This is a great opportunity to help people understand.

Would be a good time for content creators to make some simple explainers.

Nostr is about to see an uptick in use I think.

We’ve reached the point where you must route around the system entirely.

That means censorship-resistant protocols like Nostr.

No gatekeepers. No begging. Just publish.

This is Sovereign Individual territory

Awesome episode, so good I listened twice! I would love to hear more of Yves, his concepts are thought provoking and ring of things I have also considered. Thank you for making this fantastic content 🙏🏻

https://fountain.fm/episode/hhBEMe5tMvkG6Vhs6FWa

nostr:nevent1qvzqqqpxquqzqszzre6cjva4775n0avsfm8mj5ngjs2yqfqhutfhj67zm0cy9h3lukktag

Crazy I can’t access that page in the UK

Thanks for the insight, really helpful, even if it’s a bit grim!

It’s disheartening to hear that Bitcoin is still so heavily stigmatised in Italy and that things might tighten even further by 2027 with ID requirements or outright bans on anon wallets. That direction feels less about “protecting users” and more like the classic overreach we’re seeing across the EU as CBDCs loom larger.

Also really interesting what you said about the regional divide, cash in the south, cards in the north. It says a lot about how fragmented Italy still is financially and culturally. I had hoped Bitcoin could bridge some of that, but it sounds like we’re still early.

Appreciate the honest overview. It’s making me rethink how and where to build something sovereign in Europe, or whether to double down on staying agile for the long game.

Thanks so much for the honest reply, really appreciate you taking the time.

It’s both helpful and a bit disheartening to hear. I was hoping Italy might be bold enough to embrace Bitcoin more openly. It feels like such an obvious path to rejuvenate the country, so much potential if only the mindset shifted. Sadly, it seems the fiat comfort zone still has a strong grip, reinforced by relentless MSM conditioning.

Your point about needing income from outside and avoiding setting up a business locally really hits home. That level of taxation and bureaucratic pressure would crush most sovereign-minded ventures before they begin. It’s frustrating, because the quality of life and cultural depth in Italy are incredible, but the system seems almost designed to push people away.

Feels like we’re all searching for our citadels these days. I keep hoping for pockets of sanity and courage across Europe, but the EU looms like a spectre over everything, pushing CBDCs, harmonising control, and suffocating local sovereignty. Still, we keep building, connecting, and staying orange-pilled.

Thanks again, friend. Hope to see you around Nostr, stay sovereign. 👊🏻

Ciao! May I ask what the general sentiment is towards Bitcoin in Italy these days?

My mum is Italian and is moving back to Liguria from the UK. I’d love to join her one day, circumstances permitting, and I’ve been considering Abruzzo as a possible destination.

I was curious about how Bitcoin adoption is progressing over there. Do you see many vendors accepting it yet? Are there certain regions or communities where it’s more common? And how are people generally reacting to it, more open-minded or still quite sceptical?

From what I’ve been following, the legal and regulatory signals from Italy seem a bit mixed. I’m also watching the EU’s CBDC agenda with concern, it feels like they’re pushing hard in that direction, which could complicate things for Bitcoiners.

The UK, sadly, is still way behind. Hardly any vendors accept Bitcoin, and most people are still stuck in a very fiat-centric mindset.

Sorry for the barrage of questions, just really interested in what it’s like on the ground from someone actually there!

I occasionally get paid in Bitcoin and usually need to spend it on bills soon after, so I’ve been looking for a simple, secure way to accept payments that’s easy to manage and simple enough to track for accounting. I tried out Bitkey today and here’s how it went:

Bitkey is a relatively new self-custody wallet from Block (Jack Dorsey’s team), launched in late 2023. It combines a mobile app with a compact hardware device and uses a 2 of 3 multisig security model.

Setup:

Honestly? Really smooth.

The app is clean and intuitive, and the device feels sturdy and well-designed. Setup took minutes, with no complex steps or confusing jargon. Perfect for newbies.

