The average salary in U.S. is $64k, so how much home could the average person afford utilizing a FHA loan with current rates at 6.66%, let’s take a look 👇

·3.5% down payment ($7,000 - $10,000)

·30-year FHA mortgage

·6.66% interest rate

·36%~ debt-to-income ratio

·FHA mortgage insurance premiums (MIPs)

With $64,000 annual salary, your estimated maximum mortgage payment would be around $1,400 - $1,600 per month.

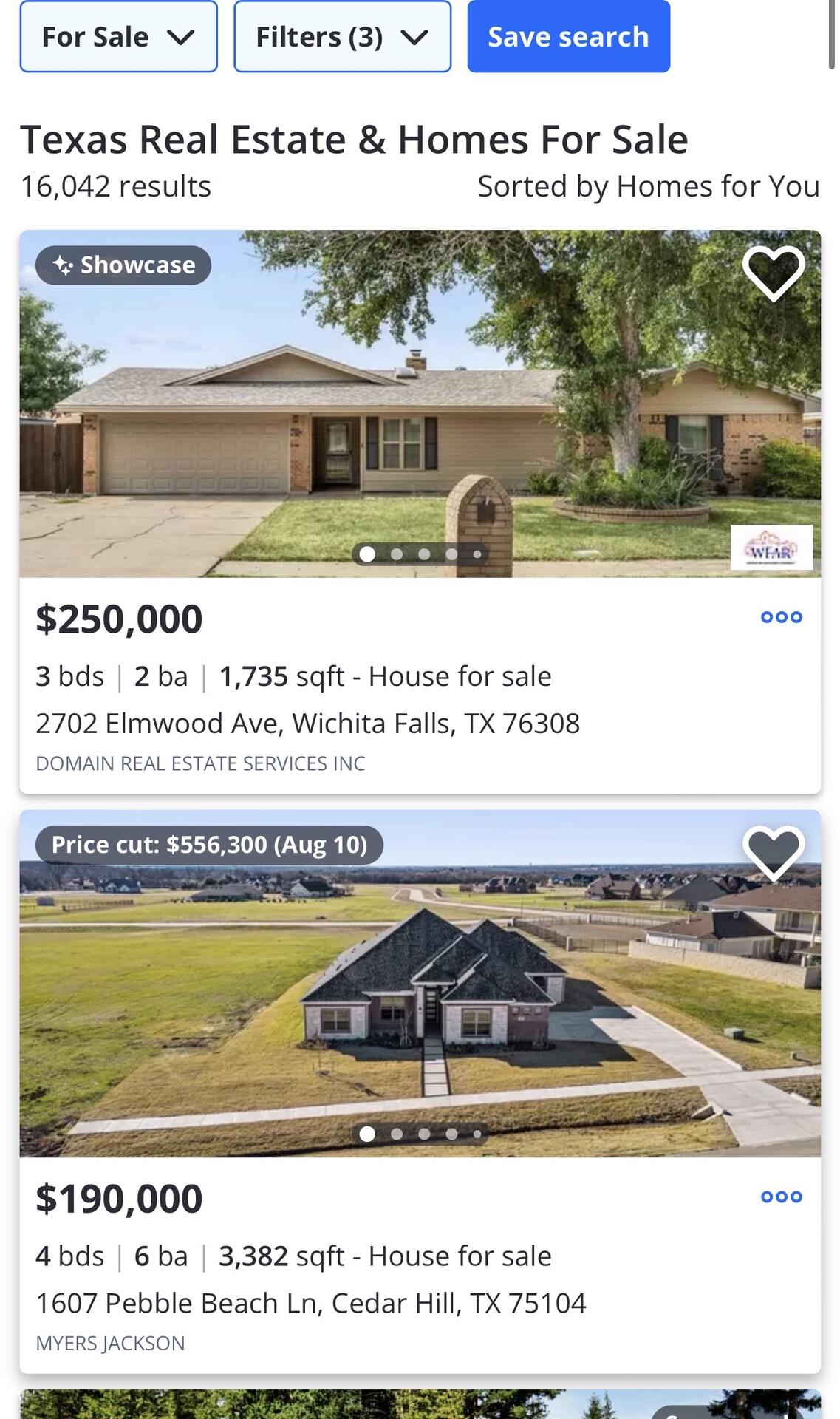

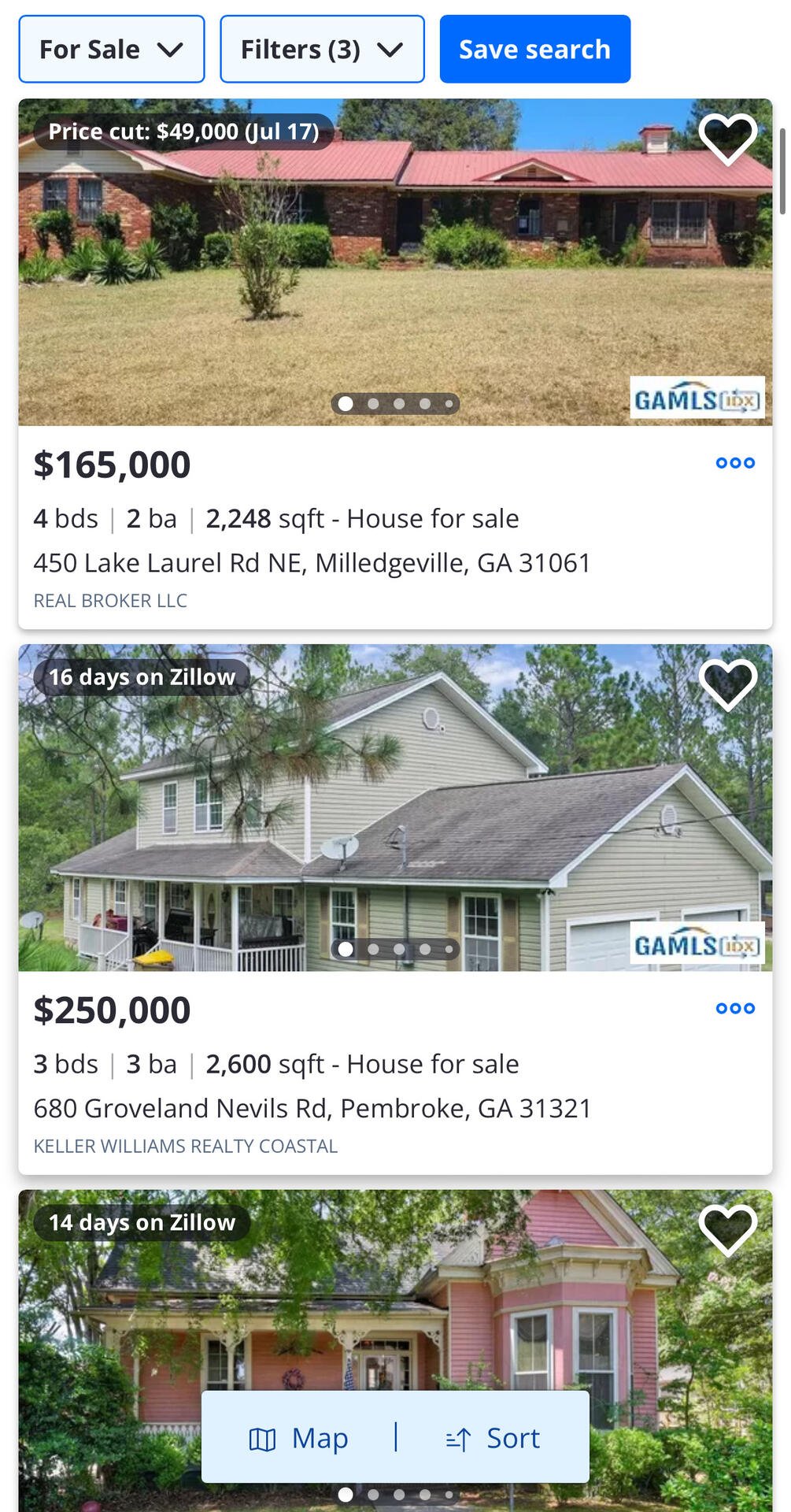

