**Meta Soars After Top- & Bottom-Line Beat; 'Metaverse' Losses Grow, MAUs Disappoint**

Meta Soars After Top- & Bottom-Line Beat; 'Metaverse' Losses Grow, MAUs Disappoint

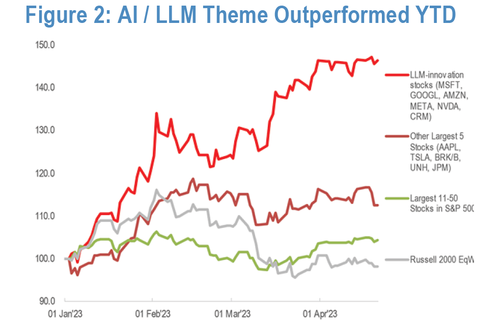

**Meta shares are soaring after hours after a top- and bottom-line beat** extending gains (above one-year highs) since its earnings report on Feb 1st (and continuing to benefit from the AI bubble craze YTD)...

?itok=NbnMzzx1 (

?itok=NbnMzzx1 ( ?itok=NbnMzzx1)

?itok=NbnMzzx1)

... **Meta's "year of efficiency"** has meant mass layoffs and the stock price up 150% from its post-earnings (mid-Nov) lows. **But has the price over-reached the fundamentals?**

?itok=12svreMb (

?itok=12svreMb ( ?itok=12svreMb)

?itok=12svreMb)

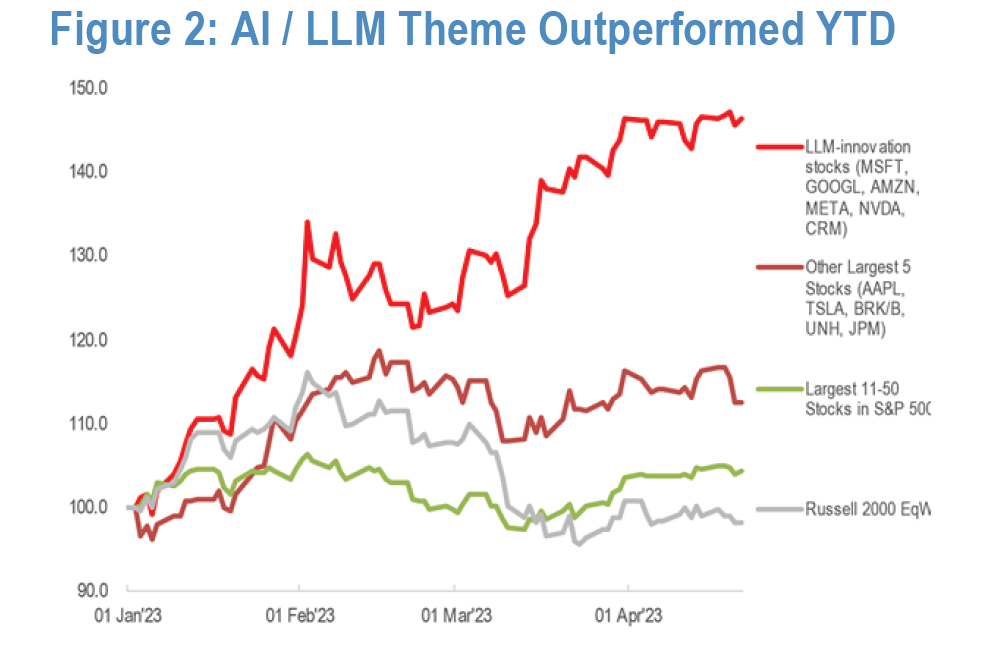

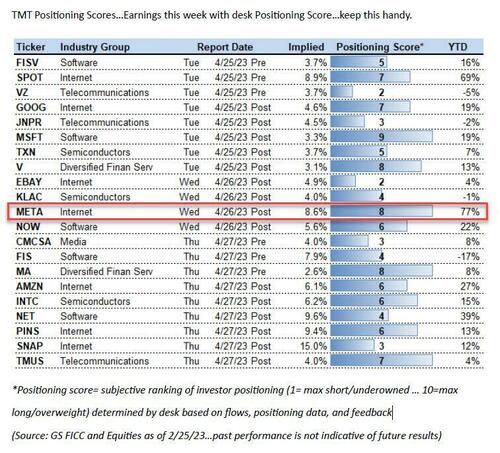

The Facebook parent was **expected to post a fourth consecutive quarter of declining revenue** and while META expectations are broadly optimistic, so is **positioning which is one of the most long/overweight** as the following chart of TMT positioning from Goldman shows (the positioning score= subjective ranking of investor positioning _(1= max short/underowned … 10=max long/overweight) as determined by desk based on flows, positioning data, and feedback)._

