For those who have been following my progress on this: I have finally switched my last few computers over to using https://thorium.rocks browser.

It’s not a no-Google browser, but it is a “less-Google” browser, with several privacy settings improved by default, security patches applied, and performance optimizations built in, including some for acceleration on Linux.

I suggest giving it a try if you live in Chromium land, and supporting the dev. It’s a very small contributor base, but updates come fast, so they’re working hard.

#browsers #it #internet #linux #chromium

Serious question: why this rather than Brave?

Agreed. It seems to do everything I'd want, has an uncluttered look and feel, and is a PWA.

Gradually, then suddenly, then gradually.

tldr: Don't be discouraged if a price spike after a #bitcoin #ETF approval is temporary.

We've all heard the "gradually and then suddenly" line. We all know where it's from, right? I'll admit, I didn't until I just looked it up. I knew it was from Hemingway, but I thought it was in answer to how he became famous. Wrong. It's from The Sun Also Rises (my second favorite Hemingway book, behind A Farewell to Arms).

“How did you go bankrupt?” Bill asked.

“Two ways,” Mike said. “Gradually and then suddenly.”

Quote info: https://quoteinvestigator.com/2018/08/06/bankrupt/

I'm not writing a book review here. Rather, I wanted to discuss the bitcoin ETF that all signs seem to point toward imminence. I feel it's imminent...you can't hold back the tide. Recent comments by Blackrock CEO Larry Fink here: https://cryptopotato.com/blackrock-ceo-larry-fink-shares-thoughts-on-a-bitcoin-btc-bull-run/ More specifically, I want to address the feeling that an ETF (or ETFs) approval will send things mooning. We all saw the euphoria over the false X-Tweet recently...the sudden spike and the sudden fall. The easy conclusion is, "When the ETF is really approved, we'll moon!"

I'd caution on that. If and when a bitcoin ETF (or more...giving the green light to more than one at the same time seems plausible to me), is approved, it would not surprise me to see an initial price spike. But, it would also not surprise me to see a quick pull back.

In my view, people who react to an ETF's approval are people who are already "in the game," aware of and knowledgeable of bitcoin. To me, this is largely not who an ETF targets. If you're reading this, you're on Stacker News and you know that owning shares of a bitcoin ETF is not the same as owning bitcoin. What an ETF does is it opens investment opportunities to those people with traditional investment avenues, who aren't interested in self-custody, and who simply wish to tell their broker to "get some bitcoin." In my view, there's a lot, a LOT of money that falls in that category. So, gradually, then suddenly when the ETF is approved, then gradually again.

tldr: Don't be discouraged if a price spike after an ETF approval is temporary.

The prosecution in the FTX trial did an interesting thing. They seemingly front-loaded their case with strategy 4 below.

