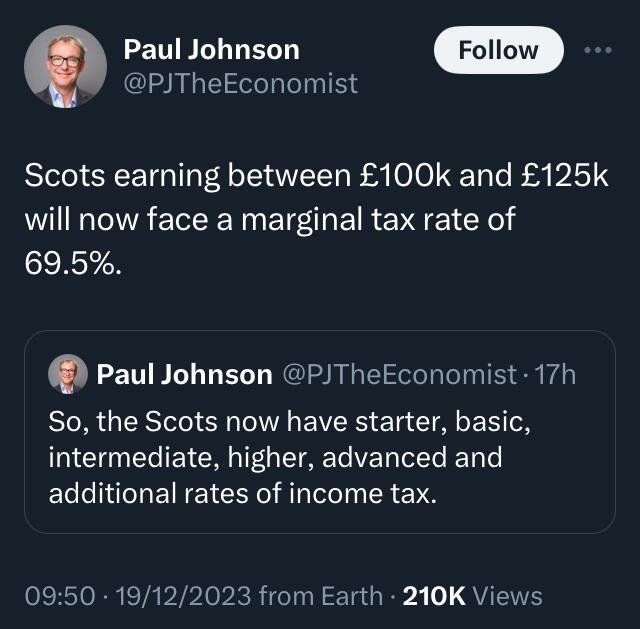

Aye.. It's a tough tax bracket.

To clarify, this is called the "£100k tax trap"

The quoted 69.5% is only on the income between £100 and £125k. This is due to simultaneous reduction of personal tax allowance between those income figures.

Tax drops back down to 45% above £125k.

In England the tax trap is 60%.

A common way to avoid the tax trap is to put anything above 100k into your pension, tax free. Only when you earn above £130k it's worth suffering the tax trap.