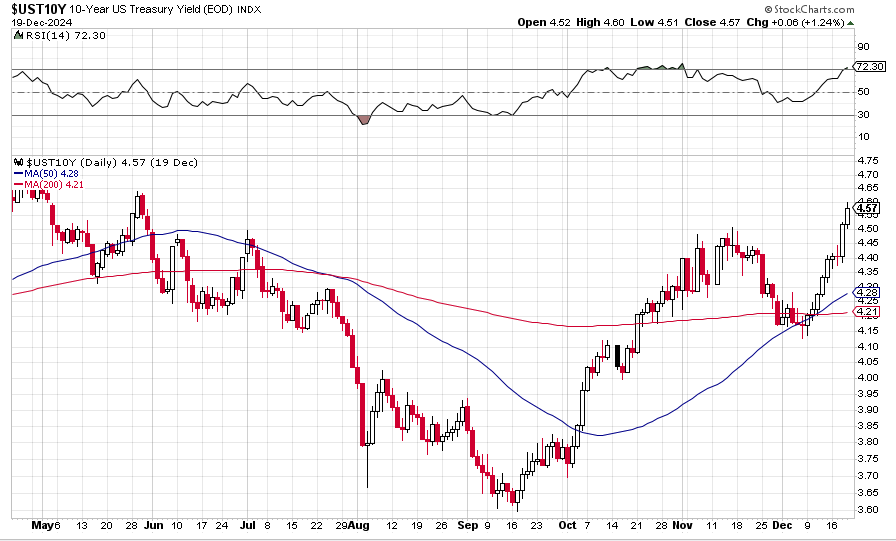

Washington, we have a problem. The day before the Fed cut interest rates on September 16th, the 10-year Treasury closed with a yield of 3.64%. The Fed has cut 100 basis points off its target rate since then. The 10-year yield has climbed 87 basis points. It’s up eight of the last nine trading days.

Official rates are going down. Market rates are going up. The bond market doesn’t like the idea of getting rid of the debt ceiling. It doesn’t like the idea of adding $2 trillion a year in new debt and paying $1 trillion interest on the $36 trillion we already have. And–this is arguable–it doesn’t seem to like the idea of borrowing even more money to ‘pay’ for new tax cuts.

The bond market can’t talk. It’s not a real person. But prices are information. And the 10-year Treasury price is the most important price in the market. The last several times the yield on the 10-year approached 5%, something ‘broke’ in the banking system (the assets of banks, when marked to market, dropped precipitously). What will happen next time? And could we find out as soon as next week/ Stay tuned.

Bonner Research