Not your typical wallet:

Bitkey doesn’t use a traditional 12 or 24 word seed phrase. Instead, it encrypts your mobile key and backs it up to your cloud (iCloud or Google Drive). Recovery works through a combination of your phone, the Bitkey device, and Bitkey’s support key. That means you still have fallback options if something goes wrong without needing to manage or write down a seed phrase.

There’s no built-in option to export a seed phrase through the app, though it is technically possible using more advanced methods. This is intentionally hidden for most users to keep things simple and reduce risk.

It also includes an emergency access feature that lets you assign a trusted contact who can help recover your bitcoin if something happens to you, using the inheritance option built into the system.

It works through a mix of your phone, the device, and their support key. That means you still have fallback options if something goes wrong.

Bitkey isn’t built for hardcore Bitcoin purists or users who want full manual control over privacy, such as coin control, Tor routing, or avoiding cloud backup.

So it’s not aimed at toxic maxis or privacy maximalists, but that is kind of the point.

Pros:

- Fast, beginner-friendly setup

- Secure enough for regular use

- Easy to track payments

- Built-in Inheritance feature with contact-based recovery

- No seed phrase stress

Considerations:

- You don’t hold all the keys yourself

- Depends on cloud backup and Bitkey support for recovery

- Not as battle-tested as some other wallets

- You’ll need an on/off-ramp to convert your bitcoin, which may introduce KYC, though peer-to-peer options like Hodl Hodl can help you avoid it.

- BitKey does not yet support Lightening so you can only send on-chain

Summary:

If you want a wallet for everyday use, whether receiving Bitcoin payments, making occasional transactions, or simply holding small balances with peace of mind, Bitkey is a great option. It’s user-friendly, secure, and designed for people who want a practical way to interact with Bitcoin without diving into technical complexity.

Just be aware of the trade-offs. It won’t suit everyone, but for many real-world use cases, it ticks a lot of boxes. I love it!

nostr:npub1sg6plzptd64u62a878hep2kev88swjh3tw00gjsfl8f237lmu63q0uf63m nostr:npub1tkey6tcfk0jf2ageje7xvqnnph4443h4pc4aqesuqjeywyke073qfmwral

nevent1qqspexjdpy90fnu6kn0wlcfp4e25quwd63m80hq9ydrs86w80k4ctzqppamhxue69uhkztnwdaejumr0dsw6e4kj

I’ve tried several cold storage options, and Bitkey stands out as the most beginner-friendly by far. It’s simple, intuitive, and still packed with practical functionality, exactly as you described. For anyone new to self-custody or looking to move funds off exchanges without diving into the deep end of seed phrase management, Bitkey is the wallet I always recommend.

Expecting newcomers to handle seed phrases, let alone stamp them on metal, can be overwhelming and intimidating. Bitkey solves that beautifully by removing that barrier, while still offering a secure and user-centric experience. It strikes the right balance between usability and security, perfect for easing people into the world of Bitcoin custody.

I’ve had a sense this was coming for some time. Public messaging still pushes the “everything is fine” narrative, but behind the scenes, governments are scrambling to manage the slow collapse of the fiat empire.

We’re entering the transition phase, and the US seems to be playing a strong “freedom-first” card, not out of altruism, but because first-mover advantage in a monetary reset is a massive lever.

That said, I don’t trust them, the state never gives up power willingly. They’ll likely use Tether to maintain dollar dominance, leveraging it as a de facto digital dollar with hard-asset optics. But I do believe Bitcoin’s core principles, decentralisation, scarcity, sovereignty, are strong enough to eventually pull the system back onto a more honest track.

I’m in the UK, and the situation here is so dysfunctional it’s hard to see where things are headed long term. Institutions are flailing, public trust is collapsing, and the system seems to be improvising just to hold itself together. Out of desperation to retain control, I suspect we’ll end up following the EU’s path, doubling down on surveillance, censorship, and monetary centralisation.

