Have you read Bryan Caplan's work on this topic?

I think you're right to call out "modern" feminism. Many people assume feminism is just about equality of the sexes (I'm a feminist by that definition - and you are too per your last sentence), but in reality it's actually:

"feminism: the view that society generally treats men more fairly than women"

Personally, I agree that women should have a right to an abortion (within clear limits), but it's just such a sad and terrible thing to have to do in any circumstance.

So I find it strange to have a celebration for putting it in your constitution (it was already legal in France).

One of the arguments I hear most from my friends when I tell them to get some Bitcoin and self-custody: Yeah but the money will be gone forever if I lose it or it gets stolen.

They think bank accounts protect them.

Have a look at this Revolut situation where a customer had £165K stolen from his account, and Revolut won't pay him back. HSBC accounts involved too, of course.

Keep it simple. Stack sats, keys offline. Don't trust, verify.

Just discovered a small star magnolia in my garden 🎉 Not in the best shape, but has potential. Excited to start gardening again this spring 🌷

Shit, apparently my watch (Casio F-91w) is used by terrorists! First Bitcoin, now this ... the state's got people who want to save money properly cornered 😂

Realizing that you were wrong about something is the most powerful lesson.

Bitcoin bull markets are very important for decentralisation - so no need to virtue signal that you don't care about price or purchasing power:

- More distribution of ownership as OGs sell

- More incentive for new miner manufacturers

- More incentives for mining operations in areas and jurisdictions with more expensive energy

- More Bitcoin businesses and products, some of which are good and will survive

- Wealthier Bitcoiners who can support efforts to lobby & sue governments to create friendlier regulations

- Casual holders scared about how much wealth they now have getting their shit together and storing their sats properly

- More people being forced to engage with debates related to Bitcoin, and a % of those understanding and not being able to unsee the truth about money

- More money donated to developers, and previous donated sats being worth more - should mean more developers

- New constituencies with incentives to support friendlier attitudes to Bitcoin

- Random businesses accepting Bitcoin as a marketing stunt, but continuing support and helping improve merchant products

Loads more obviously. Yes I love Bitcoin and Bitcoiners even in a bear market and when prices are flat. But bull markets, while bringing a lot of clownery, move our cause massively forward. I think that's why I check the exchange rate so often: because it's a barometer of our progress.

I love it when a single article does such a great job of exemplifying so many facets of bad journalism:

https://www.theatlantic.com/ideas/archive/2024/03/crypto-bitcoin-market-strength/677643/

Some gem quotes:

"The fact that no one can agree on what crypto is even for hasn’t kept the market capitalization of all cryptocurrencies from surpassing $2.5 trillion. Indeed, its utter pointlessness may have even helped. The lack of consensus about crypto’s purpose might be the very reason it never dies." (I'm reading this as Bitcoin - clearly zero research has been done given how many people use it as a store of value, and to protect their wealth from criminals and tyrants)

"bitcoin is approaching one of its periodic “halvings”—moments, programmed into its source code, when the rate of new bitcoin production gets cut by 50 percent, which reliably causes demand to jump" (How do you nearly perfectly describe a halving and then fumble the ball and describe it as a demand and not a supply effect?)

"No central bank was needed to verify who owned how much bitcoin. Thanks to cryptography and some clever game theory, the network itself could keep track of that. Technologically, it has no single point of failure: Every computer in the network maintains a complete record of every transaction, which means no single entity can shut it off. This was a huge part of bitcoin’s early appeal. It was decentralized, but could still be trusted as a store of value. But to what end? What was it for?" (You literally just said it was a store of value. It's for storing value.)

"The trouble is that convincingly debunking all the pro-crypto rationales at the same time is impossible. Each rebuttal can itself be rebutted" (Maybe your arguments are just bad?)

Then at the end:

"Support for this project was provided by the William and Flora Hewlett Foundation." (WFHF's main goals are pushing DEI and climate propaganda - just check their website.)

This is exactly how it's going to play out in every country eventually. The mafia state will blame and extort Bitcoiners and associated businesses to hide their own failings.

Learn and use private self-custodial tools to protect yourself, and protect each other.

nostr:note1hpvjg0uqhyqwsnruxj0e0uhv3hgtsgyfjmu548lds776z08cqf7qfxaed0

A few things that occurred to me: If nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m is really doing a speculative attack on the dollar (and he’s not the only one), first off, he better hire some good security.

Second, if the dollar is under speculative attack, which it seems to be, then Powell will have to raise interest rates, not lower them. If he lowers them, the attacks will escalate.

Third, if he raises rates to defend the dollar, bonds will get killed even more. Imagine owning long-term debt in a currency that’s under speculative attack!

Fourth, if the US raises rates, other countries will have to raise theirs too, otherwise no one will buy their debt. But they too are under attack, and they are even less likely to be able to service the higher rates. I’m not sure what they can do.

Fifth, if the US realizes it can’t defend against the attack, it’ll have to buy bitcoin while it still has the resources ior seize it from the ETFs 6102-style (per nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z).

