-cre-nuke-goes-small-banks-acount-70-total-commercial-real-estate-loans), Morgan Stanley (https://www.zerohedge.com/markets/new-big-short-hits-record-low-focus-turns-400-billion-cre-debt-maturity-wall), and Goldman Sachs (https://www.zerohedge.com/markets/state-commercial-real-estate-goldman-expects-sharp-spike-office-delinquency-rates) have all joined our CRE gloom parade as rumblings in the office space market emerge.

It is an unfavorable time for office property owners, particularly for those like Roth's company, which is constructing office skyscrapers. Amid all of the gathering storm clouds in the office space market, a critical question arises if the real estate mogul can still deliver on the Penn District project.

> _"Roth has missed the bus, and the bus isn't coming back until 2030 or beyond," said Mitchell Moss, a professor of urban policy at New York University, referring to the downturn in the CRE space, primarily office buildings._

It was only last year when Roth told analysts on an earnings call he was "doubly and triply excited about the Penn District." But that excitement has evaporated in a rising interest rate environment and tightening credit conditions over the past year. Roth said earlier this year that new construction is "almost impossible" because of tight lending.

Meanwhile, office space vacancy rates in New York remain at alarming highs, while companies are reducing headcount and footprint to save on costs, subsequently reducing their demand for office space.

Bloomberg Intelligence analyst Jeffrey Langbaum said Vornado's Penn District buildings will need to "sustain leasing demand by creating space that appeals to tenants looking to migrate to newer, higher-quality properties."

According to Alexander Goldfarb, an analyst at Piper Sandler, Vornado faces a series of challenges, including high debt costs and low rent prospects that could present challenges in the completion of Penn District.

Here's an idea: Vornado might want to consider constructing apartment buildings instead of office space amid the CRE downturn.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 05/02/2023 - 21:45