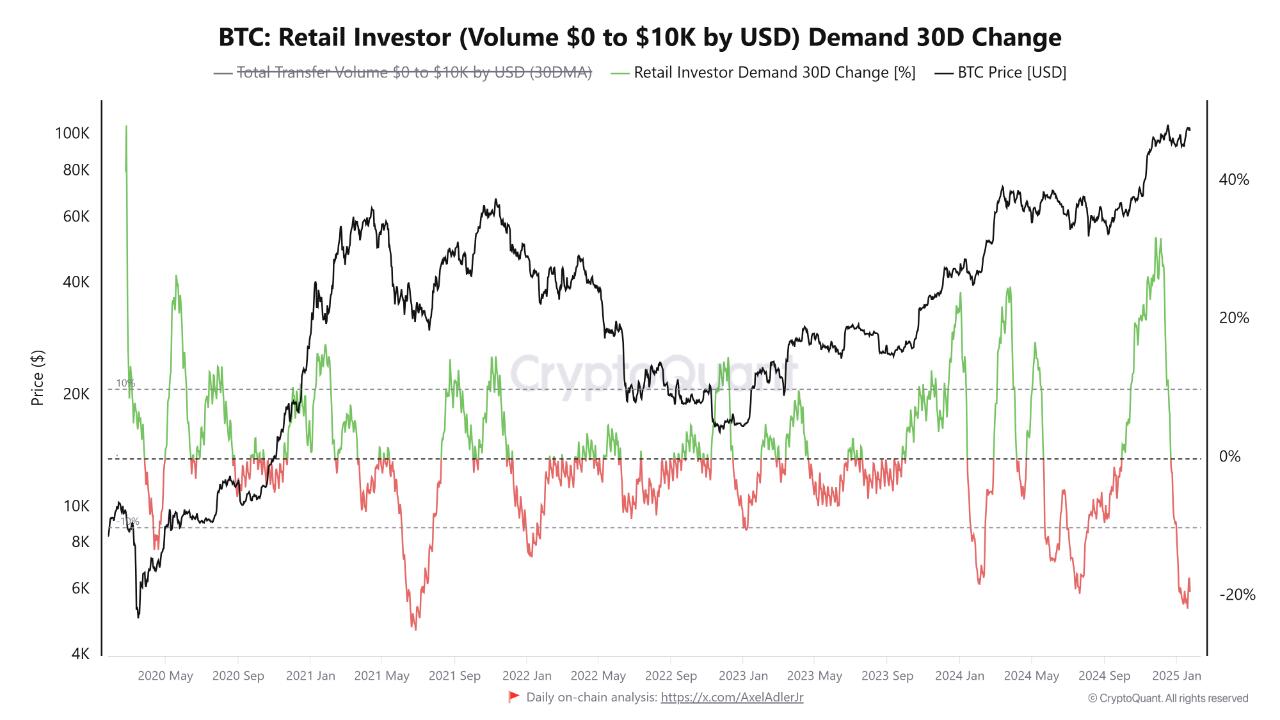

🚨 **Even with BTC near all-time highs, retail demand remains low**

Over the past 30 days, on-chain transactions up to $10K have dropped by -16.7%, indicating that retail activity remains subdued despite the current high volatility.

Typically, periods of high price volatility are accompanied by increased on-chain demand, but that’s not what we’re observing right now.

For now, retail activity patterns remain low after peaking in December and declining during the subsequent consolidation phase.

This suggests that despite new all-time highs, the on-chain structure is not "overextended," which supports the potential for further upward trends.