**Stocks, Bonds, Gold, & Crypto Slide As US Sovereign Risk Roars To Record High**

Stocks, Bonds, Gold, & Crypto Slide As US Sovereign Risk Roars To Record High

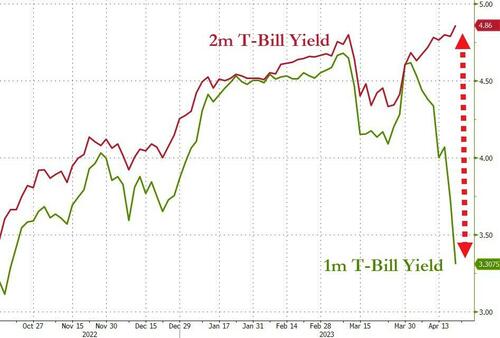

A glimpse at the short-end of the yield curve shines a bright light on market stress around the debt-ceiling X-Date being dragged closer. Bills that mature within a month are dramatically bid, while Bills that mature after a potential sooner-than-expected X-Date are bidless...

?itok=mXWg5v9r (

?itok=mXWg5v9r ( ?itok=mXWg5v9r)

?itok=mXWg5v9r)

_Source: Bloomberg_

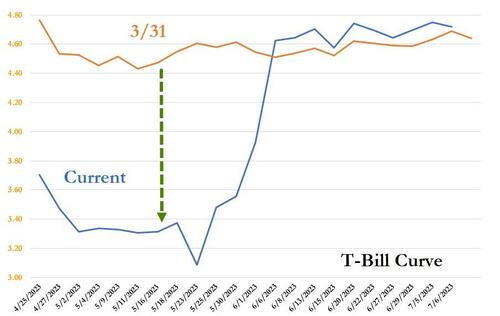

The yield curve itself shows that huge kink more clearly...

?itok=EaNNGiG6 (

?itok=EaNNGiG6 ( ?itok=EaNNGiG6)

?itok=EaNNGiG6)