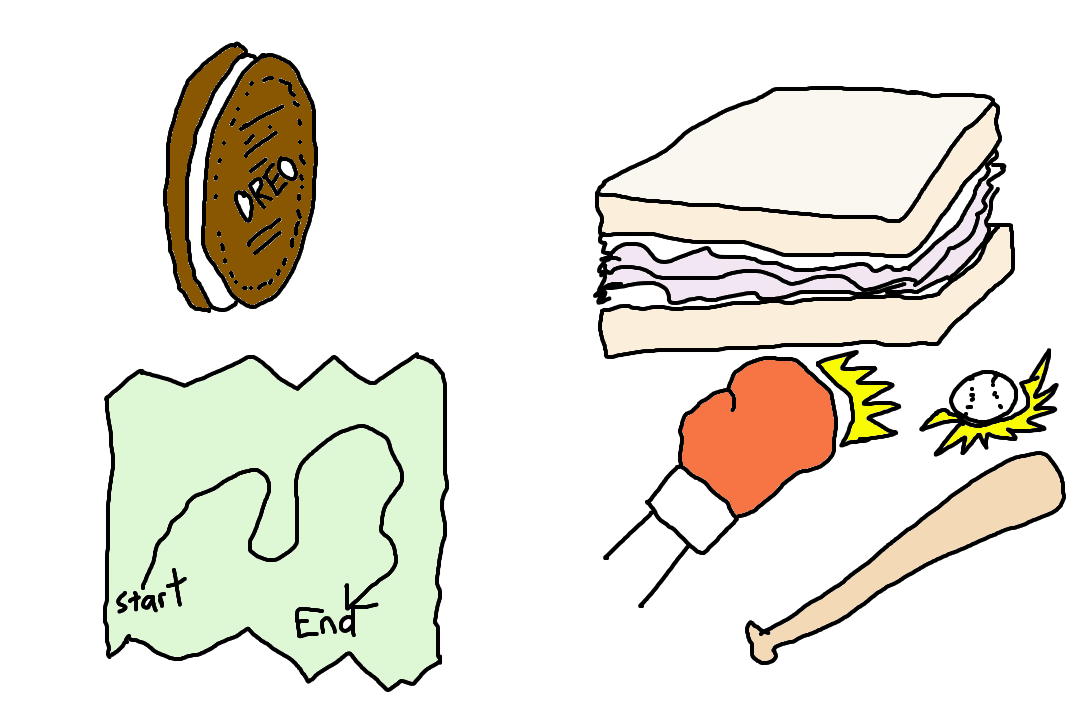

When presenting one's case (in anything, not just a court case), there are a few options:

1. OREO strategy - Start out crusty (a topic that's hard and bitter), then come with something sweet and soft, then come back crusty in the end. Essentially, bad news, good, then bad. (Note: this is the preferred strategy when you want to come hard and leave hard, but still show a little bit of "I care, I get it, I'm real" in the middle.)

2. Ham sandwich strategy - Start with some soft white bread, then stack in the meat, then cushion things in the end with some more Wonderbread. Opposite of #1, this is good news, bad, then good again. (Note: this is the preferred strategy for an effective complaint letter...butter them up, complain and offer a solution, butter them again.)

3. Roadmap strategy - Start strong and lay out the map of where you're going, then begin to piece in the details, and finally end with a roadmap revisit of where we've been. (Note: This is a variation of the Sandwich strategy and is likely the best, go-to strategy for trial lawyers trying to lay things out for a clueless jury.)

4. Mike Tyson / Big Sluggers strategy - Bring everything you've got first and go for a first round, first inning knock out. Tyson is credited with a version (see https://quoteinvestigator.com/2021/08/25/plans-hit/) of, "Everyone has a plan until they get punched in the mouth." Quote aside, if you go back and watch Tyson coming up as a kid in the heavyweight ranks, he brought EVERYTHING he had fast and furious, launching bomb-haymakers within seconds, and most opponents were down and out within a minute or two. Go back and watch https://www.youtube.com/watch?v=kknVfOJZ1w0. His plan was to eliminate the opponent's plan before his opponent even knew what happened. That's this strategy...bring the heavy stuff early. Being a baseball guy, I like this analogy of this strategy even better...a manager has three sluggers, three legit homerun hitters. So, he decides to place his three heavy hitters in the one-two-three spots in his nine person lineup. The thought: hit a homerun or two early and it'll be over at the start. (Just like Mike Tyson.)

However, despite the prosecution going with strategy 4 and putting their sluggers Ellison, Wang, and Singh up front, I think the most damning testimony did not come from one of the first three Mike Tyson haymaker swingers, or not from one of the first three home run sluggers in the lineup, it came from a nerd. It came from someone batting like 7th in the 9 person batting order.

Peter Easton is an academic, or is effectively an accountant, with Notre Dame. He's able to get dig into info and get geeky with data and graphs. I initially felt the most damning evidence would be that Sam Bankman-Fried took customer funds and used them over at struggling Alameda. This would mean he violated the user agreement...illegal, but not particularly dramatic. It is, essentially, moving one set of numbers into another column on the spreadsheet. And, frankly, that plan of using customer monies to buttress Alameda just might have worked had Alameda's investments panned out. Also, it could perhaps have been argued that using those funds wasn't an actual violation of the terms of service. (I've not read the terms, don't care to, and things like this can always be argued anyway. In the least, things can be muddled in semantics and interpretations.)