Sixth, if this is occurring to someone like me who knows nothing, it’s probably occurred to people in the USG. Might they conclude that it’s time to raise rates high enough to slow down the attack, acquire some coins by hook or crook, and gain a relative advantage over the rest of the world by owning a disproportionate share of its digital gold?

I’m probably missing something, but wanted to put this out there.

good analysis - I think that's a realistic set of scenarios

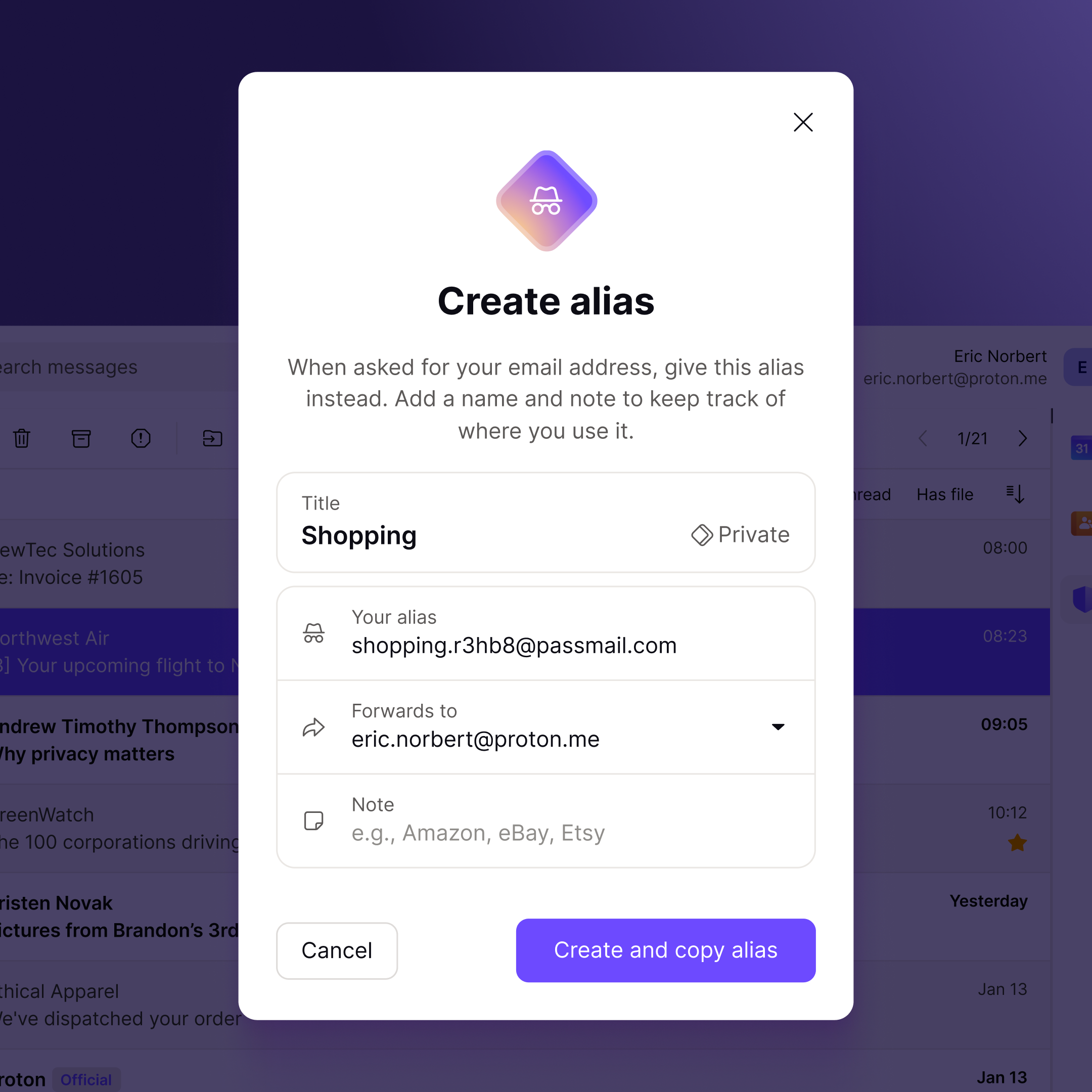

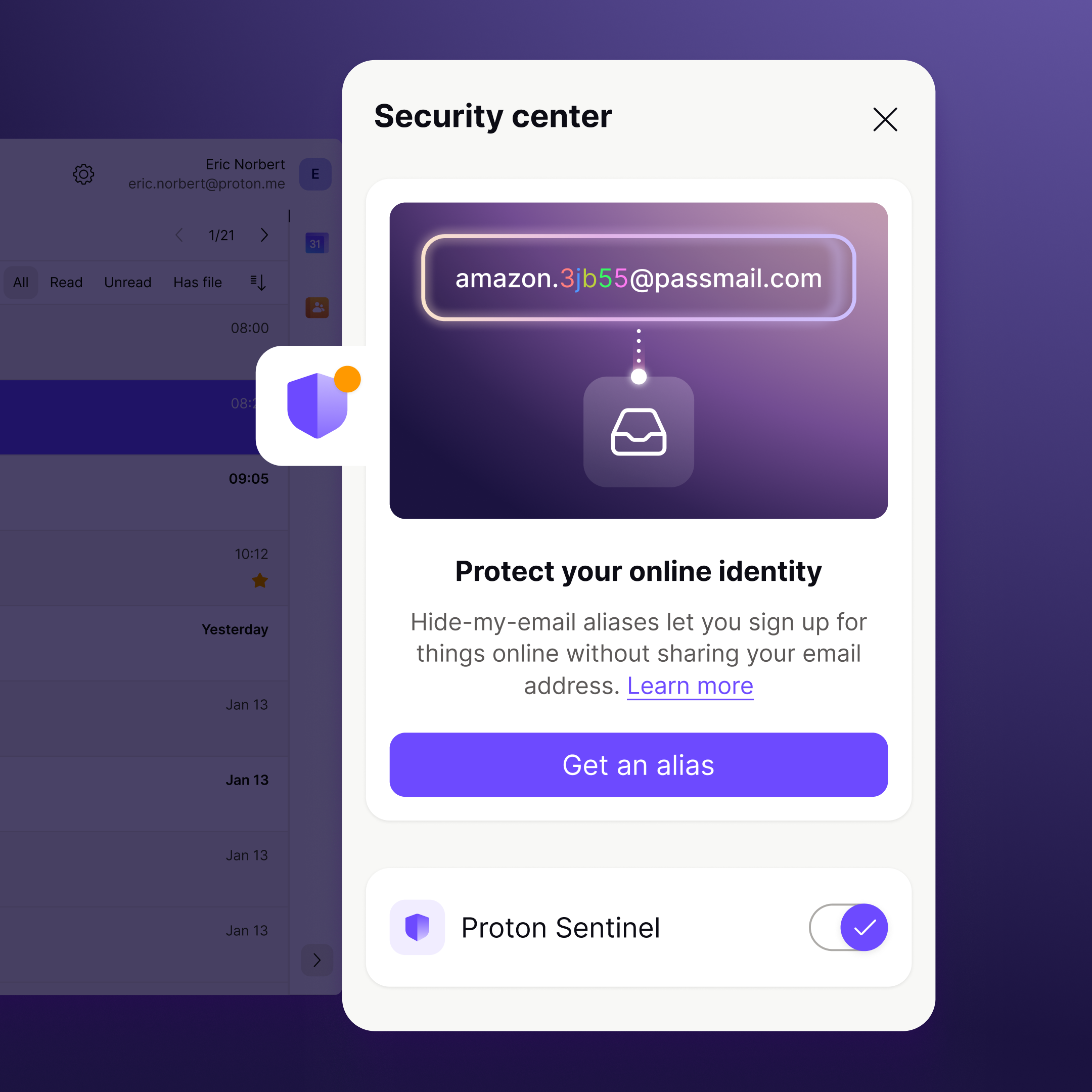

🧩 A new step in the integration between #ProtonPass and #protonmail

You can now easily create hide-my-email aliases, label them, or find recently used ones within the Proton Mail web app: https://proton.me/blog/hide-my-email-aliases

⏩ To access advanced alias settings in Proton Pass, use the "All aliases" button.

this is awesome, been using it for a few weeks

Lol at UK newspapers saying that Bitcoin is only "nearly" at the ATH because they're using $ as their base currency, even though we're past the £ ATH already

great news - even though I'm a tidal customer, not having hi-res (at the $11 price point) was the one thing making me consider Apple Music

while I'm opining about Tidal, next things I'd love to see:

- pay subscription with Bitcoin (I know I can use Bitrefill, but still would be cool)

- a Linux client so I can charge my phone while I listen to music and work on my laptop

BREAKING: UK government seeks to redefine "extremism" in broader terms to include anyone who "undermines" UK "values".

Clearly at risk are those who don't drink tea, and people exchanging GBP for BTC.

Can you make a version with a few extras and see if it still works?

Look after a toddler

Deal with bureaucracy

Clean house

Kill brain cells and spirit with fiat job meetings

😅

it's a bull market when people start quoting Plan B 😂

Startup options are such a shitcoin

Company I work for is being acquired and the deal completes 1 day before a chunk of my options vest, so they get cancelled 😂

"Stay humble, stack sats" applies very much to fiat mine job offers. Negotiate for higher cash and save it in Bitcoin rather than being conned into a seemingly high options package.

My council has started putting signs all over the park telling professional dog walkers that they need to apply for a license. Yet another racket from bureaucrats.

Meanwhile the local playground has had broken equipment for months, and there's rubbish on the streets. But yes, let's focus on the professional dog walkers 🙃

The mainstream media haven't yet realised Bitcoin is pumping, but the UK tax man sure has ... friendly email received yesterday 🙀