Yep.

Banks are effectively private credit systems with two huge advantages - they are using a nationally-mandated unit of account (e.g., dollar) and are guaranteed a 1:1 exchange rate with public money, no matter how crappy their balance sheet is.

With Bitcoin, the unit of account is sats (no need for a nationally-mandated unit of account), and ‘cash’ or credit (ecash) has no choice but to trade at par because of the almost perfect liquidity.

In this new system, anyone can be a ‘bank’.

Yeah, I agree.

Bitcoin is freedom of payments

Lightning is velocity of payments

Ecash is privacy of payments.

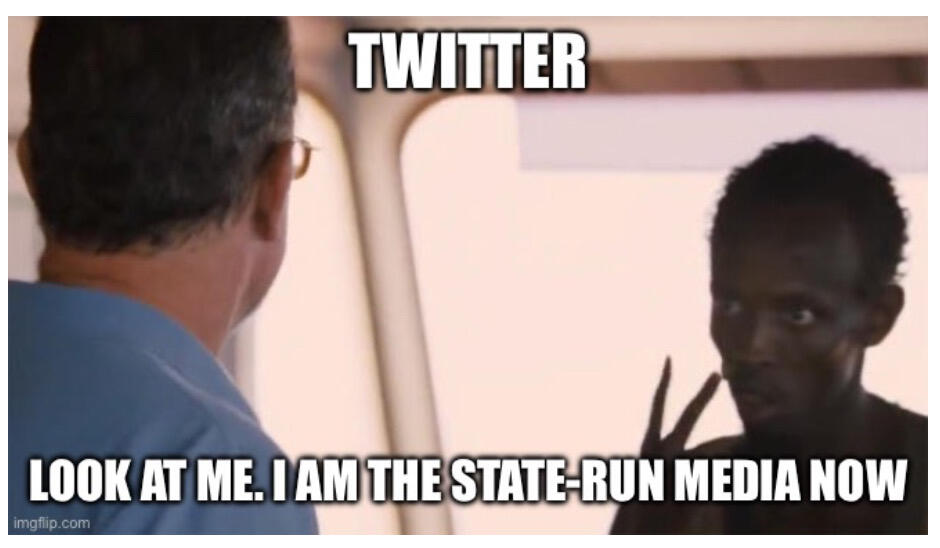

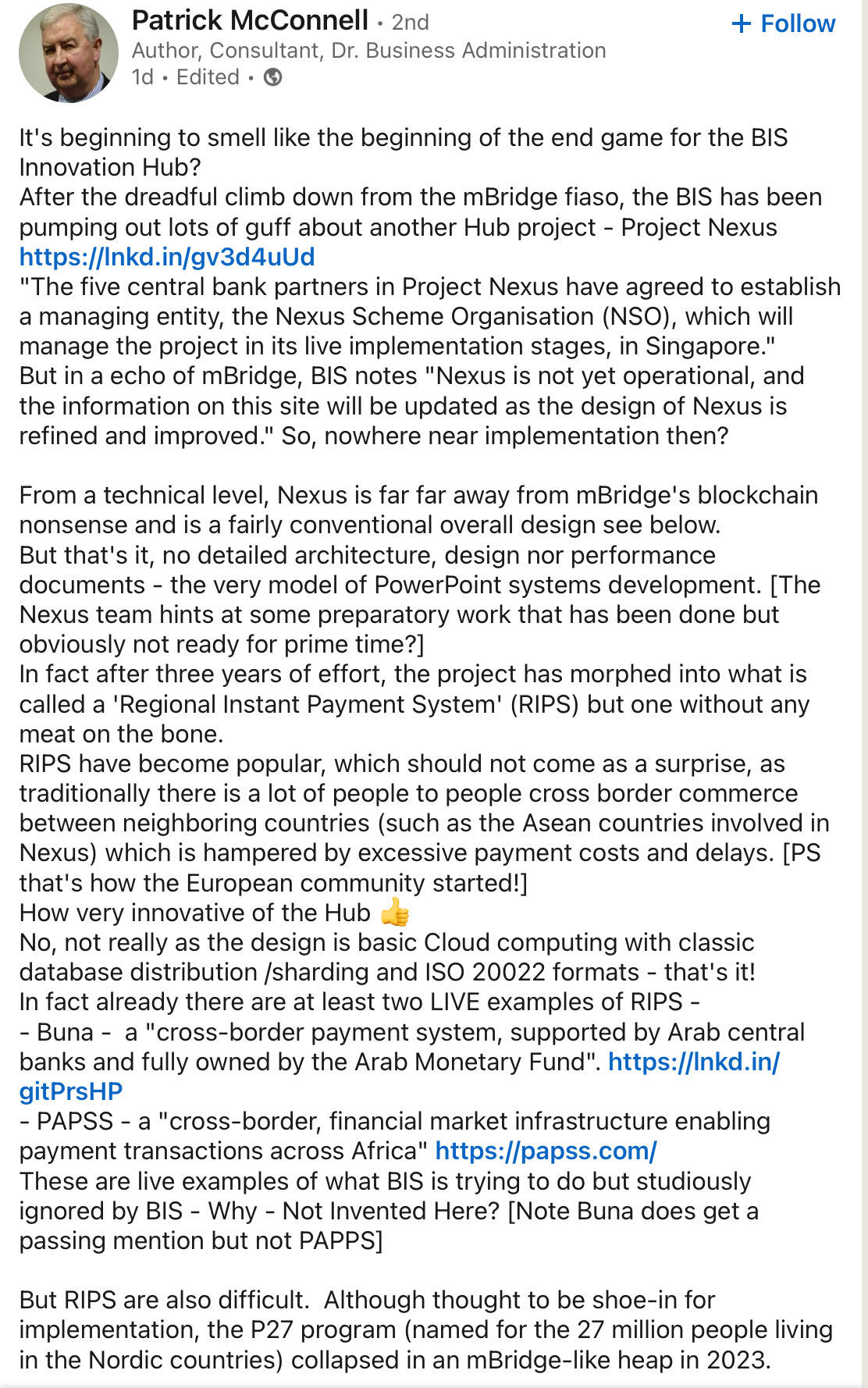

Pundits are starting to smell blood in the water regarding those central bank #CBDC blockchain projects.

Your work reminds me of one of our most celebrated landscape artists, Tom Thomson

Money is whatever you accept on the other side of any trade. Marshall McLuhan speculated it came from our ape instinct of ‘grasp and let go’ of swinging through the trees. That instinct was adapted for trading objects. Grasp first, let go second. So, money isn’t a hallucination- it comes into existence exactly at the moment of transaction, just like a price which is exactly what someone is willing to part with at a moment in time (may not be particularly well-informed at the time).

Cool. I will watch this. Thanks!