_Source: Bloomberg_

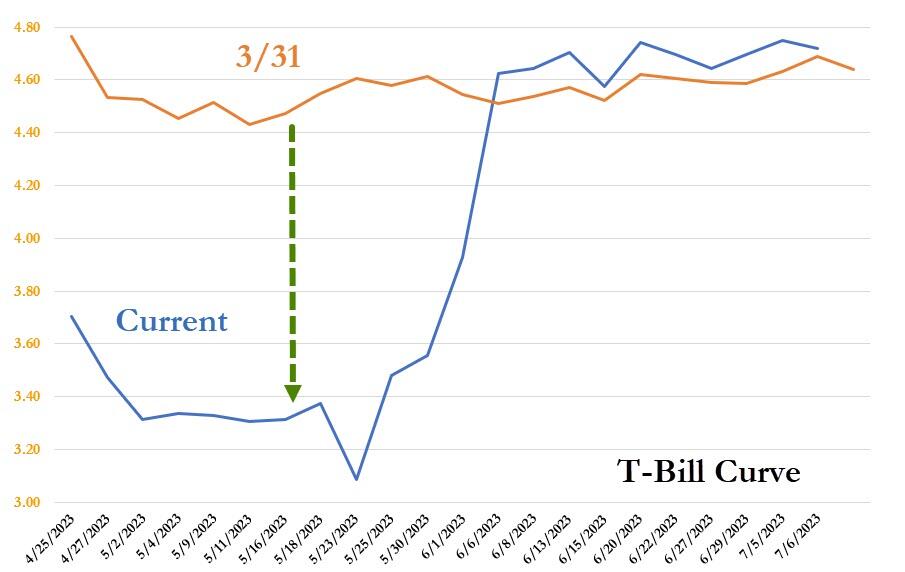

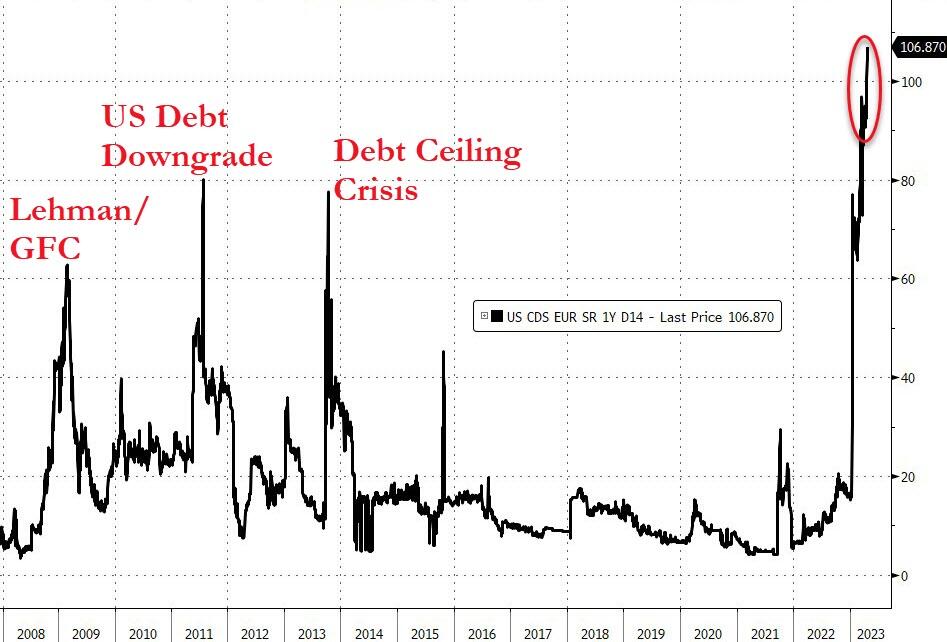

And that is reflected in the surge to record highs for short-dated USA sovereign protection costs...

?itok=UqXbkwLg (

?itok=UqXbkwLg ( ?itok=UqXbkwLg)

?itok=UqXbkwLg)

_Source: Bloomberg_

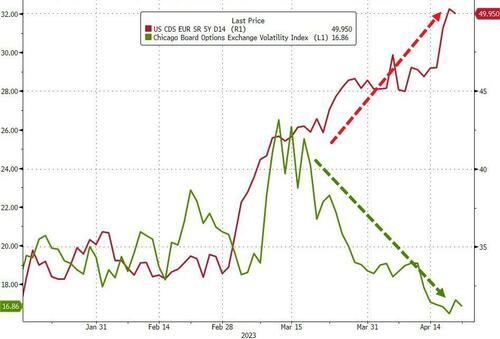

But while USA risk is rising, US equity risk has been falling all week (to its lowest close since Nov '21)...

?itok=6oFcA6jL (

?itok=6oFcA6jL ( ?itok=6oFcA6jL)

?itok=6oFcA6jL)

_Source: Bloomberg_

However, as VIX tumbled to cycle lows this week, VVIX is notably decoupling from it across today's OpEx...

?itok=fntpZRnX (

?itok=fntpZRnX ( ?itok=fntpZRnX)

?itok=fntpZRnX)

_Source: Bloomberg_

Stocks suffered their worst week since March 10th (SVB collapse) with Nasdaq the biggest loser and Small Caps actually managing small gains...

?itok=6ak0MybH (

?itok=6ak0MybH ( ?itok=6ak0MybH)

?itok=6ak0MybH)

