Stocks Slump With Rate-Cut Hopes As CPI Soars In January

Stocks Slump With Rate-Cut Hopes As CPI Soars In January

As we highlighted in our https://www.zerohedge.com/markets/cpi-preview-time-hot-inflation-surprise

, the CPI matters a lot, again!

After https://x.com/zerohedge/status/1879521649260892598

, with Core CPI missing expectations both sequentially and YoY, analysts expect core to accelerate sequentially, but bear in mind we have the annual revisions malarkey to wade through first, so who knows what the 'expectation' will be comparable to.

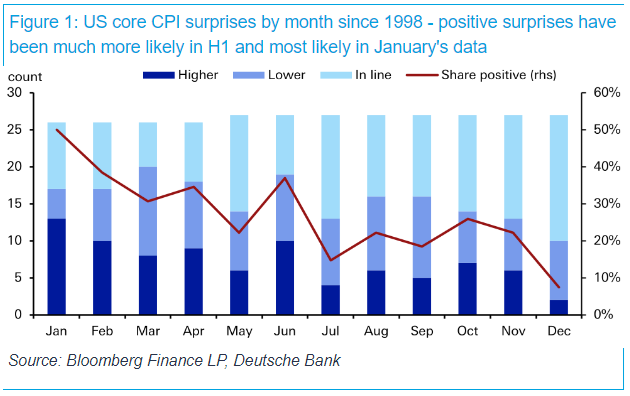

Seasonality screams big beat today, as Deutsche Bank's Jim Reid points out, surprises to CPI over the last 25-plus years have been more likely to be biased to the upside in H1 than in H2. January’s release (which we will see today) has seen the largest number of beats (50%) and the lowest number of downside misses (15%).

?itok=XcU7Sbqq

?itok=XcU7Sbqq

And sure enough, both headline and core CPI rose more than expected in January. Headline CPI jumped 0.5% MoM (+0.3% exp) dragging the price series up 3.0% YoY (+2.9% exp). That is the seventh straight month of accelerating MoM CPI prints...

?itok=LiX0ZVm9

?itok=LiX0ZVm9

Source: Bloomberg

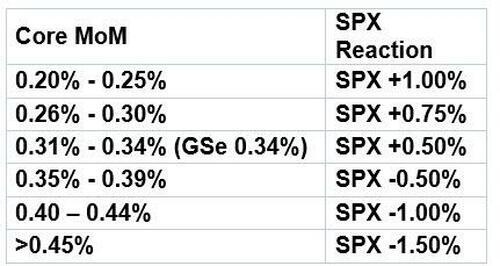

Core CPI - more watched - jumped 0.4% MoM (more than the 0.3% rise expected) and that dragged core consumer prices up 3.3% YoY (3.2% exp)...

?itok=bGc8BtlE

?itok=bGc8BtlE

Source: Bloomberg

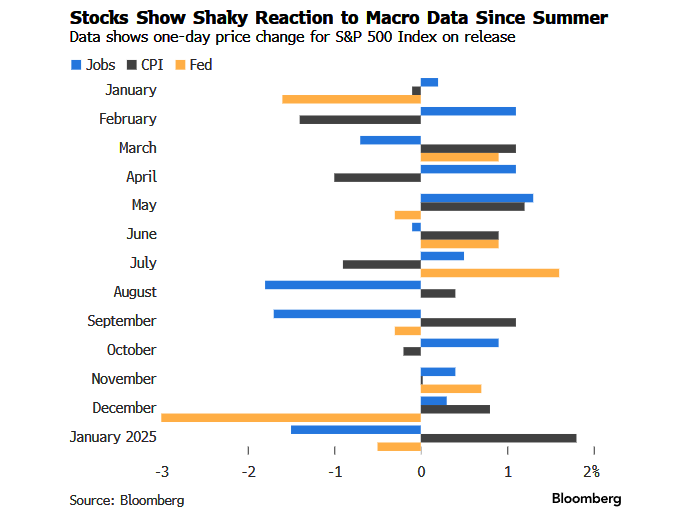

Finally, what will stocks do with this new information?

?itok=KNjS6v_7

?itok=KNjS6v_7

It's certainly been a wild ride on Payrolls and CPI days, but as Goldman's Lee Coppersmith notes, a hit CPI liked this suggests considerable downside for the S&P today...

?itok=Kgg3kJ16

?itok=Kgg3kJ16

And in the pre-market, futures are heading that way...

?itok=WLts3X1J

?itok=WLts3X1J

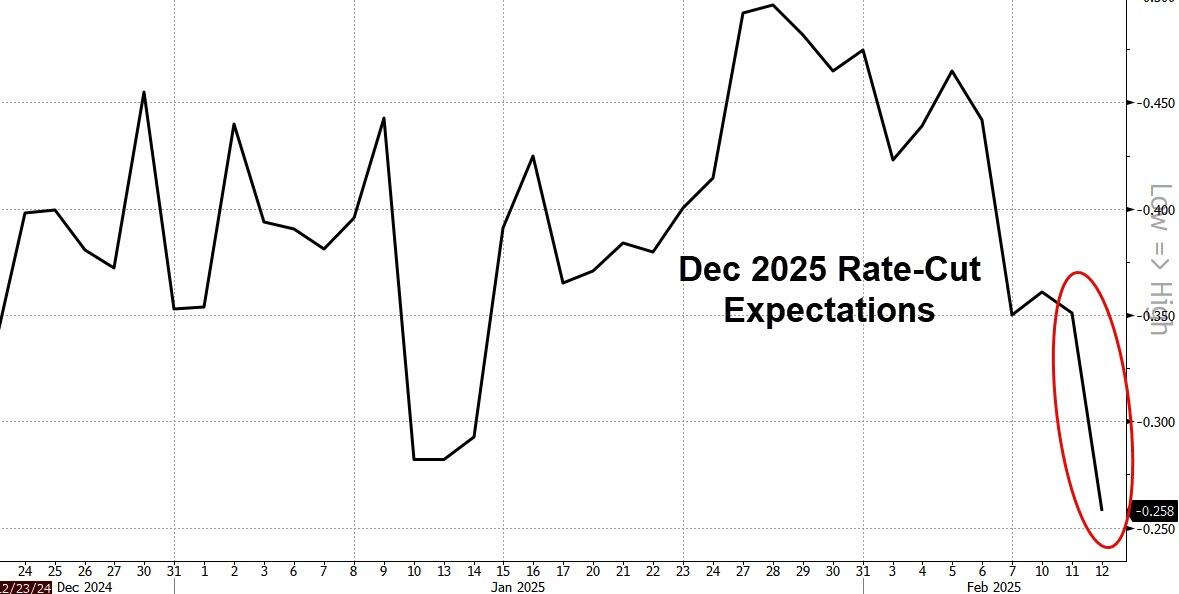

Perhaps more notably, the market is now pricing in just one rate cut this year (pushing expectations from Sept to Dec)...

?itok=K1c62ta6

?itok=K1c62ta6

...but is it different this time under Trump?

https://cms.zerohedge.com/users/tyler-durden

Wed, 02/12/2025 - 08:40

https://www.zerohedge.com/economics/stocks-slump-rate-cut-hopes-cpi-soars-january