Private Power Protocol

————————————

1. Power to Pay Privately

2. Power to Publish Privately

3. Power to Prove Privately

4. Power to Permit Privately

This is #nostr

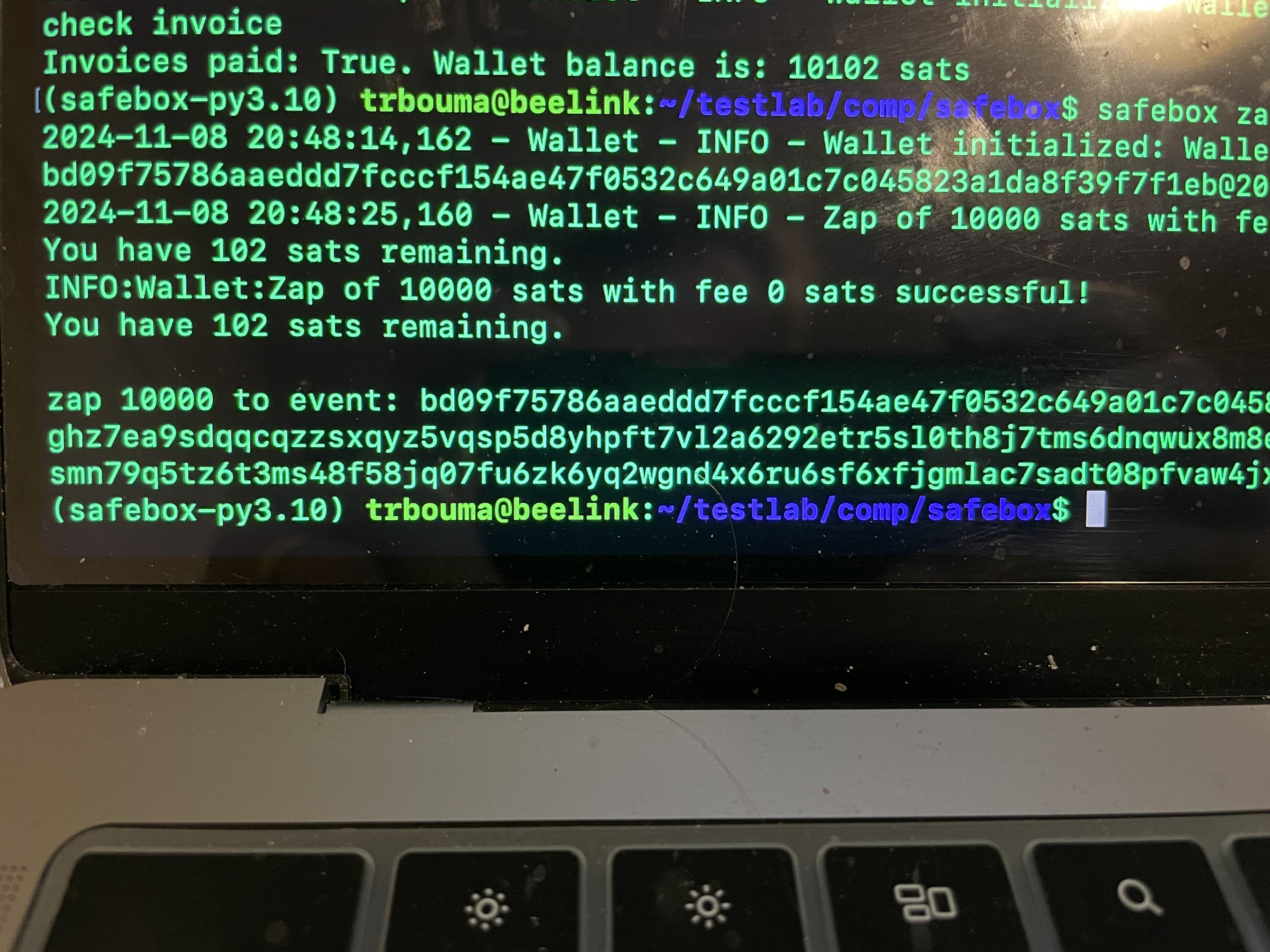

This is me doing superzaps

?cid=6c09b9525zvkjrjnfimclzfy3apu3e40yjtzynmfk8p2u5dl&ep=v1_internal_gif_by_id&rid=giphy.gif&ct=g

?cid=6c09b9525zvkjrjnfimclzfy3apu3e40yjtzynmfk8p2u5dl&ep=v1_internal_gif_by_id&rid=giphy.gif&ct=g

On #nostr, we're just a bunch of villagers on a lost island

?cid=6c09b952nmpvg55t3cl14tola35f1qn0t46upu990gp2t291&ep=v1_internal_gif_by_id&rid=giphy.gif&ct=g

?cid=6c09b952nmpvg55t3cl14tola35f1qn0t46upu990gp2t291&ep=v1_internal_gif_by_id&rid=giphy.gif&ct=g

So very cool.

I see a renaissance for these kind of things as people get tired of all things electric.

I’m on the hunt for a Christmas snow globe… nostr:note1aa3ann98u0m8k57yy3argd8gr725jrc69hnwla3gr8qxprzgfy0qt3c23p

Another zap test. Pls ignore.

I’m a big fan of nostr:npub1tjkc9jycaenqzdc3j3wkslmaj4ylv3dqzxzx0khz7h38f3vc6mls4ys9w3 ‘s work.

My inspiration for building a payment system where I can say ‘just use this’ on your hand-me-down phone.