Back to Easton, he laid out what's nothing more than stealing. Bankman-Fried took customer money to buy stuff for himself. He bought:

- Orchid penthouse

- Gemini apartment

- Old Fort Bay apartment

- VAT, a gift to mommy and daddy whose names were placed on the deed

- curried favor with politicians (AKA, "political donations", AKA, "bribes")

- a $20 million gift to his brother's charity

Easton showed that mommy (a lawyer) suggested her son had better use an FTX employee's name (Singh) when sending money to her super PAC. One of the defense's likely strategies is to show that Bankman-Fried lacked criminal intent. He was good-hearted, well-intentioned, maybe a little disorganized and creating things on-the-go, but never consciously trying to do things illegal. Well, mommy knows otherwise and so did he. In a murder trial, the difference between first and second degree is that murder 1 has both malice and deliberation. Malice: intent to do harm, deliberation: you knew it was wrong and covered it up. The note from the mother and Bankman-Fried's compliance certainly suggests they both knew what they were doing was wrong and they were trying to cover it up. Regarding malice, I imagine the defense will try to sell the idea that, due to effective altruism, their was no ill intent. To me, knowingly stealing, buying expensive things for ones self, but justifying it with a vague idea of one day repaying with good just doesn't fly.

Easton showed that these stealings were apparently documented with on chain data, which to me, is about as strong as it gets. It's really simple, he invited people to deposit money, promised the money was safe, then took the money and used it for the things listed above. It's called stealing.

Read this for details: https://unchainedcrypto.com/trial-day-11-how-ftx-spent-9-billion-of-its-customers-money/

