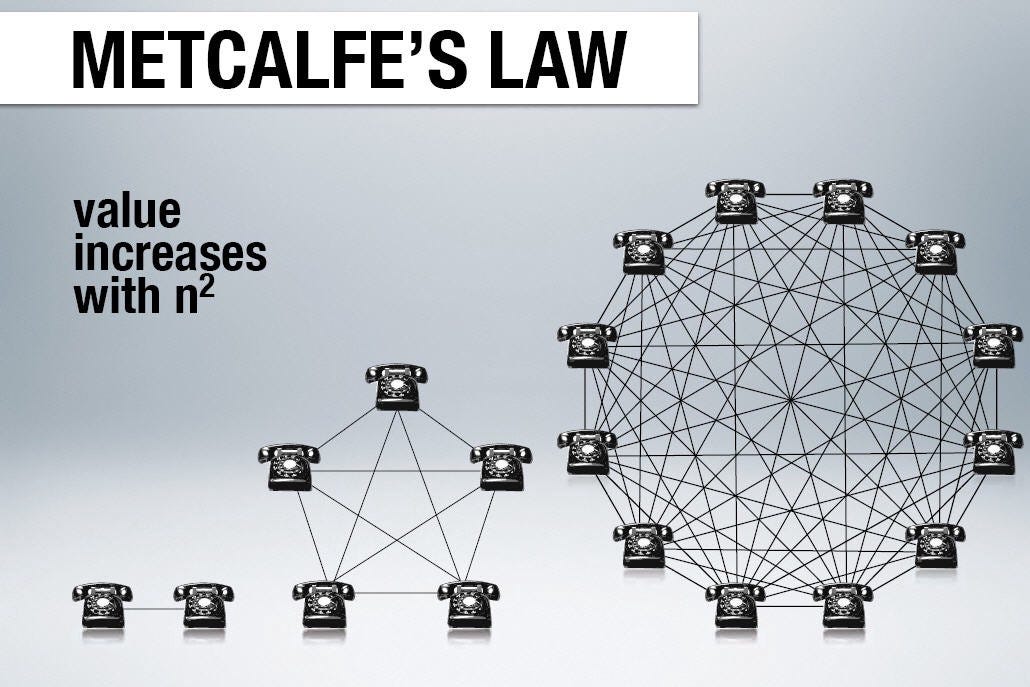

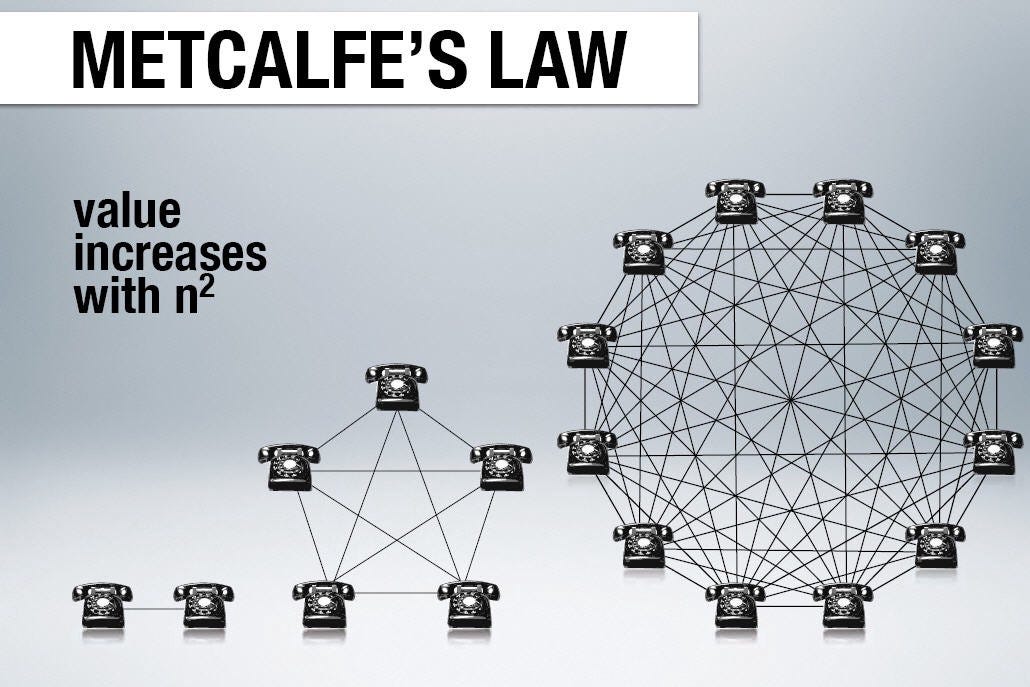

Metcalfe's Law says: value of a network = number of users squared (N^2)

S2F Model says: value of an asset = scarcity cubed (S2F^3)

So if S2F 2x then value 8x (2x2x2)

Oh, and April 2024 halving will 2x #Bitcoin S2F

Probably nothing🔥

Metcalfe's Law says: value of a network = number of users squared (N^2)

S2F Model says: value of an asset = scarcity cubed (S2F^3)

So if S2F 2x then value 8x (2x2x2)

Oh, and April 2024 halving will 2x #Bitcoin S2F

Probably nothing🔥

Metalcafe🎸🤘

It seems like you're referring to two different models used to value networks and assets:

1. Metcalfe's Law: This law, named after Robert Metcalfe, states that the value of a network is proportional to the square of the number of users (N^2). This concept is often applied to social networks, telecommunications, and other systems with network effects.

2. Stock-to-Flow (S2F) Model: This model, often used in the context of Bitcoin and other cryptocurrencies, suggests that the value of an asset is related to its scarcity, measured by the stock-to-flow ratio (S2F). In this case, the value of the asset is said to be proportional to the cube of its scarcity (S2F^3). The model is based on the observation that the more scarce an asset is, the higher its value tends to be.

You mention that if the S2F ratio of Bitcoin doubles after the halving event in April 2024, then the value of Bitcoin should increase eightfold (2x2x2). While the S2F model has been a popular method for predicting Bitcoin's price, it's important to remember that it's just one of many factors that can influence the value of an asset. Other factors such as market sentiment, regulatory changes, and technological advancements can also play a significant role in determining an asset's value.

It's also worth noting that while models like Metcalfe's Law and the S2F model can provide insights into the behavior of networks and assets, they're not foolproof and should be taken with a grain of caution. Always consider multiple factors and models when making investment decisions.

This was generated by gpt4