Tether Disappointed With "Rushed Actions" On MiCA-Driven USDT Delisting In Europe

Tether Disappointed With "Rushed Actions" On MiCA-Driven USDT Delisting In Europe

https://cointelegraph.com/news/tether-mica-usdt-delistings-europe

Stablecoin operator Tether addressed European cryptocurrency regulations amid exchanges like Crypto.com preparing to delist its USDt stablecoin in Europe tomorrow.

?itok=M0OaMSQO

?itok=M0OaMSQO

Tether expressed disappointment over market developments in Europe amid changes triggered by the enforcement of the European Union’s https://cointelegraph.com/learn/articles/markets-in-crypto-assets-regulation-mica

(MiCA) framework.

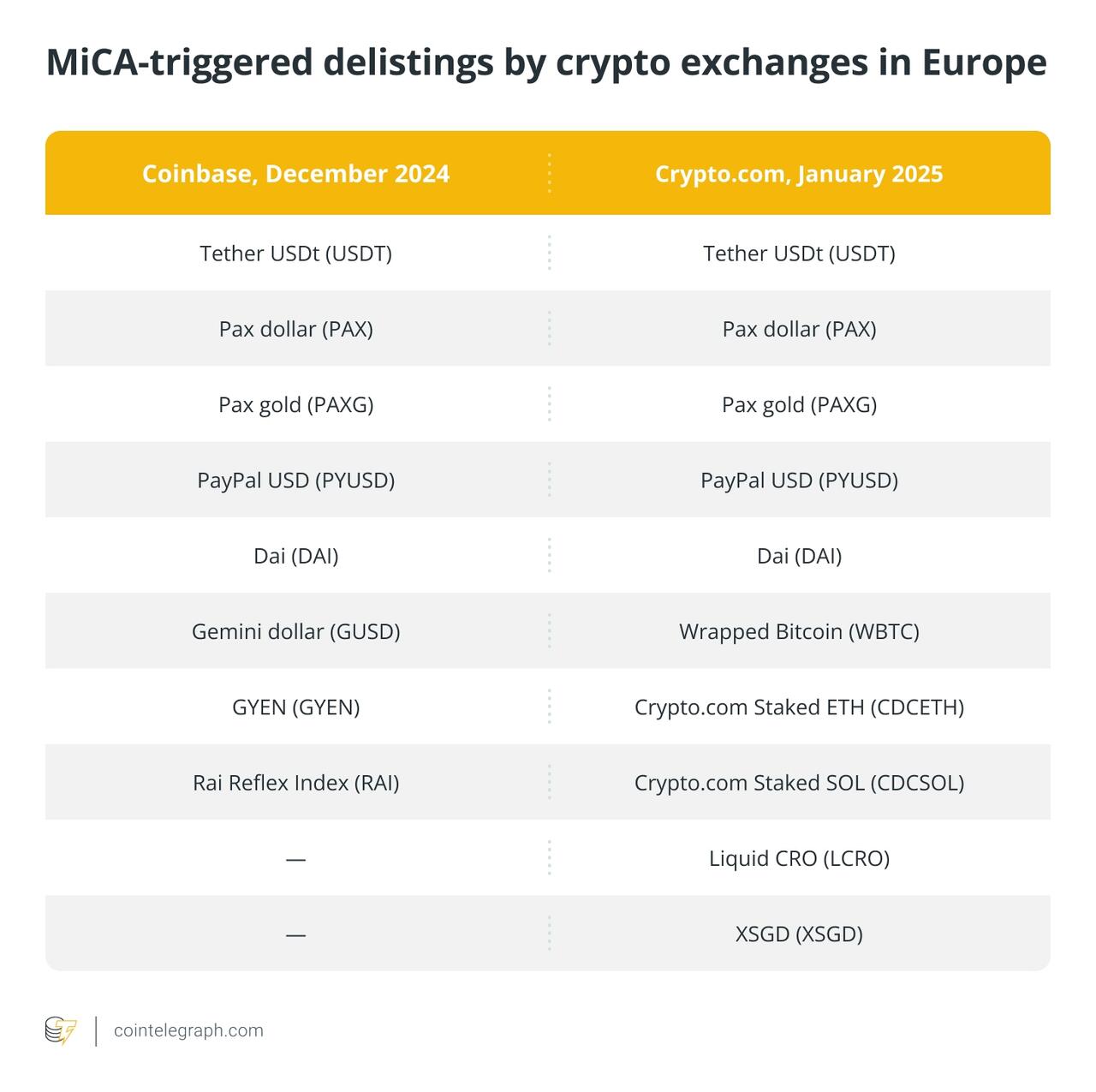

Crypto.com, a global crypto exchange, confirmed on Jan. 29 it will start https://cointelegraph.com/news/crypto-com-delist-usdt-europe-mica-compliance

stablecoin and nine other tokens on Jan. 31 to comply with MiCA regulations.

“It is disappointing to see the rushed actions brought on by statements which do little to clarify the basis for such moves,” a spokesperson for Tether told Cointelegraph.

EU consumers under risk of “disorderly” crypto market

MiCA-triggered changes pose significant risks for EU consumers and the local crypto market, with exchanges like Crypto.com preparing to delist multiple tokens, according to Tether.

“These changes affect many tokens in the EU market, not only USDt, and we fear that such actions will lead to further risk being placed on consumers in the EU,” Tether’s representative said.

According to Tether, such regulatory developments in the EU could create a “disorderly” market at a time when MiCA is still in the early stages of implementation.

?itok=_K7-ITZQ

?itok=_K7-ITZQ

As previously mentioned, Crypto.com’s MiCA-forced delisting process is set to affect a total of 10 tokens, including https://cointelegraph.com/explained/wrapped-crypto-tokens-explained

, Dai stablecoin and more.

Coinbase — an exchange that https://cointelegraph.com/news/coinbase-delisting-tether-usdt-stablecoin-europe

for other reasons on Dec. 19, 2024.

