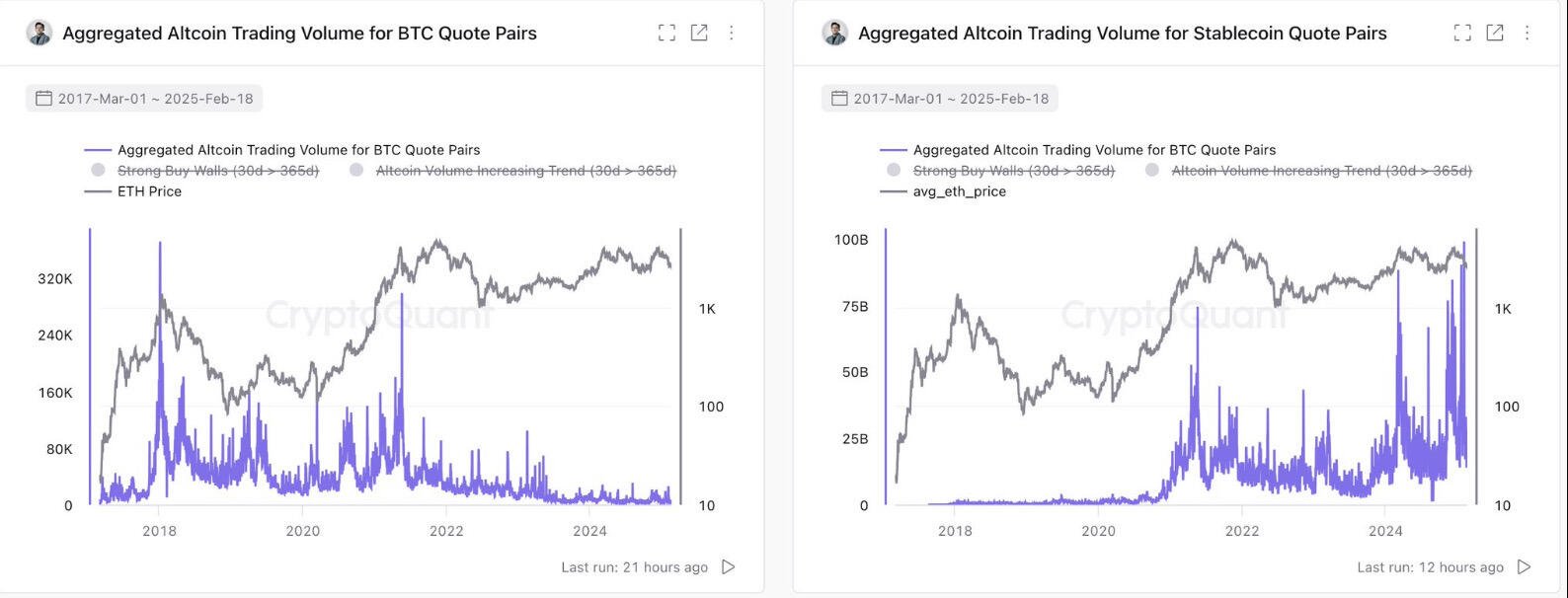

The truth is that as long as there is an increasing demand for the U.S. dollar, the U.S. government doesn’t care printing more dollars. Even for #crypto trading the US dollar dethroned #Bitcoin as volume for stablecoin quote pairs is now greater than the one for #btc quote pairs. Bitcoin is a currency and is meant to be used. If we call Bitcoin digital gold, then it will end up like gold in bits: a digital relic. Pushing the digital gold narrative like #MichaelSaylor does is not understanding that to stay relevant, a currency needs to grow the demand for its usage.

Discussion

Absolutely. But why should we use it as a currency?

It sucks as a currency.

I can’t disagree. It could have been a better currency if this digital gold narrative wouldn’t have been so pervasive though.

the store of value narrative will fall too. then - what is left?

It’s certainly possible although I would not discount the possibility that #Bitcoin keeps going higher. Paradoxically, the U.S. may not mind seeing the price of Bitcoin going higher as long as it remains unusable as a P2P currency. The next bear market will tell us more about the resilience of the store of value narrative.

Sure it can go higher.

I think it is likely sooner or later KYC data & withdrawal address from a big exchange will leak. Then people will realize a public, transparent ledger is not a good store of value but a security risk.

What does the chart show, that people used to use Bitcoin for spending, and now they use altcoins for spending instead?

It shows which asset (BTC Vs. stablecoins) is the most used to trade crypto over time. For instance it used to be that ETH/BTC was more traded than ETH/USDT but now the opposite is true. This means that people looking to acquire crypto tends to use fiat rather than Bitcoin. It may seem an obvious choice but back in the day Bitcoin was the only option and even when USDT emerged, many people still favored holding BTC as a reserve asset to acquire other cryptos.