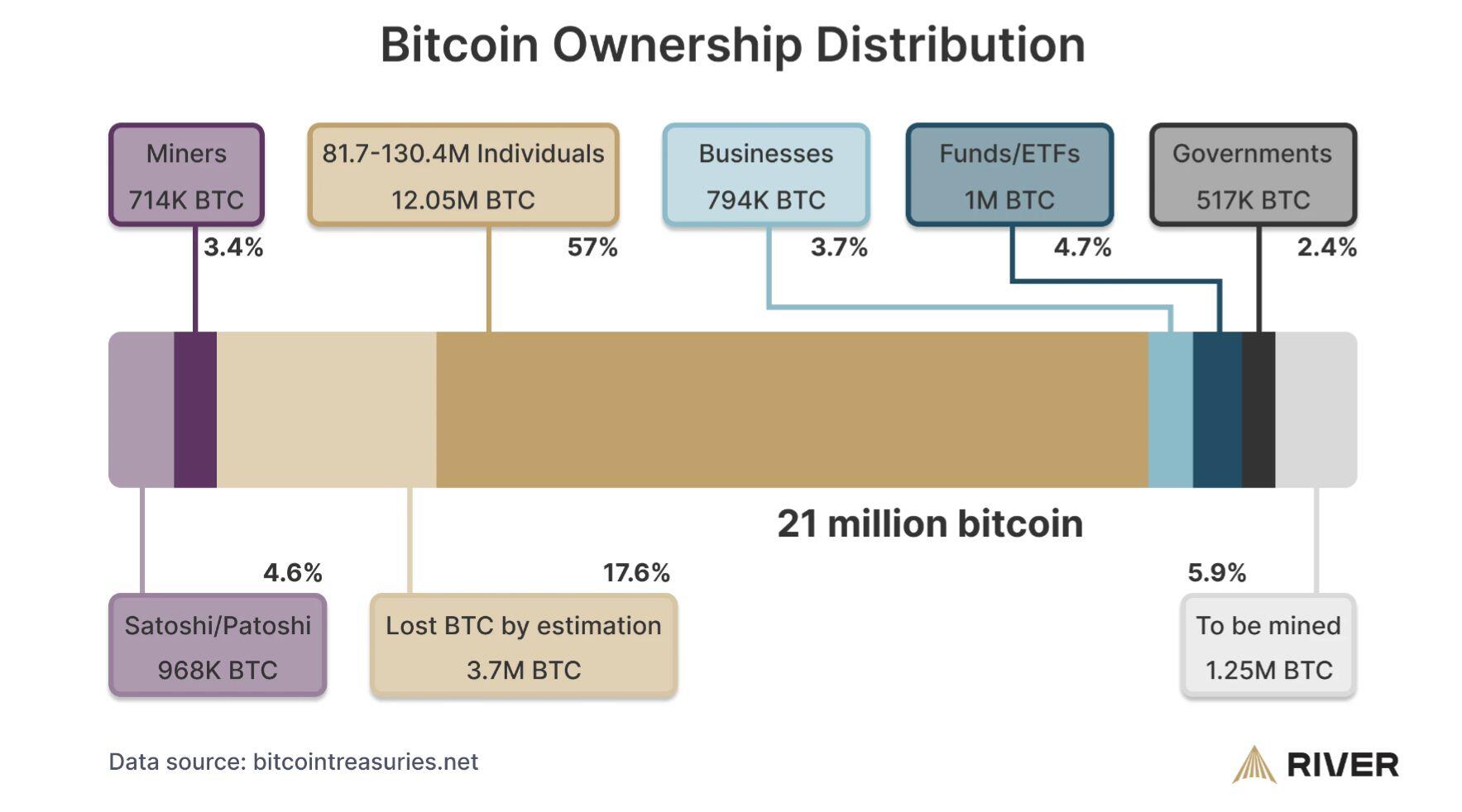

As of 2024, there are roughly 19.45 million Bitcoin mined. The distribution of these coins is highly uneven:

•Top 0.01% of Bitcoin addresses hold 27% of all Bitcoin.

•Top 0.1% of addresses control approximately 60% of Bitcoin.

•Top 1% of addresses hold roughly 90% of the Bitcoin supplly

According to the most recent on-chain data, the BTC distribution is as follows:

Whales (1,000+ BTC): These addresses control 42% of Bitcoin supply. There are around 2,000 such addresses.

Humpbacks (10,000+ BTC): A few hundred addresses belong to exchanges or institutional investors, holding a combined 10%+ of supply.

Large Fish (100-1,000 BTC): These wallets hold around 20% of supply.

Retail Investors (0.1 - 10 BTC): The bulk of addresses fall within this range, but they collectively hold less than 10% of the Bitcoin supply.

Dust wallets (under 0.001 BTC): These small wallets make up the majority of addresses but hold a minuscule amount of BTC.

So, I think it's clear as of today that Bitcoin is highly uneven distributed, just like fiat money.

If we assume that there will be a shift from the Whales towards the smaller wallets (because it represent the bulk of BTC addresses/and humans owning them) then what makes you think that the Whales won't use the BTC they own to amass more BTC from the other categories?