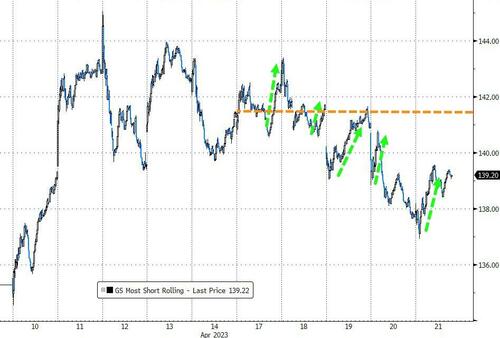

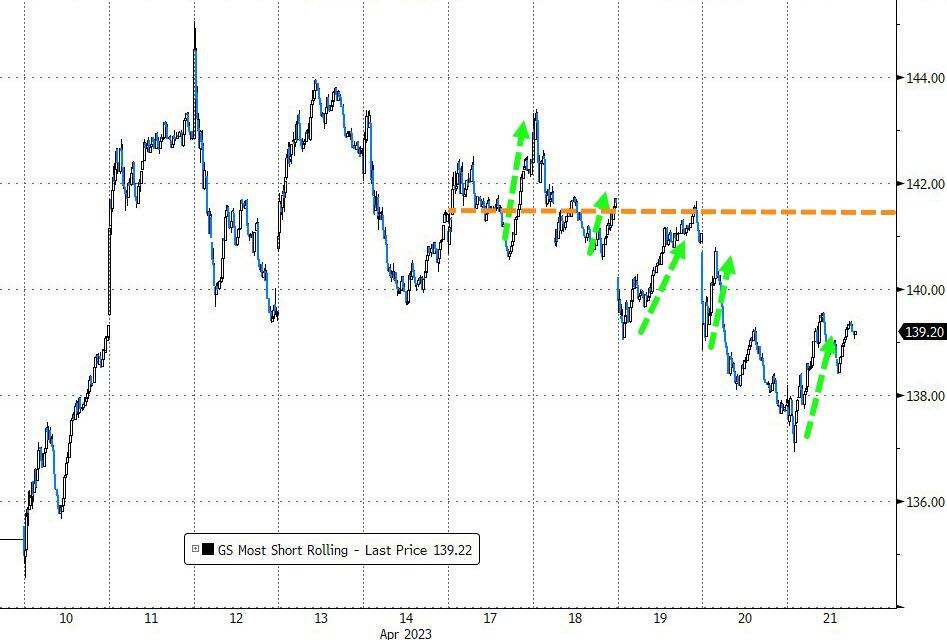

Despite squeezes everyday this week, 'Most Shorted' stocks ended lower...

?itok=n9jPBL6I (

?itok=n9jPBL6I ( ?itok=n9jPBL6I)

?itok=n9jPBL6I)