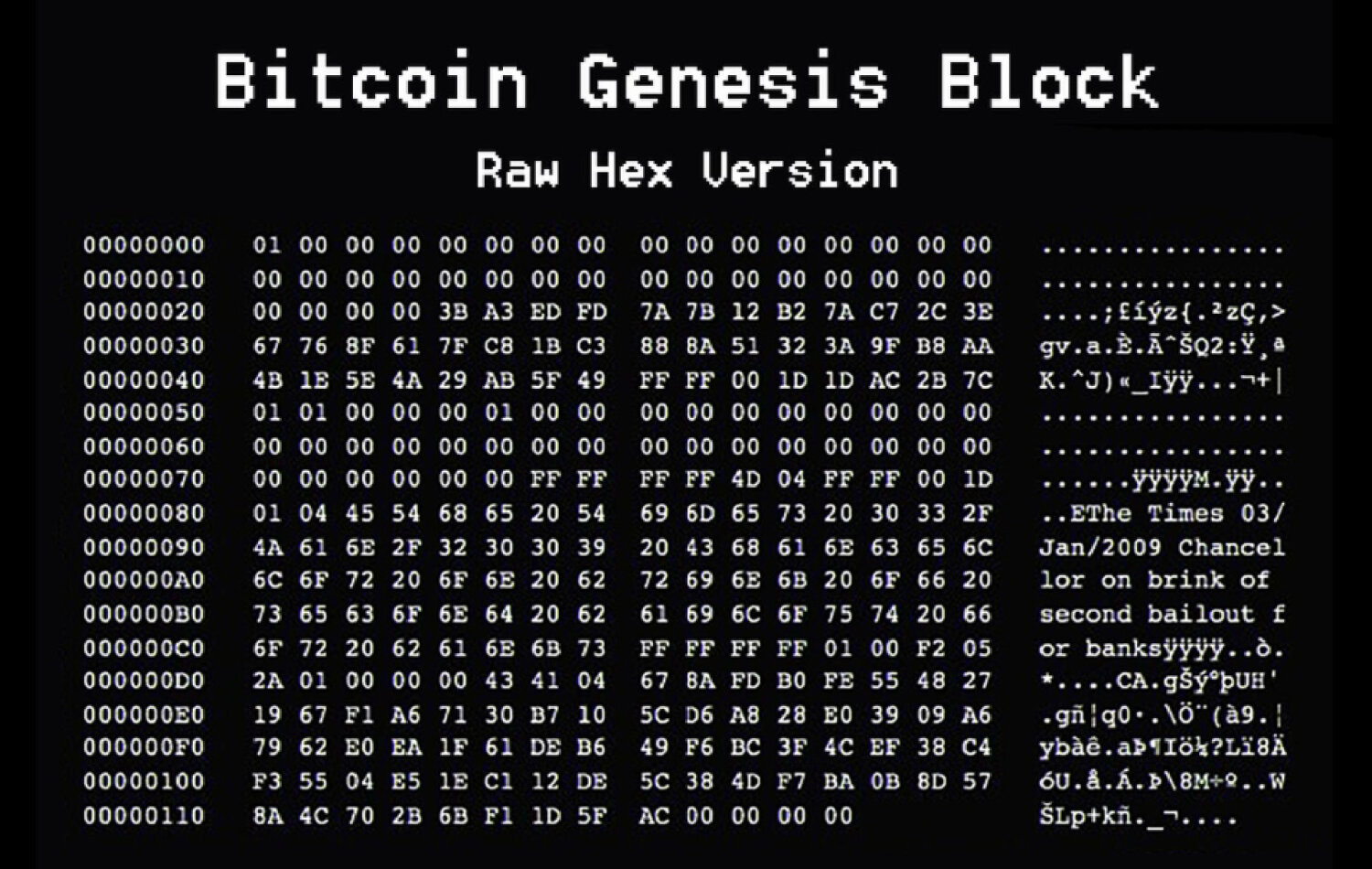

I made this gif last year...

Hard to believe Oct.31 will be 15 years for The whitepaper.

Source: https://peakd.com/cryptocurrency/@crrdlx/happy-bitcoin-day

Being still a #nostr newbie (I started in May, which is 6 months ago, am I still a newbie in nostr time?). As nostr is still new, things are pretty fluid and front ends are as well. I've jumped around front end to front ends. Started with Coracle (got me in, but dang clunky), then Iris (still use a bit), then Plebstr (liked it, but got rid of it for some reason), then Satellite (never seemed to work for me), then Snort (still use a bit), then Amethyst (current go-to on Android). Feel like I'm forgetting some.

Only a couple of days in, I will say I'm really liking #noStrudel at https://nostrudel.ninja

I don't need to be confused early in the morning like this.

A CNBC article headline got me confused as soon as I woke up. It was talking about hyperinflation and the struggles created. I get that. It talked about how people were getting #bitcoin any way they can to combat #inflation. I get that. It talked about how people were using Tether to combat inflation because one dollar was worth only 15 cents. Huh? And, how is a dollar-backed #stablecoin helping with that?

To be fair, the article was a little long and I didn't read it all. Still, with a headline like that, I kinda felt there wasn't a point to read it all.

Trying nostrudel

You can't hold back the tide. Free people demand free money and simply don't care what government alphabet agency bureaucrats have to say about it.

So, when Gensler succumbs to the fact that his anti-bitcoin world view is over, he decides to explain bitcoin ETFs as if no one knows what they are. He can't bring himself to say "ETF" or "exchange traded fund," but goes with "product" instead. That's okay, admission is the first step. #bitcoin

https://twitter.com/3TGMCrypto/status/1714707405391474927?t=ZD8fTbFDqyP11xrhKbG_yQ&s=19

Running shipyard

I'm trying out shipyard.pub right now.

So far, I'm liking the "focused writing" feature, which is this...no distractions.

Also, the "drafts" ability is terrific and the "schedule" posts time and date could be useful as well.

