**Western Alliance's CFO Blames 'Puts' For Crashing His Stock... Here's Why That's Doubtful**

Western Alliance's CFO Blames 'Puts' For Crashing His Stock... Here's Why That's Doubtful

_Via SpotGamma,_ (https://spotgamma.com/western-alliances-cfo-claims-puts-dropped-their-stock-not-true/)

_The link between options flow and the underlying shares is based on the concept that options dealers and market makers buy and sell shares of underlying stock to hedge option positions. These hedging requirements are generally measured through Delta (the number of shares required to hedge an option from the directional move of the underlying) and Gamma (the rate of change of Delta)._

The impact of options trading on underlying equities is now well-accepted, following both the GameStop (https://spotgamma.com/gme-gamma-squeeze/) (GME) and AMC Theaters (https://spotgamma.com/amc-gamma-squeeze-in-review/) (AMC) saga of 2021, and the recent 0DTE flow affecting major US indices such as the S&P 500.

**While there are now many documented cases of option flow driving stock prices, we also see examples where options activity is incorrectly blamed as a scapegoat for equity moves.**

Case in point, last week the WSJ published an article titled: “Did Options Trading Fuel a 47% Plunge in Western Alliance Stock? The CFO Thinks So (https://www.wsj.com/livecoverage/stock-market-news-today-04-20-2023/card/did-options-trading-fuel-a-47-plunge-in-western-alliance-stock-the-cfo-thinks-so-pmNmQHeLBzRcJFlxyop3)“. Let’s investigate:

The Setup

> Western Alliance shares lost almost half their value in a single session last month. The bank’s CFO says options traders are partly to blame.

>

> The shares dropped 47% to $26.12 on March 13, down from around $49 the prior session. Dale Gibbons, the bank’s chief financial officer, says a burst of put options trading—alongside thin activity in the pre-market session—was in part behind the move.

>

> In the prior session, on March 10, options activity tied to the bank skyrocketed after almost no trading for most of the year, Cboe Global Markets data show. Mr. Gibbons says the aggressive trading, especially in bearish put options, helped drive the shares lower.

>

> A snippet of what he said about put options trading on the bank’s earnings call this week (https://www.wsj.com/livecoverage/stock-market-news-today-04-19-2023/card/western-alliance-bonds-surge-along-with-shares-PxKhC2v13ZbyCCI4OBOp) is worth a read:

>

> **_“To me, that’s somebody that had an agenda and then on Monday morning, before the market opens at 5 AM New York Time, they were in the pre-market session selling and nobody trades pre-market, so it’s pretty easy to move the stock price around and push it down, down, down.”_**

>

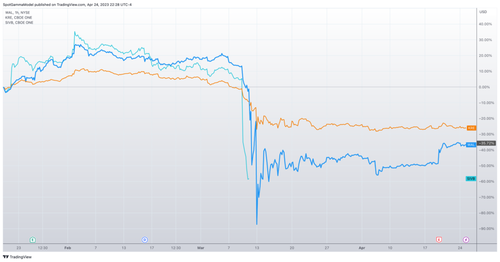

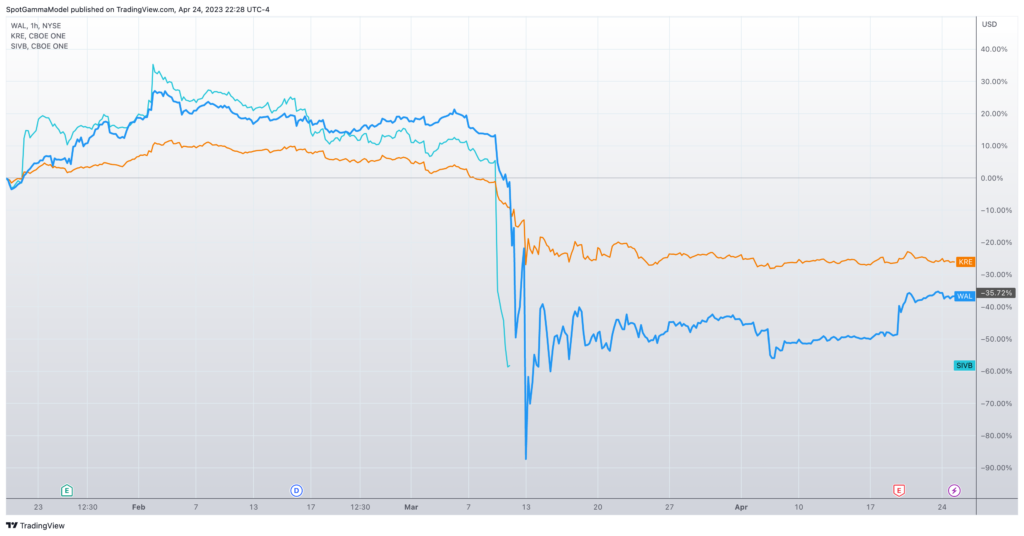

Bank Weakness Ahead of Move

Several days before the March 13th WAL crash, Silicon Valley Bank (SIVB, teal) was closed by the FDIC. These events placed heavy pressure on all regional banks as shown by the KRE price line (orange), leading to a -25% decline in that regional bank ETF. In sympathy, WAL stock dropped 50% the week of 3/8, which was _before_ the stock fell another 50% on Monday, March 13th.