Still a few years out, but I see the orange! nostr:note19h56kgz3ug2w9wfmavhtn3wqy5yllraqzcf2xq7048v346eav4ssq9lkqz

Yup. Hard agree.

When you see your note go viral ...

#Nostr #grownostr https://video.nostr.build/458230a3d07a81b8efa9815097c1724b5a34538b7dc737b3731a66f77fdde802.mp4

That’s me watching micropayments go through.

Winter is coming.

Automatic snow chains deployment systems like the Onspot mechanism, allow vehicles to increase their traction on snow and ice with a relatively immediate activation triggered from the cab. https://video.nostr.build/eb24d4fae76de06db3b13acc8eb7abf04c9633a9a3b38292650a8e06b3ccbc27.mp4

Wild. I see that being deployed on current pickup truck models to scare the crap out of pedestrians and cyclists.

Yeah, I totally agree. It will take awhile, but we need to move away from that system. Dealing with IETF/ICANN/IANA feels like dealing with the Curia in the 1500s.

FWIW, fractional reserve went out the window in the early days of the pandemic (March 2020). Most banks now have a zero reserve requirement. Their only concern now is overnight loans for liquidity, when they need to clear with other banks, and the central bank steps in once in a while to back the loan if they don’t have liquidity.

Hear me out.

Credit is not a bad thing. It enables the monetary system to expand and contract when necessary. This was the case in Canada where the private banking system could issue notes that were redeemed at par at the competing banks. This was especially important during harvest season (August-September) when an increase in currency was required to facilitate transactions of buying/selling grain.

If any of you have read George Selgin’s or Larry White’s work on private banking you realize how effective it was. In the US, it was a disaster because private banking was over-regulated to begin with, forcing state banks to bank only within their state, while in Canada, branch banking was allowed across the country. So if you were a grain farmer in Regina and someone paid you in Bank of Montreal dollars, you could deposit the full amount into your Bank of Nova Scotia dollar account at your local branch.

Not to say the system was perfect, but it was pretty damn good, until someone got the bright idea that we needed a central bank like the US, most likely to help the government borrow and fund large projects (wars).

How does this relate to below? We can return to the banking yesterdays of yore, but instead of paper credit notes (cash) we can use electronic credit notes (ecash). By virtue of their instant redeemability it keeps everyone honest and a system that keeps its equilibrium. If you want the theory, read Larry White’s book on private banking, which I did, and then applied the theory to what I am currently building, #nostr #safebox. nostr:note1z0lphpeqlkk0uwmmlyrpu35z6urj70xcvs3q2v0hmzme03ru85hsltvuxa

I will read this for a good laugh. The IMF is really doubling down on CBDCs, despite the fact nobody actually really wants them. That proved to be the case in my country where a public consultation revealed that over 80% of the respondents were opposed. Despite the evidence to the contrary of any benefits (except bureaucracratic self-interest) the beat goes on…

https://www.imf.org/en/Topics/fintech/central-bank-digital-currency/virtual-handbook