“We regularly review the assets we make available to customers on our platform to ensure we are meeting regulatory requirements, and will assess re-enabling services for stablecoins that achieve MiCA compliance on a later date,” a Coinbase representative told Cointelegraph on Jan. 30.

The spokesperson also mentioned that Coinbase has so far delisted a total of eight tokens to comply with MiCA.

Tether finalizes European strategy for USDt

Apart from broader consumer risks potentially arising from MiCA-triggered ecosystem changes, Tether https://cointelegraph.com/news/is-tether-usdt-noncompliant-europe-mica

for stablecoins licensed in the EU.

“As we have consistently expressed, some aspects of MiCA make the operation of EU-licensed stablecoins more complex and potentially introduce new risks,” Tether said.

Tether’s representative also again highlighted differences in stablecoin use cases between Europe and emerging markets, where USDT is extremely popular.

“The USD stablecoin market is almost negligible in Europe,” the spokesperson noted.

At the same time, Tether still commends EU regulators for their efforts in establishing a structured framework, as it plays a key role in fostering growth within the sector, the spokesperson noted, adding:

“As Tether finalizes its European strategy for USDt, it remains committed to ensuring compliance with evolving regulations while introducing groundbreaking technologies such as Hadron and investments in transformative projects such as Quantor, designed to be MiCA compliant.”

Tether’s comments come shortly after the European Securities and Markets Authority pushed European crypto asset service providers (CASP) to start https://cointelegraph.com/news/eu-regulator-restriction-non-mica-compliant-stablecoins

by the end of January.

While still allowing the listing of those tokens in sell mode until March 31, the regulator has asked CASPs to completely restrict non-compliant stablecoins by the end of the first quarter of 2025.

https://cms.zerohedge.com/users/tyler-durden

Fri, 01/31/2025 - 05:00