**European Banks May Be Riskier Than US'... And More Regulation Won't Solve It**

European Banks May Be Riskier Than US'... And More Regulation Won't Solve It

_Authored by Daniel Lacalle,_ (https://www.dlacalle.com/en/european-banks-may-be-riskier-than-u-s-ones-and-regulation-will-not-solve-it/)

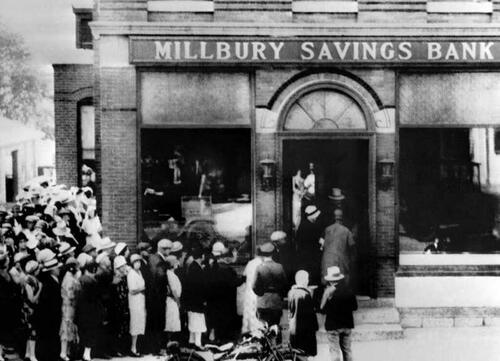

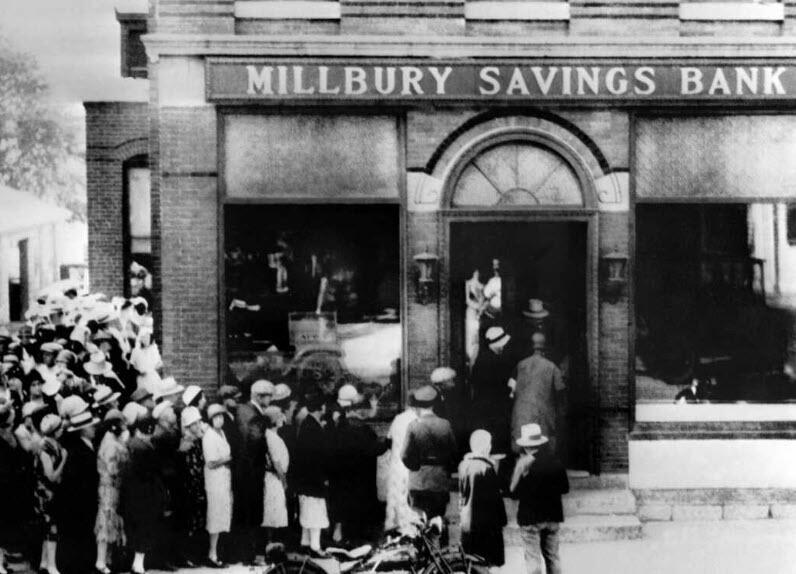

Deposits at U.S. commercial banks have fallen to lowest figure in nearly two years, according to the **Federal Reserve**. This figure has fallen by $500 billion since the Silicon Valley Bank collapse. However, total banking credit has risen to a new record high of $17 trillion, according to the U.S. central bank. **Fewer deposits, but more credit. What could go wrong?**

?itok=tUsheQlC (

?itok=tUsheQlC ( ?itok=tUsheQlC)

?itok=tUsheQlC)

**The inevitable credit crunch is only postponed by a consensus view that the Fed will inject all the liquidity required and that rate cuts will come soon.** It is an extremely dangerous bet. Bankers are deciding to take more risk expecting the Fed to return to a loose monetary policy soon and expecting higher net income margins due to rising rates despite the elevated risk of increasing non-performing loans.

The fact that the banking crisis has been mitigated does not mean that it is over. The banking system collapses are symptoms of a much larger problem: Years of negative real rates and expansionary monetary policy that have created numerous bubbles. The risk in the banks’ balance sheet is not just on diminishing deposits on the liability side, but a declining valuation of the profitable and investment part of the assets. Banks are so leveraged to the cycle and the expansion of monetary policy that they simply cannot offset the risk of a 20% loss on the asset side, a significant rise in non-performing loans or the write-off of the riskiest investments. The level of debt is so high that few banks can raise equity when things get worse.

**Deposit flight is not happening because citizens are stupid. The largest depositors are businesses, small companies, etc. They simply cannot afford to lose their cash if a bank goes to liquidation. Once the Fed introduced the discretionary decision on which banks’ deposits are made whole and which are not, fear took over again.**

Investors and businesses in America understand this.

**However, in the U.S. eighty percent of the real economy is financed outside of the banking channel.** Most of the financing comes from bonds, institutional leveraged loans, and private-direct middle market loans. In Europe, 80% of the real economy is financed with bank loans, according to the IMF.

You may remember in 2008 when European analysts repeated that the subprime crisis was a specific event that only affected the U.S. banks, and that the European financial system was stronger, more capitalized, and better regulated. Well, eight years later, the European banks were still recovering from the European crisis.

Why are European banks equally at risk, or more?

**European banks have strengthened their balance sheet with a very risky and volatile instrument, contingent convertible hybrid bonds.** These look incredibly attractive due to the high yield they have, but they can create a negative domino effect on the equity of the firm when things turn sour. Furthermore, European banks’ core capital is stronger than in 2009, but it can deteriorate rapidly in a declining market.

European banks lend massively to governments, public companies, and large conglomerates. The contagion effect of a rising concern about sovereign risk is immediate. Additionally, many of these large conglomerates are zombie firms that cannot cover their interest expenses with operating profit. In periods of monetary excess, these loans seem extremely attractive and negligible risk, but any decline in confidence in sovereigns can rapidly deteriorate the asset side of the financial system rapidly.

**According to the ECB, euro area banks’ exposures to domestic sovereign debt securities have risen significantly since 2020 in nominal amount.** The share of total assets invested in domestic sovereign debt securities has increased to 11.9% for Italian banks and 7.2% for Spanish banks, and close to 2% for French and German banks. However, this is only part of the picture. There is also a high exposure to state-owned or government-backed companies. One of the main reasons for this is that the Capital Requirements Directive (CRD), permits a 0% risk weight to be assigned to government bonds.

What does this mean? That the biggest risk for European banks is not deposit flight or investment in tech companies. It is the direct and uncovered connection to sovereign risk. This may seem irrelevant, but it changes fast and when it does it takes years to recover, as we saw in the 2011 crisis.

Another distinct feature of European banks is how fast the…

https://www.zerohedge.com/markets/european-banks-may-be-riskier-us-and-more-regulation-wont-solve-it