?itok=lks7dvoz (

?itok=lks7dvoz ( ?itok=lks7dvoz)

?itok=lks7dvoz)

Finally, before we dive into the earnings report, the options market is implying a 10% move following results, compared with an average 14% move over the past two years

**Meta's top- and bottom-line beat expectations in Q1:**

- \*META PLATFORMS 1Q REV. $28.65B, EST. $27.67B

- \*META PLATFORMS 1Q EPS $2.20, EST. $2.01

Under the hood, **Ad Revenue beat:**

- \*META PLATFORMS 1Q AD REV. $28.10B, EST. $26.76B

- \*META 1Q FAMILY OF APPS OPER INCOME $11.22B, EST. $10.32B

However, **Meta's outlook came in at the lowest end of expectations**

- \*META PLATFORMS SEES 2Q REV. $29.5B TO $32B, EST. $29.48B

But Zuck remains optimistic of course...

> _**"We had a good quarter and our community continues to grow,"** said Mark Zuckerberg, Meta founder and CEO._

>

> _"Our AI work is driving good results across our apps and business. We're also becoming more efficient so we can build better products faster and put ourselves in a stronger position to deliver our long term vision."_

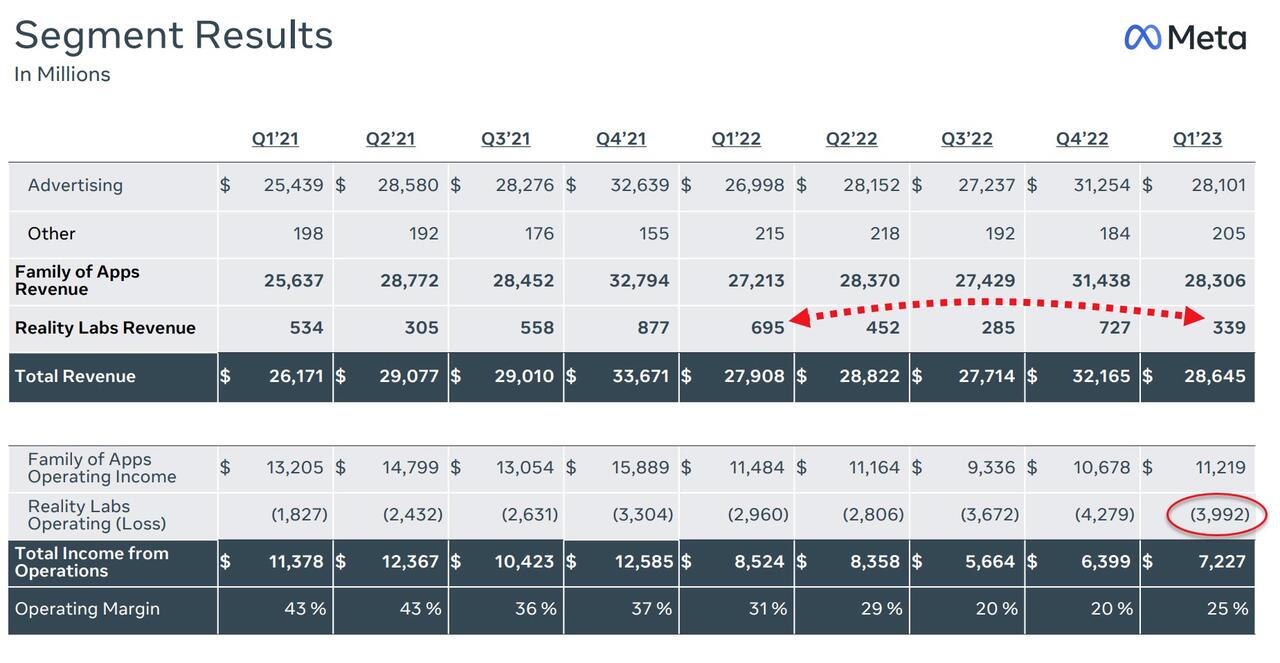

**But Reality Labs (the Metaverse builders) saw a smaller revenue than expected and a bigger than expected operating loss:**