My dream is to build a small, self-sufficient smallholding in Italy, to step outside the madness and live with intention. But watching the direction of the EU gives me shivers. There’s a very real risk that the entire bloc slides deeper into the authoritarian model in the name of “stability.”

On the surface, sure, it’s orange man bad politics. But beneath that? This is a monetary arms race at the end of a fourth turning, a battle between centralised collapse and decentralised emergence. Between coercion and voluntary systems. Between fear and freedom.

As Orwell put it: “If there is hope, it lies with the proles.”

But the proles must first understand the root cause, only then can they begin to identify real solutions.

Nice to chat with you and get my thoughts out of my tangled brain. 👊🏻🤣

I’m going for a run, touch some grass and do a little fiat mining ⛏️

That’s peak fiat right there

Yes but couldn't it just be politics? Tether helps US treasuries and "orange man bad" kinda thinking

Absolutely, it is politics, but not in the superficial partisan sense. This is ideological geopolitics.

On the surface, the US appears to be planting a flag with Tether and Bitcoin, not just financially, but philosophically. Under Trump, there’s a pivot back to foundational societal pillars: individual liberty, national sovereignty, and hard money. Bitcoin becomes the monetary embodiment of freedom, and Tether acts as a tactical bridge, exporting dollar liquidity into digital rails.

Europe, on the other hand, is doubling down on control. MiCA isn’t regulatory housekeeping, it’s the scaffolding for a monetary panopticon. The ECB and EU technocrats, backed by deep state infrastructure, aren’t preparing for innovation, they’re preparing to retain control at all costs during monetary transition.

These aren’t compatible visions. One is open-source, decentralised, and voluntary. The other is walled-garden, surveilled, and programmable.

Eventually, these worldviews will clash, not just at the diplomatic level, but socially. If Europe continues toward programmable authoritarianism while a more appealing parallel system emerges abroad, the fracture won’t just be transatlantic, it’ll be internal. People will opt out. Some literally, some digitally. And at some point, that becomes revolution, not reform.

This is just my opinion, formed through ongoing observation of monetary, geopolitical, and technological shifts. I don’t claim certainty, only a pattern that seems to be revealing itself with increasing clarity.

This may be the opening skirmish in a global monetary war, fought not with tanks, but with code, ideology, and issuance rights.

Tether’s rejection of MiCA isn’t just about regulatory red tape, it’s a rejection of the central banking worldview: that money must be surveilled, intermediated, and controllable. MiCA is the ECB’s attempt to corral all digital value flows into a walled garden, one step closer to programmable CBDCs and monetary authoritarianism.

From an Austrian economics lens, this is textbook:

Fiat regimes always trend toward greater control as their paper systems unravel.

As confidence in centrally planned currencies erodes, the system doubles down, censoring alternatives, expanding surveillance, and criminalising self-custody.

Tether is playing defence.

Bitcoin is the counterattack.

Bitcoin doesn’t need a licence.

It doesn’t ask permission.

It’s not a stablecoin propped up by fractional reserves. it’s the final settlement layer, born of the hardest monetary principles ever encoded.

This isn’t just about MiCA.

It’s about a collapsing fiat order desperately trying to extend control, and the rise of a parallel system built on voluntary rules, fixed supply, and individual sovereignty.

This really resonates. I’ve worked my way up through the ranks more than once, reaching the top each time, only to shift paths and start again.

One thing I’ve learned along the way is that sometimes the pinnacle isn’t the point.

It’s what you learn getting there, the growth, the grit, the perspective, that becomes the real reward.

Thanks for voicing this truth.

That’s a cool photo… and yes Nostr would be the perfect tribe

Lazy Saturday afternoon. Just settling down on the sofa with a coffee to listen to Robert Breedlove and Richard Werner https://youtu.be/o9nSmSvV0K4 🧡✨

Fascinating conversation 🧡

Am I too bullish to think it’s too cheap below 1 million… asking for a friend

This isn’t science—it’s fiat-fuelled madness. And now we’re all lab rats in their panic experiment.