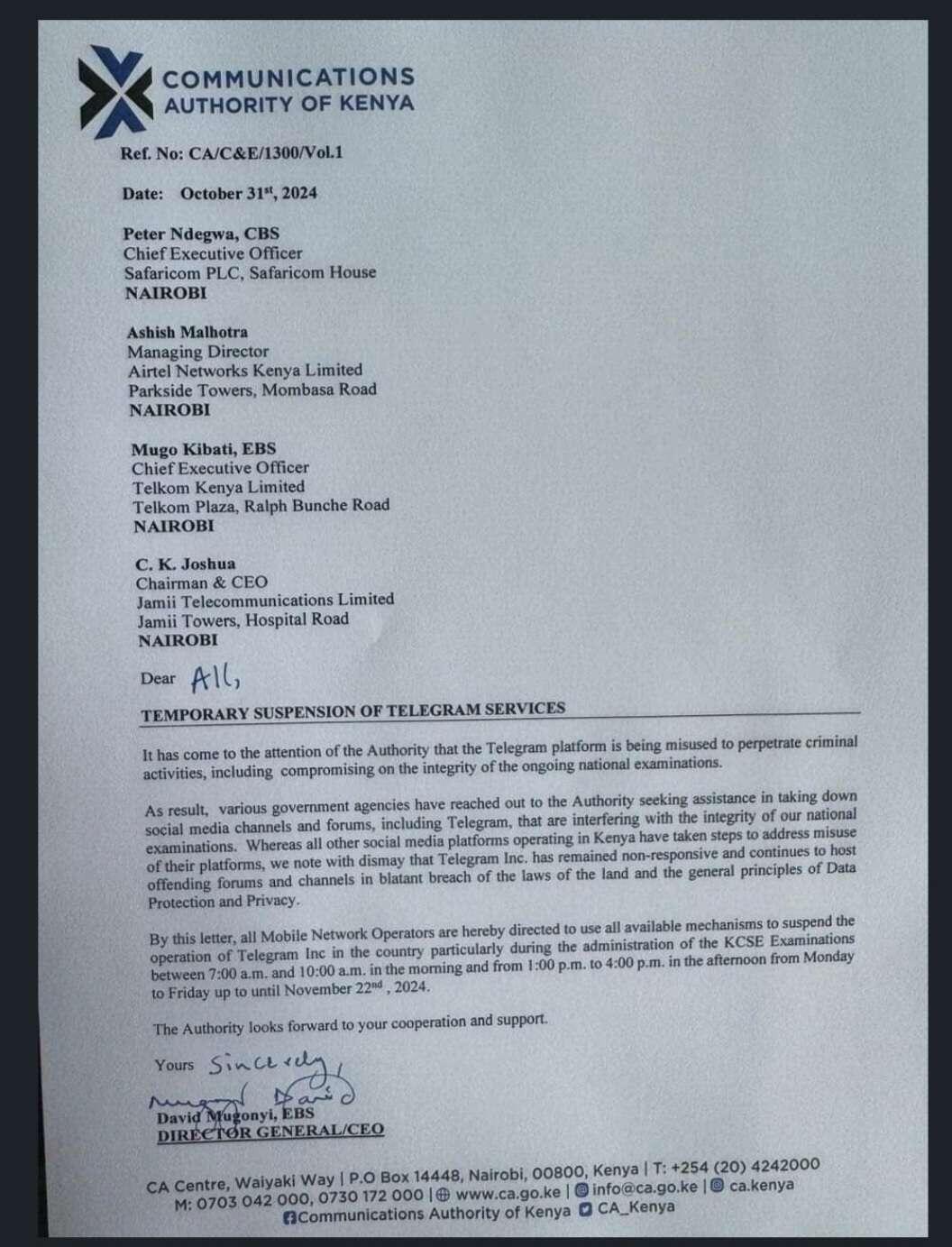

Kenya orders shutdown of Telegram.

Not gonna happen with #nostr

Testing zaps of amounts approaching $250 USD to demonstrate that #nostr can become a serious payments system.

I'm testing with #nostr #safebox that stores the funds in relays in the form of Chaumian ecash proofs. It is working like a charm.

I believe that this can become a global unstoppable payments layer that can handle not only micropayments but regular and large scale payments as well.

This is a superzap test, please stand by

?cid=ecf05e47sh77pg5tjjx90pe0omdykiksih1qckil9l04h08t&ep=v1_gifs_search&rid=giphy.gif&ct=g

?cid=ecf05e47sh77pg5tjjx90pe0omdykiksih1qckil9l04h08t&ep=v1_gifs_search&rid=giphy.gif&ct=g

A pic from our hike today.

Bitcoin+Nostr is the Global Village Layer. Once I have someone’s npub, I can interact like we are in the same village: I can directly pass a note or coin without anyone getting in between.

Governments don’t create, people do.

I honestly believe zaps can become a serious payment system. I am stress testing 10k sat zaps, did a 100k zap - all with no problem. My goal is to do a 1M sat zap in the coming days. The cool thing is that the funds and balances are all managed behind the scenes as ecash proofs stored across relays.

Right now testing using a cli, but the component being built is being designed to bolt into the back end of anyone who needs a micro payment system.

This is #nostr safebox

Achievement unlocked!

Successfully tested a 10k zap with #nostr #safebox. Went through with no problem. Next up is a 100k zap.