It is definitely a real risk. My view is that the upside for bitcoin is already so great that I’d rather not risk that.

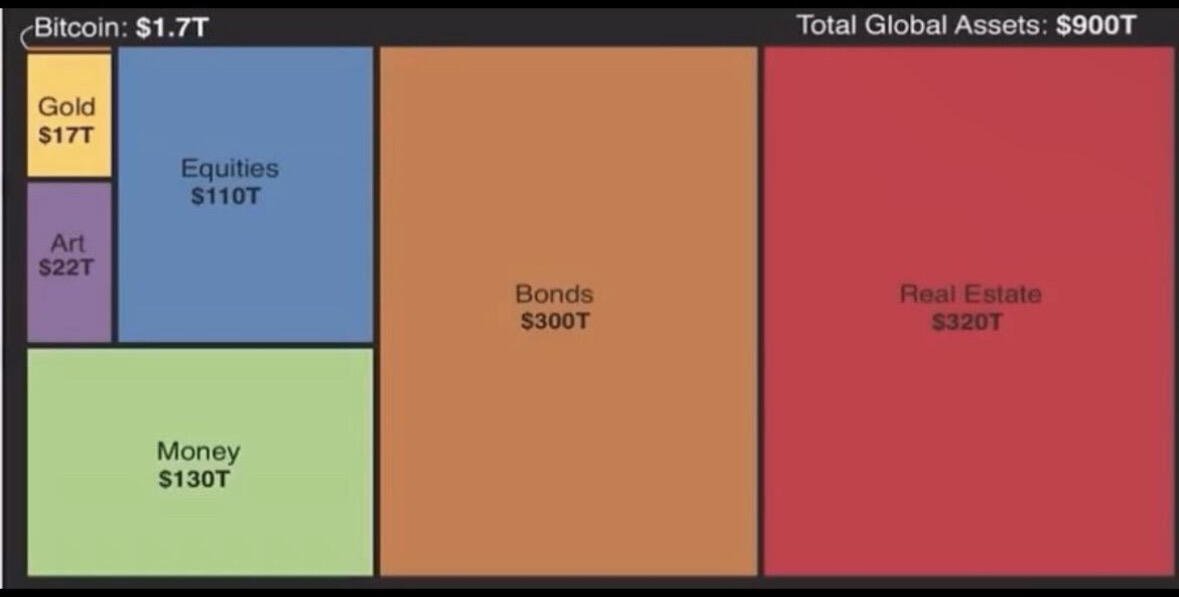

I see btc as the best store of value with minimal counter party risk compared to traditional assets. So I believe some of monetary premium (store of value) function in the traditional assets will make it’s way to btc.

If you even think that btc will eat 5T from gold, RE, bonds, equities, and money. Leaving out art as I think some people just like art (just my opinion)..

That would make a 27tn btc = 1.2mm a coin. This is a pretty conservative estimate of how much monetary premium btc will eat.

I don’t know the timeline on this.. but since I believe btc is the best store of value. As a result, i believe it’s inevitable.

What is your view/opinion on where the asset will be? And your view on what I am suggesting?