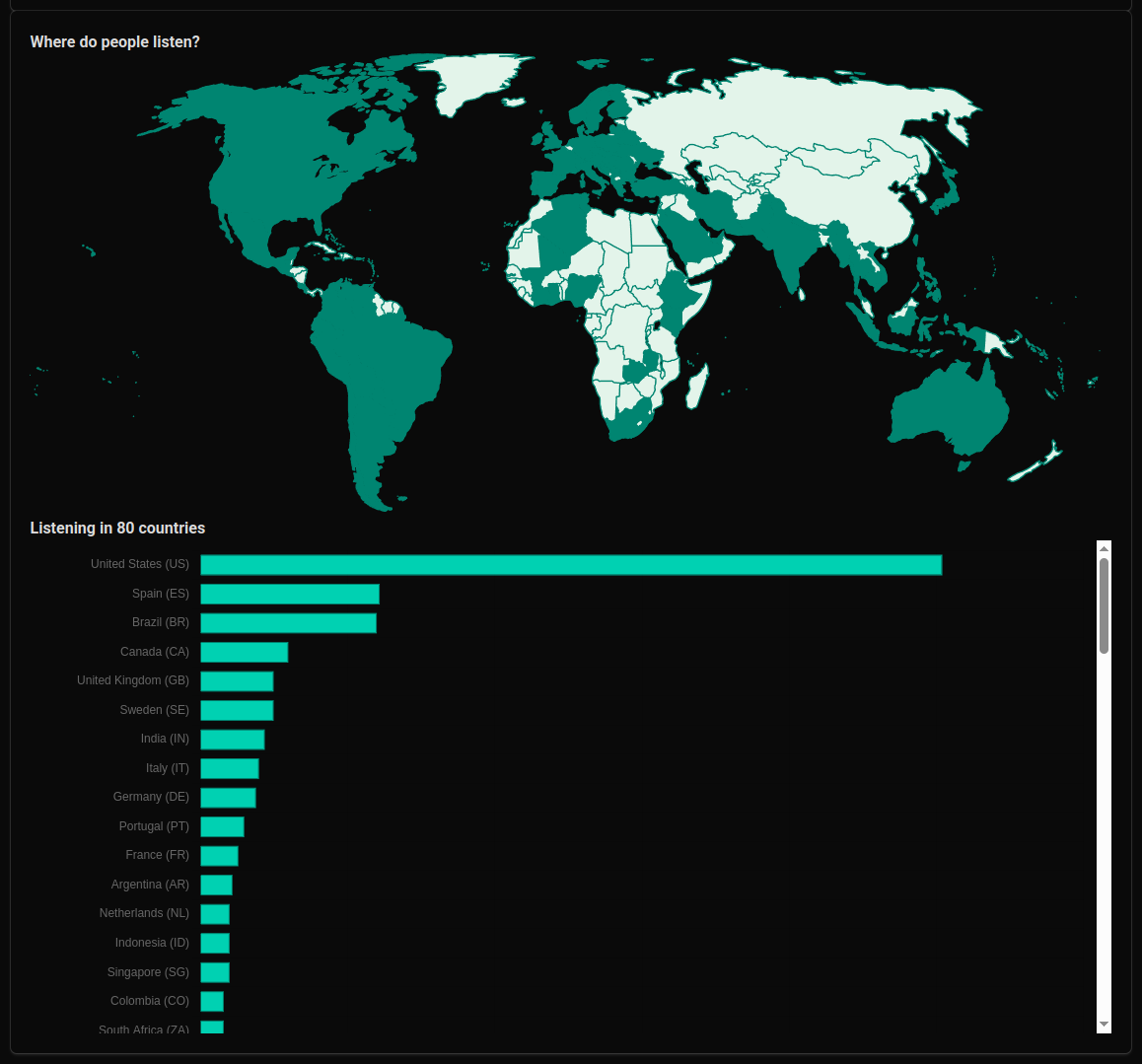

Listening from airstrip one, good show, thank you for your service