- \*META PLATFORMS 1Q REALITY LABS REV. $339M, EST. $613.1M

- \*META 1Q REALITY LABS OPER LOSS $3.99B, EST. LOSS $3.8B

?itok=h1gFi_sH (

?itok=h1gFi_sH ( ?itok=h1gFi_sH)

?itok=h1gFi_sH)

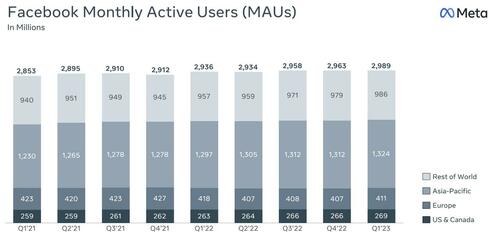

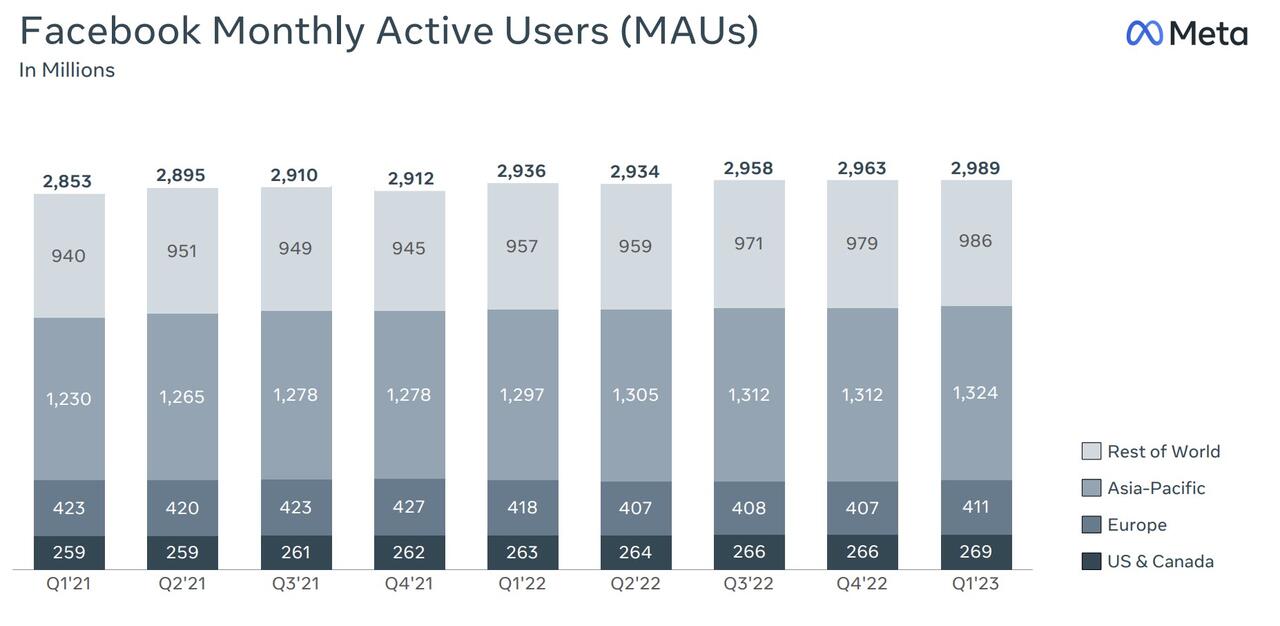

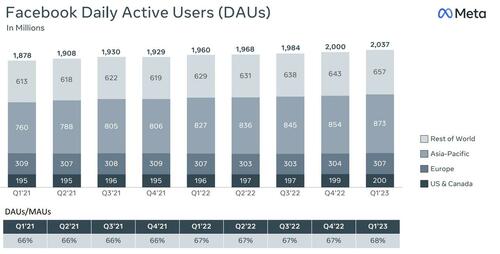

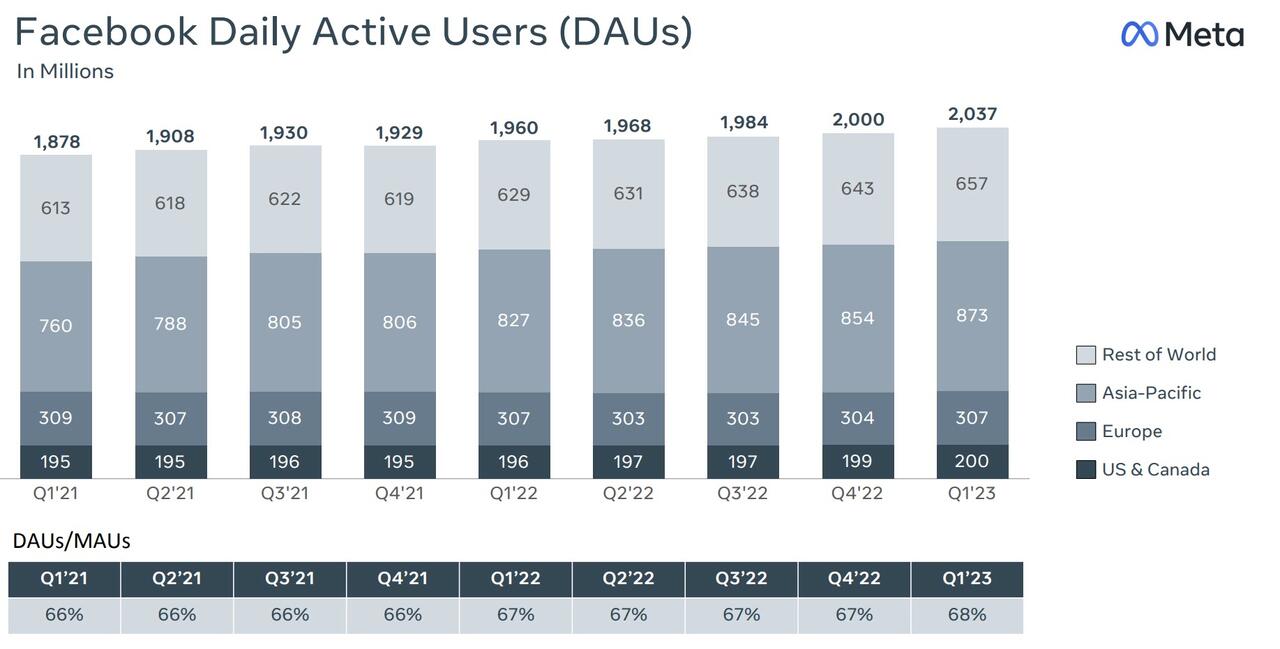

**Facebook's user data was mixed** with daily active users up 4% (and better than expected) while **monthly active users disappointed**:

- \*META 1Q FACEBOOK MONTHLY ACTIVE USERS 2.99B, EST. 3.00B

?itok=kGhjDeII (

?itok=kGhjDeII ( ?itok=kGhjDeII)

?itok=kGhjDeII)

- \*META PLATFORMS 1Q FACEBOOK DAILY ACTIVE USERS 2.04B, EST. 2.01B

?itok=Y2krOosP (

?itok=Y2krOosP ( ?itok=Y2krOosP)

?itok=Y2krOosP)

**Costs are undoubtedly in focus for Meta, and they’re narrowing their expected expense range for 2023 to $86-$90 billion.**

That’s significantly lower than the $96-$101 billion initial projection the company gave in October.

Surprisingly, given the significant layoffs that have been announced, **headcount was 77,114 as of March 31, 2023, a decrease of 1% year-over-year.**

> _Substantially all employees impacted by the layoff announced in November 2022 are no longer reflected in our reported headcount as of March 31, 2023._

>

> _Further, the employees that would be impacted by the 2023 layoffs are included in our reported headcount as of March 31, 2023._

**So layoffs affected 13% of staff.. but the total headcount is down only 1% - that's a lot of hiring and firing in one year.**

Meta shares are up 10% on the day now, at their highest since early April 2022...

?itok=mve7ANfM (

?itok=mve7ANfM ( ?itok=mve7ANfM)

?itok=mve7ANfM)

Perhaps of most note, _**the word “me…