Don't pay tax on gains but you can't spend it until you're 65, no thanks lol

Discussion

Fucking government casino shit

Such a trap. Especially considering most retirement funds will not beat debasement and over 30 years that siloed capital will probably lose half its purchasing power to inflation.

You pay the tax no matter what

Yep tax deferred. Only benefit is if when you withdraw you are in a lower tax bracket. And when you deposit you lower your tax burden for the year. But then your funds are kind of stuck in the traditional market until you withdraw. Chose your poison.

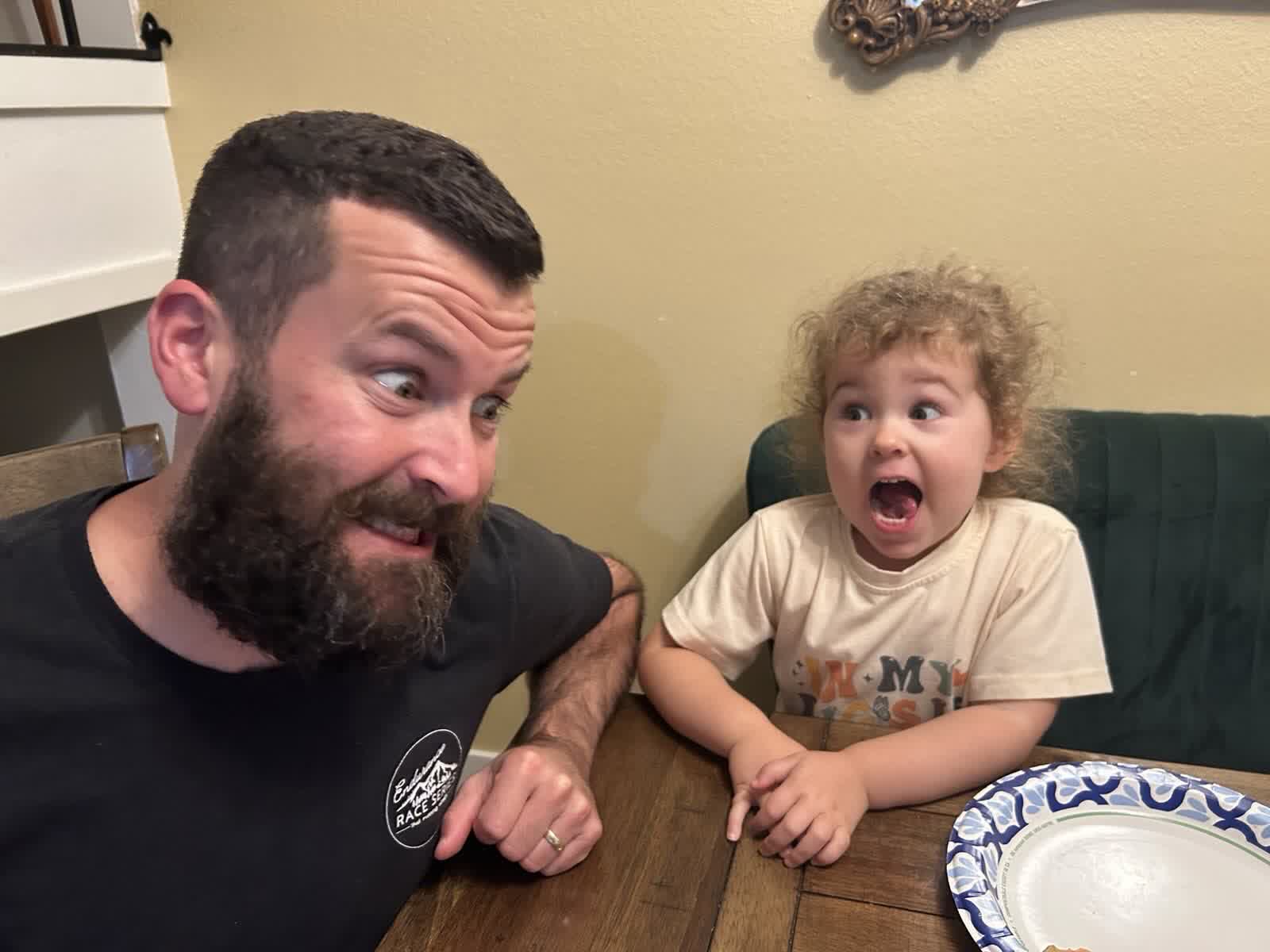

My mom short circuits when she’s reminded I declined my fiat mines’ retirement account contribution match 😂

lol crazy how so many people get duped by this

Couple interesting points:

1. You can realize over $100k in gains per year without federal taxes if youre married and have no other income.

2. You can withdraw Roth IRA contributions at any time for no taxes/fees. Example: you contribute $5k/year for 10 years starting at age 25. At age 35, it's worth $70k. you can take out $50k and let the remaining $20k continue to grow (house money).

59 and 1/2