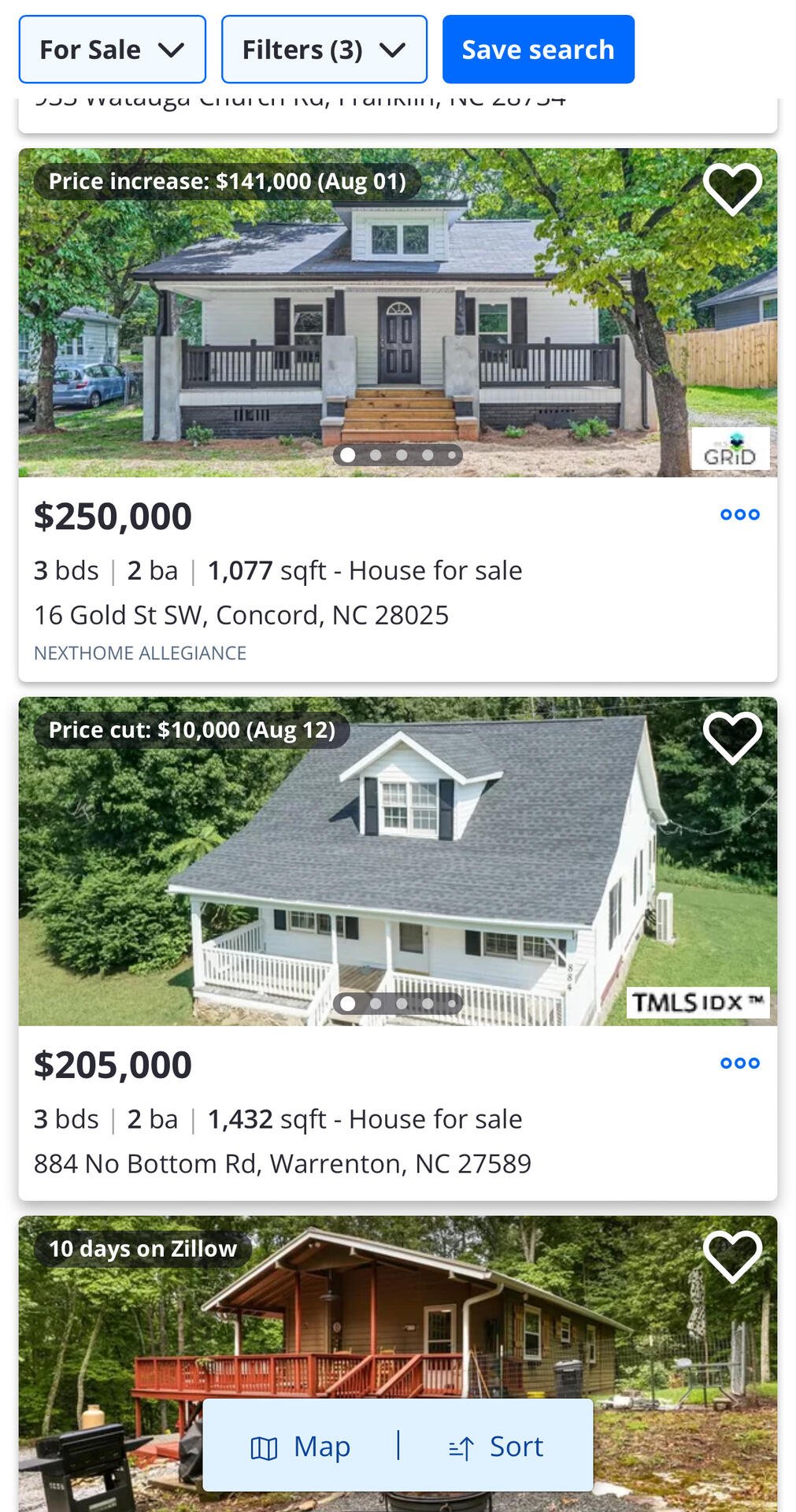

Using an FHA mortgage calculator, here are some possible scenarios:

1. $180,000 home: $1,144 monthly payment (assuming 3.5% down, 6.66% interest)

2. 200,000 home: $1,264 monthly payment (assuming 3.5% down, 6.66% interest)

3. $220,000 home: $1,384 monthly payment (assuming 3.5% down, 6.66% interest)

Keep in mind that higher interest rates reduce your purchasing power. FHA loans still offer competitive terms and lower down payment requirements. You can also look into potential down payment/closing cost assistance to offset some costs.

Remember to consider additional costs like property taxes, insurance, and maintenance when determining how much home you can afford. Consult with a lender (we have a few in WealthSquad ), financial advisor, or mortgage broker for personalized guidance.

You might not get the house you want, in the state you want, but there are options still out there. 🫡

#realestate #assets #nostr