_Source: Bloomberg_

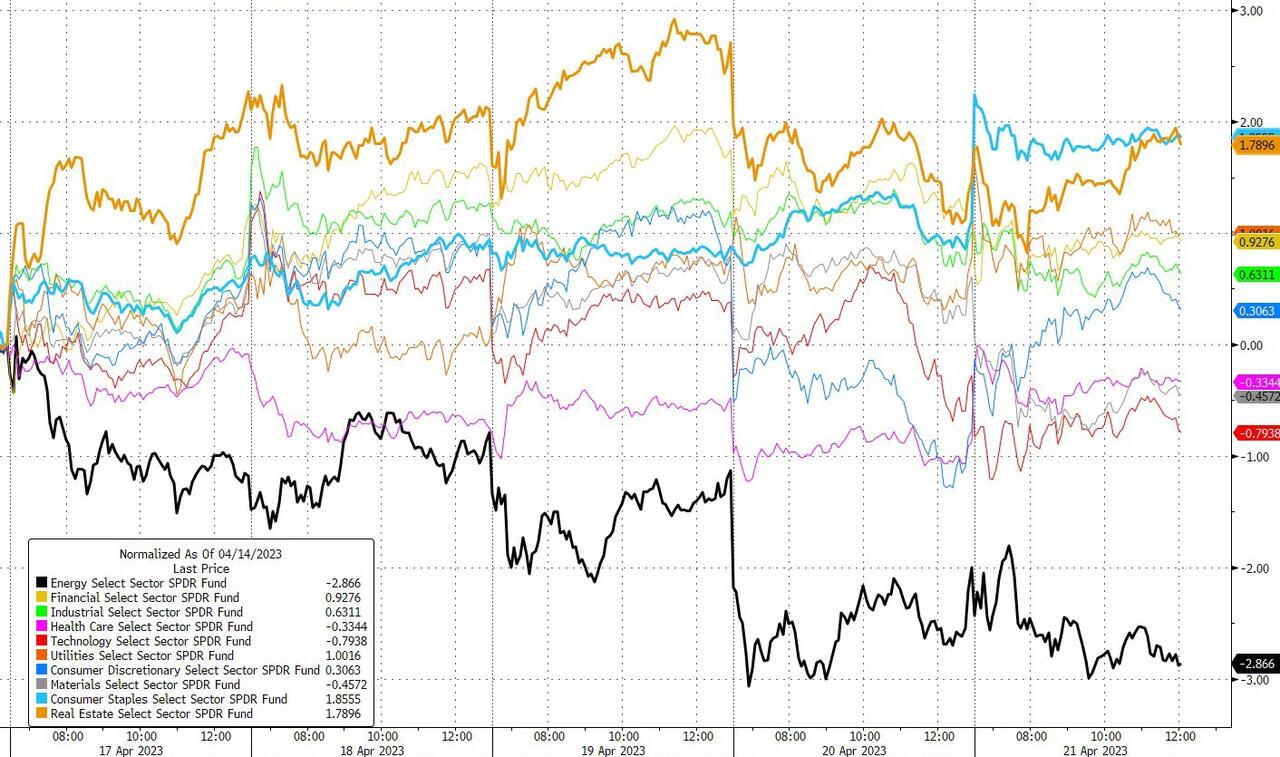

Energy stocks were the weakest this week while Staples and Real Estate outperformed...

?itok=q-eXlI-h (

?itok=q-eXlI-h ( ?itok=q-eXlI-h)

?itok=q-eXlI-h)

_Source: Bloomberg_

As Defensives outperformed Cyclicals...

?itok=ySaiS6ii (

?itok=ySaiS6ii ( ?itok=ySaiS6ii)

?itok=ySaiS6ii)

_Source: Bloomberg_

FSOC voted to tighten up regulation on the financial system (including non-banks) but while regional banks were up on the week, marginally, they are well off the week's highs...

?itok=Ut8-luHK (

?itok=Ut8-luHK ( ?itok=Ut8-luHK)

?itok=Ut8-luHK)

...and remain just drooling along at the post-SVB lows in context...

?itok=I-jcjMRp (

?itok=I-jcjMRp ( ?itok=I-jcjMRp)

?itok=I-jcjMRp)

_Source: Bloomberg_

Treasury yields ended the week higher (with the short-end underperforming) after today's post-PMI spike changed the week...

?itok=l7SPTcYX (

?itok=l7SPTcYX ( ?itok=l7SPTcYX)

?itok=l7SPTcYX)