?itok=oWVJZ3NI (

?itok=oWVJZ3NI ( ?itok=oWVJZ3NI)

?itok=oWVJZ3NI)

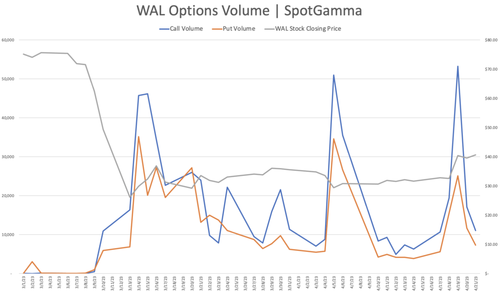

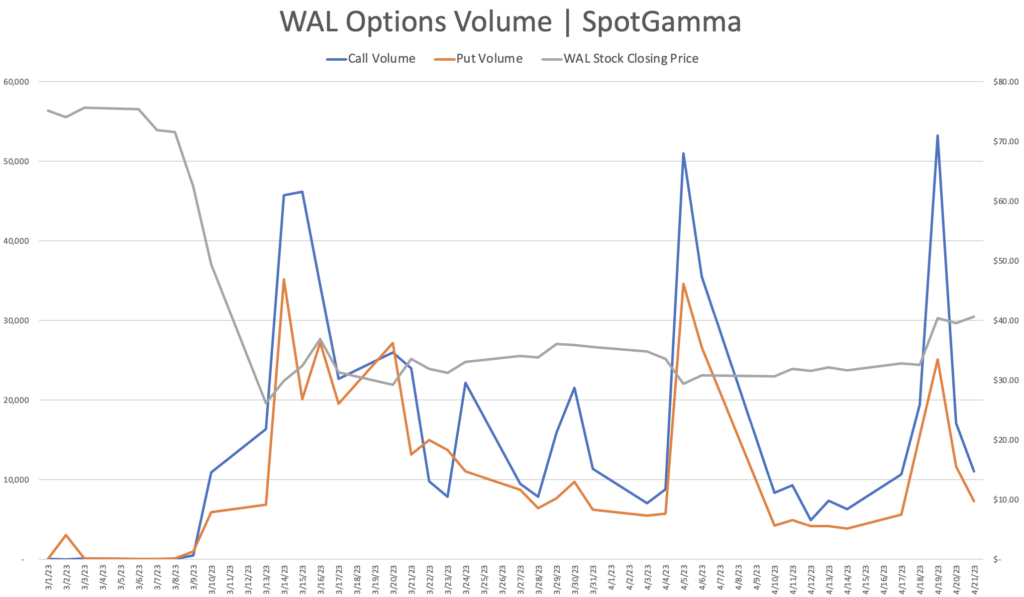

Options Volumes Reflected Bullish Support

Looking at basic volume metrics below, we can see that the options volume started to increase the week of March 6th, with a spike in options volume _on_ March 13th. On the 13th call volume (blue) _exceeded_ put volume (orange), as the stock opened at $12, and closed at $26.

?itok=Pfd9rE4X (

?itok=Pfd9rE4X ( ?itok=Pfd9rE4X)

?itok=Pfd9rE4X)

Further, the stock traded higher in the following days. Since equity options don’t start trading until 9:30AM ET, it’s unlikely that options volume could have driven the opening low on the 13th.

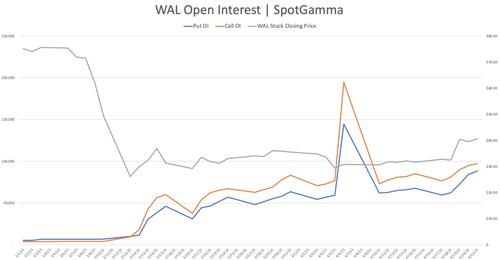

Open Interest Confirms Limited Hedging Requirements

Is it possible that hedging flows from existing options positions were a major driver?

For that we first turn to open interest, and you can see that both put and call open interest are quite low until _after_ the 3/13 stock lows. Low open interest implies less options related hedging is required.

?itok=GN6vPWOQ (https://cms.zerohedge.com/s3/files/inline-images/Screen-Shot-2023-04-24-at-11.50.32-…

?itok=GN6vPWOQ (https://cms.zerohedge.com/s3/files/inline-images/Screen-Shot-2023-04-24-at-11.50.32-…