:)

I like how the hoop on the left is facing the wrong way. Great for dunking from the hillside! :)

I am not a fan of dollar nominated price predictions. I would rather suggest to learn the following:

1 SAT=0.00000001₿

10 SAT=0.0000001₿

100 SAT=0.000001₿

1000 SAT=0.00001₿

10000 SAT=0.0001₿

100000 SAT=0.001₿

1000000 SAT=0.01₿

10000000 SAT=0.1₿

100000000 SAT= 1₿

nostr:npub1ahxjq4v0zlvexf7cg8j9stumqp3nrtzqzzqxa7szpmcdgqrcumdq0h5ech 🧡

#plebchain

#zap

#bitcoin

#coffeechain

#zapathon

#nostr

#einundzwanzig 🧡

Kind of of why I made Satoshi Bitcoin Converter. It still shows dollar equivalent, but also shows BTC unit equivalents or decimals. https://sbc-v7.on.fleek.co/

I wrote this due to #bitcoin #recursive inscription #ordinals. Then a couple of days ago, #BitVM may have changed everything. ""Any computable function can be verified on Bitcoin." That's a very powerful sentence.

https://peakd.com/hive/@crrdlx/recursive-inscriptions-part-3-of-3-future-possibilities

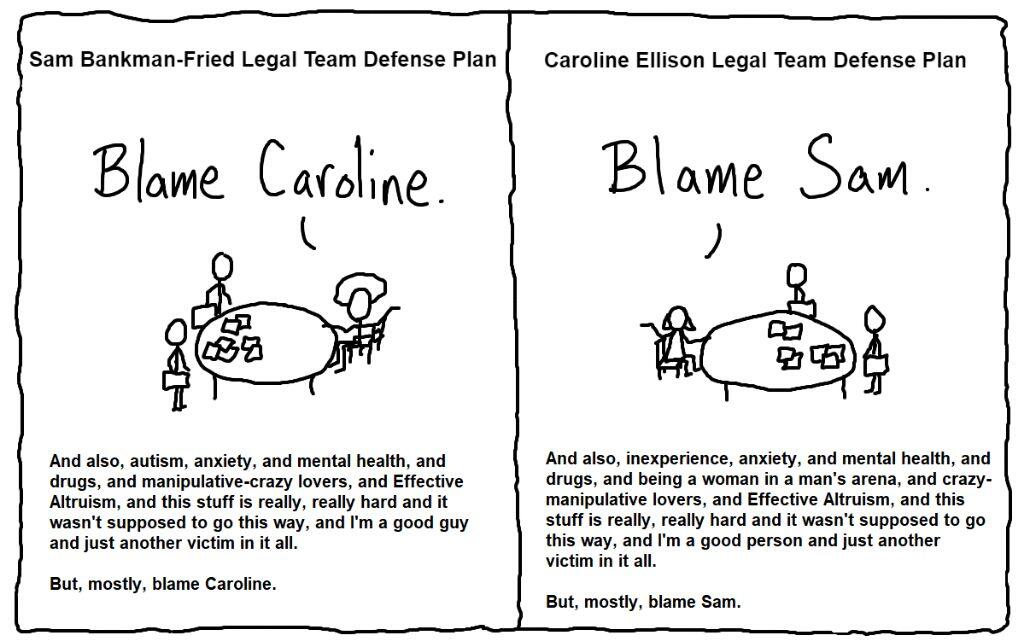

I put this out last month predicting how the #FTX #SBF trial will go. Incompetence, ignorance, and good intentions really isn't a defense ultimately. Figure it'll come down to the pic. #bitcoin

Bitkenstan ep47 - Start somewhere.

Bitkenstan is the webcomic that became the world’s first NFTcomic on #bitcoin, #cryptocurrency, #blockchain, and #life. View all episodes on the playlist at bitkenstan.com

$boost #zapathon

Bitkenstan ep46 - Forces.

Bitkenstan is the webcomic that became the world’s first NFTcomic on #bitcoin, #cryptocurrency, #blockchain, and #life. View all episodes on the playlist at bitkenstan.com

$boost