_Source: Bloomberg_

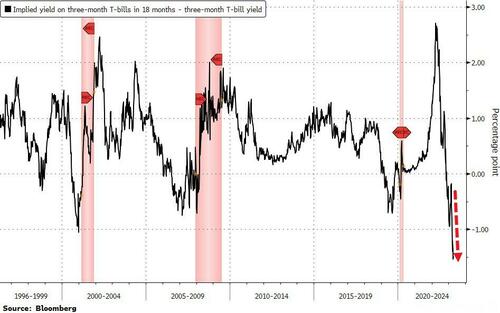

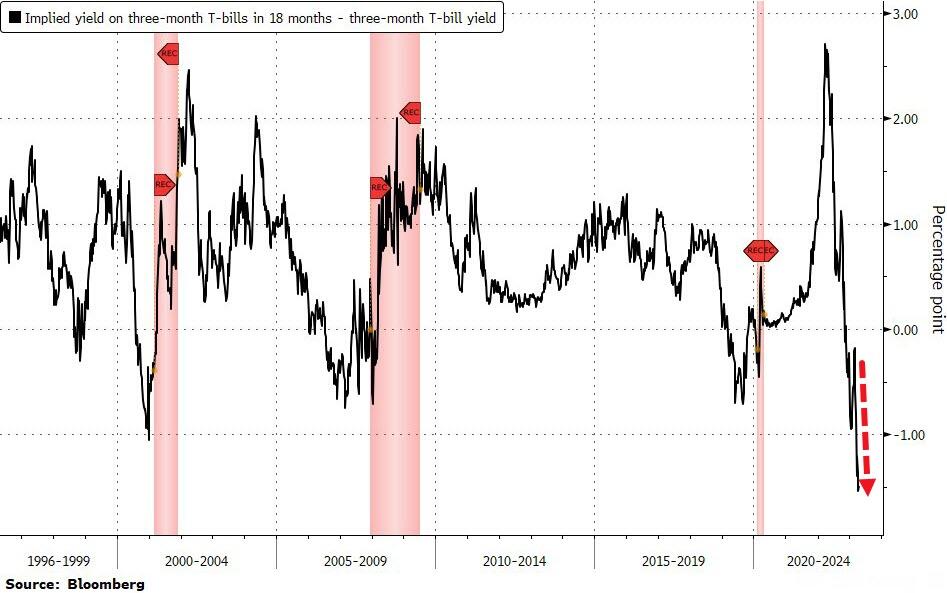

Fed Chair Powell's favorite yield-curve-based recession-signal (18m fwd 3m to spot 3m yield spread) hit its most inverted ever this week....

?itok=fwl17UkT (

?itok=fwl17UkT ( ?itok=fwl17UkT)

?itok=fwl17UkT)

_Source: Bloomberg_

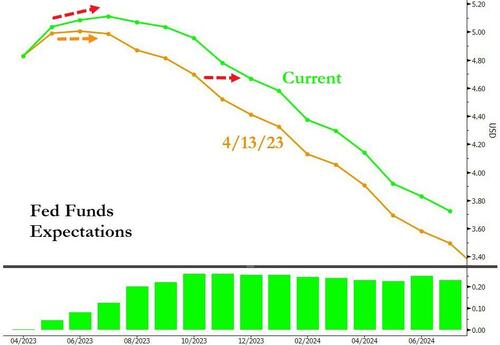

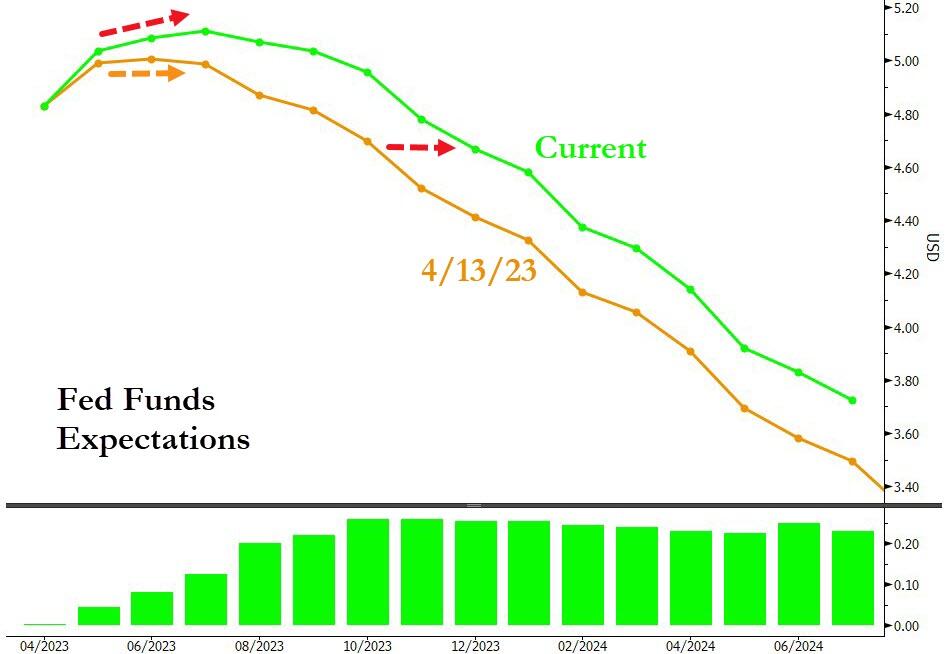

Rate-hike expectations continue to rise for next week (now 92% odds of a 25bps hike) but we also saw the entire STIRs curve shioft hawkishly (with June now at 25% odds of a 25bps hike) and the terminal rate back above 5.00%...

?itok=__DR2isH (

?itok=__DR2isH ( ?itok=__DR2isH)

?itok=__DR2isH)

_Source: Bloomberg_

The dollar saw its first weekly gain since…

https://www.zerohedge.com/markets/stocks-bonds-gold-crypto-slide-us-sovereign-risk-roars-record-high