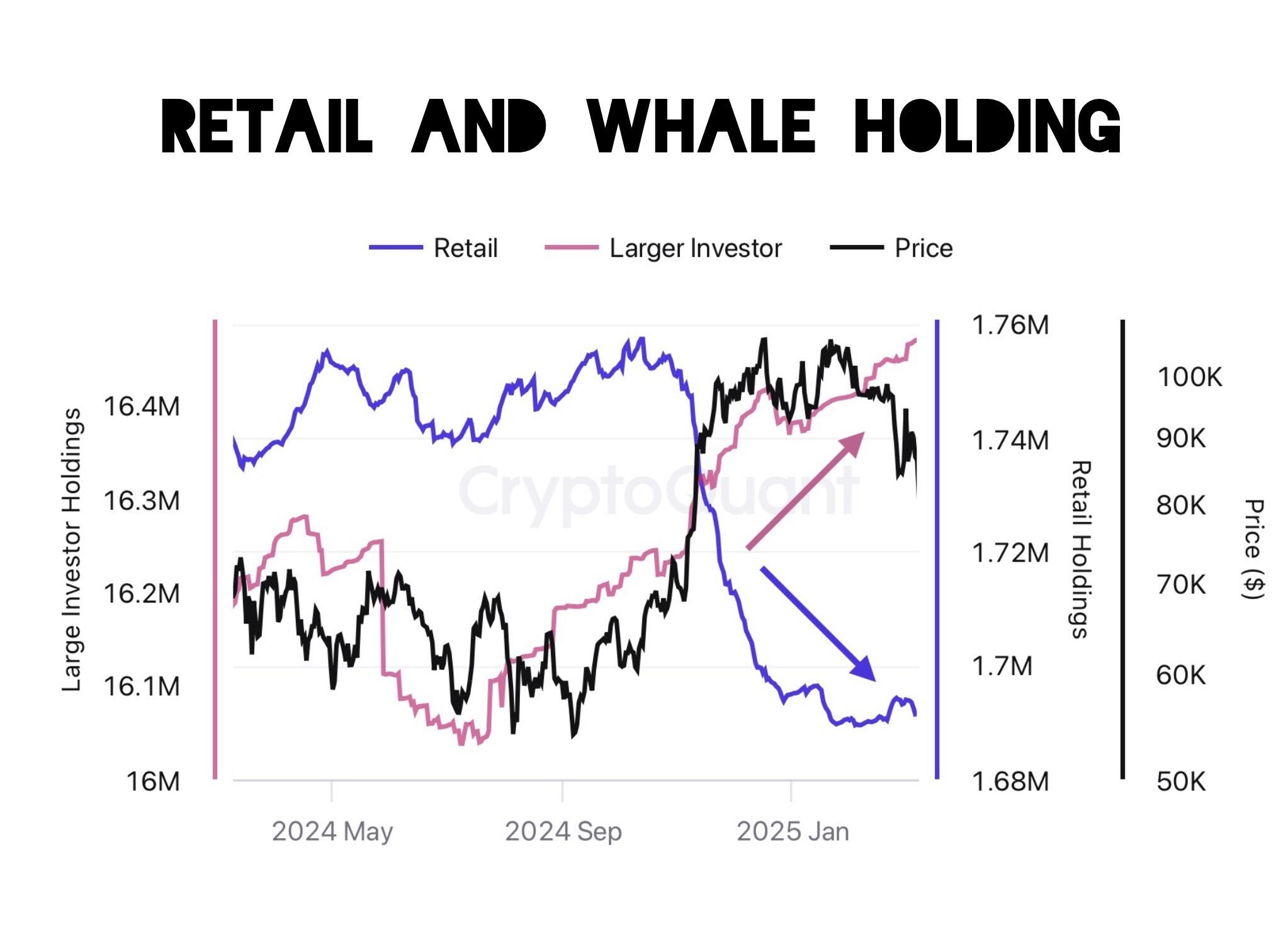

And btc hodl ers, are not steering the boat here - wall street is. Fast track aint gonna happen. There was an article on this in a bitcoin magazine today, i have been saying it for some time.

I think that number is too high, after checking with other sources, it was a quick lookup on ai, so it is suspect.

I dont know what he means by margin called. I think of broker calls on margin on shorted stocks, not on bitcoin owned. If he is referring to loans secured by bitcoin, that is a moot point, since he will have to sell his bitcoin to pay off any loans due, secured or not, or incur more debt, or issue more equity, all which dilute the value of his stock. Currently there is 9 % short interest in the stock, and that data is old. Much higher today I am sure.

He ran minus 1.06 billion dollars in levered free cash flow last 12 months, so his only hope is a fast ramp up in btc, or else he is in deep crap. This is a ponzy scheme, no doubt, built on future sales of appreciating btc. No real cash flow .

He may understand bitcoin, but he definitely doesnt know how to run a business. For all we know, he is the big seller causing the decline in btc. Wouldnt surprise me. Again, he is draining cash in an equity that produces no income. Agree straight btc the way to go.

If the world is on fire, why wouldnt you flee to btc. So instead, you sell?

The debt-to-equity (D/E) ratio for MicroStrategy (MSTR) can be calculated using the formula:

Debt-to-Equity Ratio

=

Total Debt

Total Stockholders’ Equity

Debt-to-Equity Ratio=

Total Stockholders’ Equity

Total Debt

From the data for 2024:

Total Debt: $18.226 billion

Total Stockholders' Equity: $9.784 billion

D/E Ratio

=

18.226

9.784

≈

1.86

D/E Ratio=

9.784

18.226

≈1.86

This indicates that MicroStrategy's debt is approximately 1.86 times its equity as of the end of 2024

That is high. Very high.

Really. You think a good thing?

Agree. But here is what I was referring to: "Overleveraged companies often face bankruptcy as a last resort to restructure or discharge their debts. This process can result in loss of control over operations and liquidation of assets." Having said that, I haven't looked at #mstr balancesheet, just offering that as a possibilty.

Deflation is the mantra.

Pitfalls of tech.

White House AI & Crypto Czar David Sacks said they aren’t even sure if the U.S. government actually has the 200,000 Bitcoin until they conduct a full audit. https://m.primal.net/PbIe.mp4

Bwwwaaah. Bankman-Fried strikes again!

Starmer calls for ‘positive’ US-Ukraine talks in call with Trump

https://www.ft.com/content/f593b86a-7354-4d1f-baec-447cd0af85b4

The guy is full of shit

#BTC 73.8k a good swing pivot area to pick up some.

I gotta bunch myself.

#GOLD on the weekly showing a nice tight bull flag. Going breakout soon.